Chainalysis: the most popular crypto

The Global Crypto Adoption Index is one of the most anticipated insider reports regarding Chain analysis‘ effort, this is the ranking of the top 20 countries with the highest rate of cryptocurrency adoption among a total of 146 for which data was taken.

Chain analysis: the world is becoming increasingly informed about crypto

After last week’s report on the spread of crypto around the world and people’s perceptions of this market, a new article comes to shed light on this resource, and the data it brings is remarkable.

The perception is that the world is becoming increasingly aware of what cryptocurrencies are and the potential they hold, a potential that is ready to explode at any moment, perhaps as inflation and bear markets come to an end or perhaps sooner to accelerate the end.

The report is a precursor to a larger work carried out in the same way, but this time on all countries around the world, Geography of Cryptocurrency Report 2022.

This document is a real milestone to get a sense of how in the world investors enter the digital currency market to a greater or lesser degree and fundamental to understand where and how to trade to make people increasingly aware and interested.

Chainalysis aims to highlight the relationship between the adoption and use of cryptocurrency around the world to provide an important tool on the flows and openness of different populations to this world, as well as bring out how many people invest the largest share of their wealth in digital currencies.

The aim of the index is to accurately measure where most people invest most of their capital, covers 146 countries spread around the world and has an accuracy recognized by the very experts who verify the data.

The professionals interviewed when asked about the report claimed that this index matches their perception of the markets in which they operate, giving a strong injection of confidence in the methodology used and the reliability of the content.

Key points in the research that has been carried out

The research mainly focuses on five central points, which are the following:

- On-chain cryptocurrency value received in centralized exchanges, weighted by purchasing power parity (PPP) per capita;

- On-chain retail value received at centralized exchanges, weighted by PPP per capita;

- Volume of peer-to-peer (P2P) exchanges, weighted by PPP per capita and number of Internet users;

- Embedded cryptocurrency value received by DeFi protocols, weighted by PPP per capita;

- On-chain retail value received from DeFi protocols, weighted by PPP per capita.

This year, compared to the research done in the two previous years for which we have a history, more indices were included based on the transaction volume of decentralized finance and the modification of two other indices to include only the transaction volume related to centralized services. such as bringing forward the countries at the forefront of DeFi and addressing the issue of inflation and transaction volume driven by it.

The World Bank categorizes countries according to four macro sets limited to revenue volumes and general economic development:

- high income

- upper middle income

- lower-middle income

- low income.

With this division, one can find that the two middle categories come out strongly at the top of the index.

Ten of the top twenty countries in the ranking are low-middle income: Vietnam, the Philippines, Ukraine, India, Pakistan, Nigeria, Morocco, Nepal, Kenya and Indonesia

Eight countries are upper middle income: Brazil, Thailand, Russia, China, Turkey, Argentina, Colombia and Ecuador, while only two are upper income, and they are the United States and the United Kingdom, which were recently affected by the mourning of the Queen. Elizabeth II.

Lower middle and upper middle income groups usually use Bitcoin, Ethereum and the other cryptocurrencies to send remittances or accumulate their savings in times of currency volatility such as the one we live in and meet other financial needs in their economies.

Much to our surprise, although there were some signs already in 2021, tiny Vietnam ranks first in crypto adoption due to its very large purchasing power and the variety of centralized, DeFi and P2P cryptocurrency instruments on the ground.

The United States rose from eighth to fifth place despite being among the countries with the largest crypto usage in terms of volume.

The use of P2P exchanges tends to be highest in countries with low purchasing power.

The United States of America is by far the highest-scoring developed market country in the index and one of only two in the top 20 along with the United Kingdom, while China re-entered the top 10 countries in the world this year despite that from September 2021 the government gave another waist spin that lowered the asset.

China, which has always (like Russia) been swinging on the adoption or non-adoption of Bitcoin and the like since last year, has returned negatively to the market and despite everything, this does not seem to have been enough to put a brake on the growth of crypto volumes and transactions on its soil.

Thanks to the use of centralized services, Dragon grabs the second place overall for transaction volume relative to individual purchasing power, despite this very strong crackdown carried out again by the Beijing government.

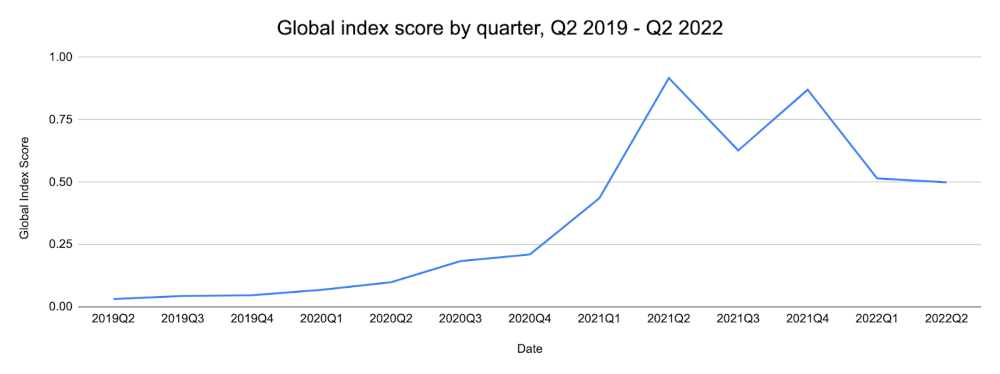

Despite the bearish market, it is important to note that overall adoption of cryptocurrencies and their financial instruments remains above pre-mining market levels in 2019, with seemingly no setback on the horizon.

A hopeful phenomenon is pointed out in the fact that a significant critical mass of new users who invest their capital in digital currencies during periods of rising prices still tend to remain in the market even when prices fall and make the market less attractive to some.