Kaszek, YC backs DolarApp’s mission to ‘dollarize’ Latin America’s finances with crypto • TechCrunch

When DolarApp founders Zach Garman, Álvaro Correa and Fernando Terrés lived in the US and Europe, they spent time in Latin America, where they saw the problems their friends had when it came to finances and access to banking services in dollars.

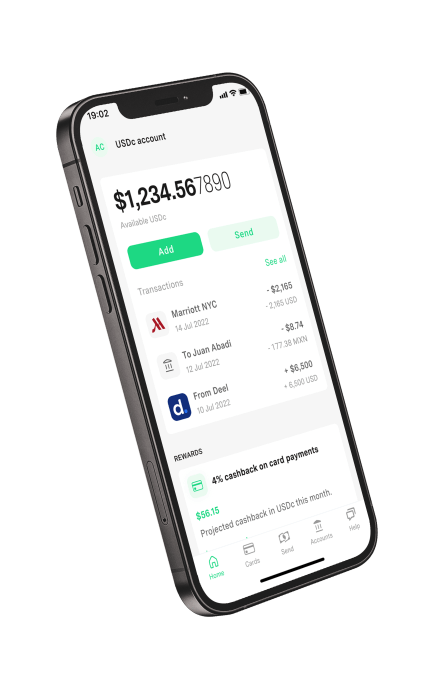

DolarApp’s platform showing USDc account Image credit: DolarApp

So the three former Revolut employees started thinking about a way to give that access to dollars and even cryptocurrency. The company, founded in 2021, will start in Mexico, where Terrés said about 20 million residents travel to the United States each year.

“They don’t go with a card, but with $5,000 in cash and go to the exchange at the airport, which means they lose money on the spread,” he added. “Remittances between the U.S. and Mexico totaled roughly $50 billion last year, and the fees are outrageous, averaging 5% of the total amount sent.”

With DolarApp, users can open a bank account that goes from the peso to the dollar-dominated stablecoin USD Coin (USDc) and back in seconds. They can also save in USDc, earn 3% annually, and pay with an international Mastercard with up to 4% cashback. In addition, users can send and receive payments in the United States for a flat fee of $3 versus the $3 fee plus 2% fee that other money transfer companies charge, Terrés said. The company makes money from the flat transfer fee and from earnings on the balances.

The company is now afloat with $5 million in funding led by Y Combinator and Kaszek Ventures. The round also included a group of over 50 angel investors.

“DolarApp allows Latin Americans to manage their finances in USDc, protect their savings in a stable currency and without the expensive bank fees associated with international wire transfers and card payments – all in a single account,” Hernán Kazah, founder and managing partner of Kaszek Ventures, said in a written statement. “At Kaszek, we are convinced that it will be a tremendous economic tool to help Latin America move forward towards greater financial inclusion.”

The DolarApp founders were part of the YC Summer 21 group but didn’t make Demo Day and mostly stayed down since then, working on the product, Terrés said.

The company started a beta program over the summer and will use the new funds to add to its team, which currently consists of 11 people, as well as marketing efforts and preparing for a full launch.

Although Terrés declined to provide hard growth numbers, he said that in the past two months DolarApp had gained “a few thousand beta adopters.”

Next, the company will focus on use cases in the Mexico market and launch virtual payments – for example with Apple Pay and Google Pay.