Bitcoin (BTC) tops $22,000 ahead of inflation data, Ethereum merges

Bitcoin topped $22,000 as it continues a week-long rally ahead of US inflation data and a long-awaited Ethereum network upgrade.

The world’s largest cryptocurrency hit $22,341.50 at 9:45 p.m. ET Sunday before dipping slightly, according to CoinDesk data. Bitcoin was trading at $22,203 around 4:03 a.m. ET on Monday.

After falling below $19,000 on Wednesday to its lowest level since June, bitcoin has since rallied around 17%.

This also comes on the back of a winning week last week for US stocks. Bitcoin has been closely correlated to stock markets, particularly the Nasdaq, often moving higher when the tech-heavy index rises.

Crypto investors are looking ahead to the August consumer price index report, scheduled for release on Tuesday, to see where inflation is heading, which could hint at future policy moves by the US Federal Reserve.

Crypto is facing an unusual double whammy this week: US inflation data and [hopefully] the long-awaited and oft-delayed Ethereum merger. Hold your breath for a rollercoaster ride.

Antony Trenchev

co-founder, Nexo

Stocks have been under pressure this year as the Fed has raised interest rates to try to control rampant inflation.

Cryptocurrencies, which are also risk assets, have been subjected to blows. Almost $2 trillion has been wiped off the entire crypto market since its peak in November. Bitcoin is down more than 50% this year.

This decline has also been driven by crypto-specific issues, including the collapse of key projects and bankruptcies that have spread across the industry.

Meanwhile, the Ethereum network will complete a long-awaited upgrade called the merger. This will transform the Ethereum blockchain from a proof-of-work to a proof-of-stake model and significantly reduce the amount of energy required for the network to operate.

Advocates say this could pave the way for wider use of ether, the token that runs on Ethereum.

“Crypto faces an unusual double shock this week: US inflation data and [hopefully] the long-awaited and oft-delayed Ethereum merger. Hold your breath for a roller coaster ride,” Nexo co-founder Antoni Trenchev said in a note on Monday.

“In an age full of narratives, there’s none bigger than the merger in crypto, and it’s one the whole world should take notice of with Ethereum’s carbon footprint set to be cut by 99%.”

However, analysts cautioned that the merger would not necessarily speed up the Ethereum network, which is known to be slow, nor would it reduce the fees associated with transactions.

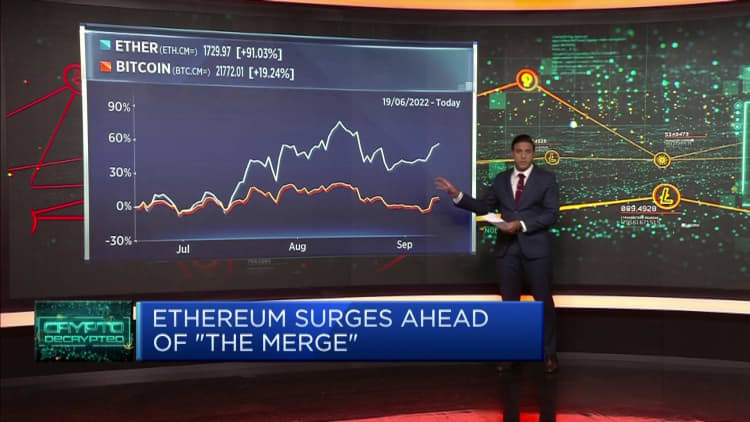

Nevertheless, excitement has grown for the merger. Since ether hit its lowest level for the year in mid-June, the price of the world’s second largest cryptocurrency has far surpassed bitcoins. Ether has risen more than 90% since June. 19 while bitcoin has risen just over 20%, asking how much the merger has already been priced in.

The Federal Reserve is also widely expected to raise interest rates again next week when its Federal Open Market Committee (FOMC) meets, which is another dark cloud hanging over the crypto market.

“The merger could trigger a ‘sell fact’ situation in the crypto market, and we still need to be cautious ahead of next week’s FOMC meeting. Bitcoin may continue to rally, but it may be quite short-lived,” Yuya Hasegawa, crypto market analyst at Japanese exchange Bitbank, said in a note Monday.