Despite war and inflation, crypto markets continue to mature (KPMG)

The leading global accounting firm – KPMG International – claimed in one of its recent reports that the cryptocurrency market has shown increasing maturity in recent months. This comes despite the ongoing military conflict between Russia and Ukraine and the record high inflation that is spreading in some countries.

It’s also worth noting that most digital assets are trading well below their 2021 all-time highs, but that hasn’t stopped investment in the space. Prominent entities such as Trade Republic, Fireblocks and FTX have allocated billions of dollars to support startups that are part of the ecosystem.

The cruel reality

The COVID-19 health disaster, rising inflation, the military conflict between Russia and Ukraine, and the energy crisis, among others, are all factors that have directly or indirectly affected a significant part of the globe.

Apart from taking millions of lives, the coronavirus pandemic severely affected the global financial system. The residency rules, plus the controversial mass printing of fiat currency by some central banks, were preconditions for a future monetary crisis simply because the increased amount of money in circulation did not respond to the crippled production.

As a result, inflation rates have reached multi-decade highs, with Turkey, the UK, the US and others as examples.

The energy crisis, which began to affect some regions in 2021, has intensified in recent months due to the military conflict between Russia and Ukraine and is another component weighing down the economy.

The world’s largest country by land area stopped some of its gas supplies to several nations that imposed sanctions on the country in advance. With the winter season approaching in Europe, uncertainty is increasing as some states risk being left without enough energy in the coldest months.

Not surprisingly, the negative trends have taken their toll on almost all financial markets, including the crypto sector. Today’s global market value for cryptocurrency is around 1 trillion dollars, while in November last year it passed 3 trillion dollars. Bitcoin, for one, is currently about 70% below its ATH less than a year ago.

Despite this, the crypto market is maturing

In contrast to the clear decline, KPMG International has mean the digital asset market continues to mature. The consultancy said many investors focused on the industry in the first half of the year due to the uncertainty in traditional finance and doled out billions of dollars.

German online broker – Trade Republic – raised $1.1 billion to support organizations in the digital assets niche. Crypto custodian Fireblocks secured a $550 million fundraising and achieved a $8 billion valuation. Sam Bankman-Fried’s flagship exchange – FTX – closed a $400 million Series E venture capital round and is currently valued at over $32 billion.

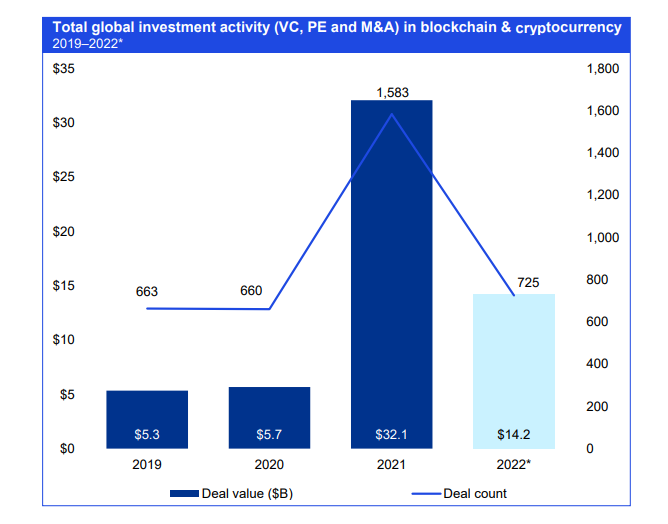

In total, the investments in the crypto space since the start of 2022 correspond to 14.2 billion dollars. This is significantly less than the $32.1 billion in 2021, but more than 2019 and 2020 combined.

However, it is worth noting that the interest in the crypto industry was not so impressive in 2019 and 2020. When we talk about the record investments in 2021, these can be explained by the bull run when bitcoin and many of the altcoins reached everything. time heights.

In addition, giant institutions like Tesla bought billions of dollars worth of BTC, while prominent companies like Expedia, PayPal, Rakuten and Etsy started accepting payments in crypto.

The hype peaked in September 2021 when El Salvador became the first country to embrace bitcoin as legal tender within its borders.

KPMG’s crypto efforts

The entity began interacting with the cryptocurrency industry in 2020. Back then, it introduced a project called KPMG Chain Fusion, which helps traditional financial firms provide well-managed digital asset services.

In February of this year, the Canadian subsidiary of KPMG made its first cryptocurrency investments by adding Bitcoin (BTC) and Ether (ETH) to its corporate coffers.

A few months later, it hired Ian Taylor to lead the company’s UK crypto team and guide its Web3 work. As he is also the CEO of CryptoUK, he has a wealth of experience in the field.

Binance Free $100 (Exclusive): Use this link to sign up and receive $100 free and 10% off Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to sign up and enter code POTATO50 to receive up to $7,000 on your deposits.