What Happens to Bitcoin When You Die – Bitcoin Magazine

This is an opinion editorial by Jenna Bunnell, Senior Manager of Content Marketing at Dialpad.

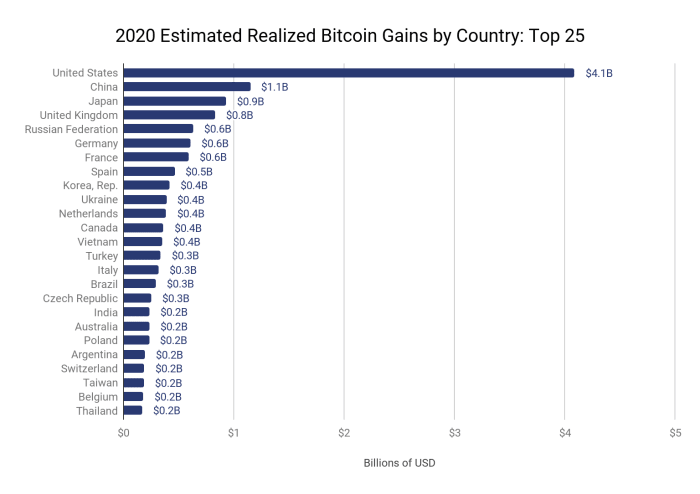

Whatever you think about bitcoin, it’s obvious that it’s here to stay and will continue to grow in use.

As a virtual peer-to-peer currency, bitcoin has been widely accepted in many countries. You can sell bitcoin for cash, or exchange it with peers across different networks and use it to invest in everything from art to real estate.

But since it is a virtual currency, the question arises; what happens when you die? Although it is a morbid thought, it is important to plan ahead for your family and loved ones. So, what happens to bitcoin when you die, and how do you include BTC in any inheritance plans? Is it a simple process to include BTC in a will like you would with tangible assets like your house and bank accounts?

What is Bitcoin?

The origins of Bitcoin lie all the way back in 2008 when a white paper was published entitled “Bitcoin: A peer-to-peer electronic cash system” written by Satoshi Nakamoto (a name believed to be a pseudonym, perhaps even belonging to more than one person). The idea behind the white paper was to create a fully digital currency that would exist outside the normal centralized controls of banks and governments.

At its core is peer-to-peer software and the use of high levels of encryption (based on the SHA-256 algorithm designed by the US National Security Agency). All transactions are recorded in publicly accessible ledgers on servers around the world, and anyone with a computer can set up one of these servers, known as nodes.

Each time a transaction occurs, it is broadcast to the entire network and shared between nodes. These transactions are collected, approximately every 10 minutes, into a block and added to the blockchain.

People often have the misconception that they need to buy whole units, but BTC can actually be divided by up to seven decimal places, creating smaller and more affordable units — rate.

Once you’ve bought (or mined) bitcoins, you keep them in a digital wallet that you can access using special software. Given that these coins do not exist in real life, and that ownership is based on consensus among members of the network, how do you decide what happens to bitcoin when you die? Also, since many BTC owners remember the wallet key and keep no other records, what happens if they suddenly die?

Memento Mori

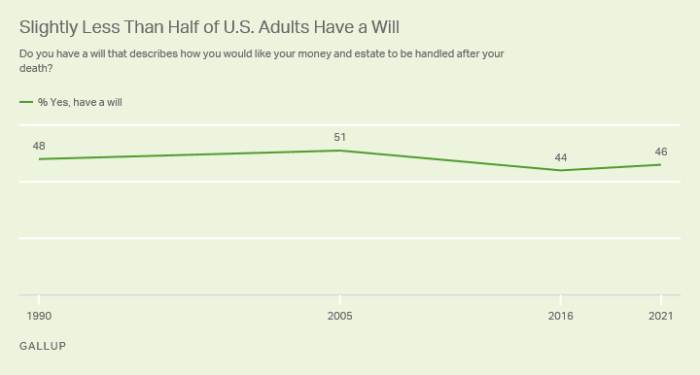

It’s not the nicest thing to talk about or think about, but death is inevitable. Less than 50% of US adults have already created a will, but of course this number varies across age groups – over 75% of people over 65 have created a will, while only 20% of people under 30 have created a will.

From a legal perspective in the US, it can be quite confusing. The IRS does not view cryptocurrencies as currencies, but rather as tradable goods that can be taxed by the relevant authorities. Nevertheless, we also treat them as assets and must therefore have some form of legal control when it comes to inheritance.

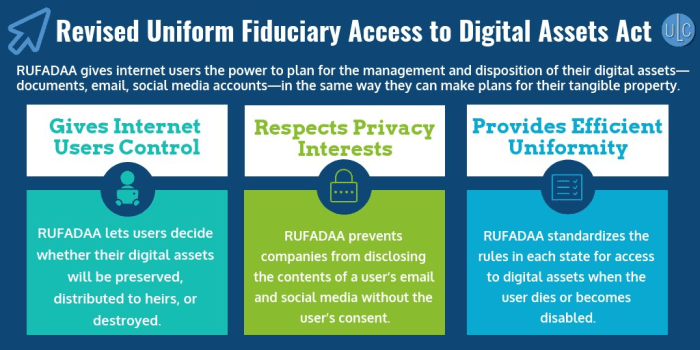

This control or oversight comes from the Revised Uniform Fiduciary Access to Digital Assets Act (RUFADAA). This law was developed to provide relevant parties (such as lawyers or trustees) with clarity and a legal way to deal with any digital assets held by a deceased person’s estate (or indeed when a person is incapacitated).

The law was written by the Uniform Law Commission (ULC) so that the states could then examine it and enact it. As of 2021, 47 states had adopted the law. So, at least for the US, there is a framework governing the management of digital assets, which will come as a relief to many who were previously unsure.

How does RUFADAA work?

You must first consider that there are three groups of people who have a vested interest in what is happening:

- The owner of the digital assets who may want a level of privacy.

- The custodian of these assets (companies that create, store or sell online assets).

- The trustee or lawyer handling the estate.

The biggest obstacle the law faced was that, unlike physical assets, there has always been a degree of secrecy surrounding digital assets. In the early days, there were no laws providing access to the digital files and wallets in the event of death or disability. If the original owner of the digital assets had not left a note on how to access those assets, then the sad reality is that they could be lost forever.

It is important to note that RUFADAA does not focus exclusively on cryptocurrencies, but on all digital and online assets. That includes things like Facebook or Google accounts. Custodians have certain rights to what they can release, or whether they request a court order to hand over access and/or information. In the case of things like Facebook accounts, the custodian can also decide what is “reasonably necessary” when it comes to releasing any information.

RUFADDA and Bitcoin

RUFADAA only applies if the original owner has authorized access to their bitcoin. This can be through documents signed with and held by the custodian, or it can take the form of a legal document such as a power of attorney, a will or a trust document.

A custodian can also limit the amount of access your trustee has, usually to include only aspects that allow them to carry out their responsibilities. The custodian also has the right to charge administrative fees for any access they provide. This can be important information if you are trying to decide what happens to your bitcoin when you die.

One of the main benefits of RUFADAA is that it clarifies the legal hierarchy when it comes to the documentation – and subsequent distribution – of your digital assets. The custodian (or online management system) is regarded by RUFADAA as the highest authority regarding ownership of a cryptocurrency account.

What that means in reality is that if you made person A the recipient of your digital assets in a document with your custodian, that document takes precedence over other legal avenues such as wills, POAs or trusts. If you have no beneficial ownership agreement with your custodian, ownership will pass to anyone named in the regular inheritance documents.

Should a scenario arise where none of the usual agreements or a custody agreement exists, any transfer of ownership or fiduciary responsibility may be determined by the custodian’s own terms and conditions.

What should you do?

You have two main choices when thinking about what happens to your bitcoin when you die.

You can either ask your custodian if they have specific tools or a framework for naming a beneficiary to your account, which would only apply if you held your bitcoin on an exchange – an ill-advised practice. Your other choice is to go the traditional route and name any beneficiary of your BTC in a will, trust document, under POA or in estate documents.

If your holdings include BTC (or other cryptocurrency), consider a plan that includes all aspects of your digital assets. This means having a way to transfer all details such as account details, keys and access to any hardware wallets to the person you want to inherit those assets or to your trustee/lawyer.

In any will or similar document, you must include directives for the transfer of data, especially the most sensitive data related to the account. Simply passing on the hardware device being used is probably not enough for the recipient to take control of the account.

The takeaway

Despite its growth, many people still question whether BTC is a real currency. Nevertheless, the growth and the figures show that it is something that is here to stay.

You should think of any bitcoin you own as an asset; It may not be a physical one like your house or car, but it still has real value. So you should carefully consider what you want to happen to your bitcoin in the event of your death or incapacity. Knowing the steps to take and what happens to your bitcoin when you die means your assets can be transferred to the beneficiaries you want.

This is a guest post by Jenna Bunnell. Opinions expressed are entirely their own and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.