The Fibonacci retracement tool is often used in technical analysis to predict possible future prices in the crypto market. It is a confirmation tool that can help you get better trading results when used with other indicators and that is how you use the Fibonacci retracement tool in cryptocurrency trading.

What is Fibonacci Retracement?

Fibonacci retracement is an important technical analysis tool for crypto trading that provides insight into when to execute and close trades or place orders and limits. The indicator uses percentages and horizontal lines to identify important support and resistance points during an uptrend or a downtrend. You can use it as part of a crypto trading strategy.

Price does not move in a straight line; it goes through a series of pullbacks, forming something like a zig-zag pattern. In an uptrend, for example, the price does not continue to move straight up; it moves upward and reverses before continuing its upward motion. This pattern occurs continuously within a trend.

Many crypto traders use the Fibonacci retracement tool to look for possible places where a price pullback might find support or resistance. A pullback, also known as a retracement, is a temporary reversal in the crypto market trend. It differs from a reversal in that it is only a short-term movement against the trend, followed by a continuation of the current trend.

Understanding Fibonacci numbers

Fibonacci is all about numbers and these are the key values to look out for.

The Fibonacci sequence

The Fibonacci number sequence was discovered by Leonardo Pisano, who was also called Fibonacci. He documented them in his book, Liber Abaci“The Book of Numbers”, which he published in 1202. The order of numbers is as follows: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, etc.

The series is derived by adding the two consecutive numbers to form the next. With that in mind, you can assume that the sequence’s next three numbers will be 233, 377, and 610.

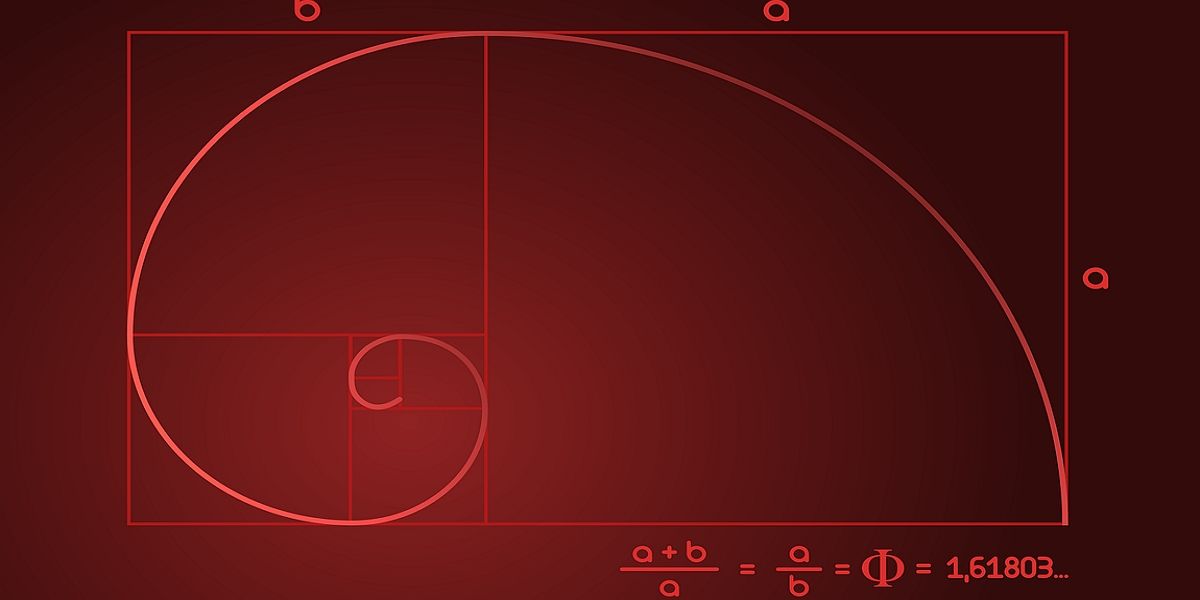

Fibonacci Golden Ratio

One of the remarkable things about the sequence is the relationship between the numbers. Each number is approximately 1.618 times greater than the previous number. The 1.618 derivative is known as the golden ratio. The term “golden ratio” is not only based on the derivation of the sequence, but also because the ratio is reflected in almost everything around us.

Fibonacci numbers appear in DNA molecules, reproductive patterns, hurricane patterns, tree branches, etc. For example, if you look closely at flower petals, you will find that an intact buttercup has five petals and lilies have three, which are Fibonacci numbers.

Using Fibonacci numbers in cryptocurrency trading

Just as Fibonacci numbers are evident in everything around us, they are also in trading. Crypto traders use the Fibonacci retracement tool to identify support and resistance points while trading. The tool consists of numbers derived from the differences between the numbers in the sequence. The numbers include 0.236, 0.382, 0.618 and 0.786.

We have already described how the ratio 0.618 is derived: by dividing a number by the previous one. Dividing a number by another two places higher in the sequence will give approximately 0.382. For example, dividing 21 by 55, 89 by 233, and 233 by 619 will give us approximately 0.382.

Using the same pattern, dividing a number by another number three places higher in the sequence will give approximately 0.236. Thus the ratios 0.236, 0.382, 0.618 and 0.786 are formed from the difference between the numbers. They can also be expressed as a percentage as 23.69%, 38.2%, 61.8% and 78.6% respectively.

Another important number commonly used in the Fibonacci retracement is 0.50, or 50%. It is not derived from the Fibonacci numbers, but it has been seen as an important point of probable reversal based on other theories.

From the image above, we can see that the price bounced off the 0.618 Fibonacci level, and the uptrend continued. The 0.618 Fibonacci level acted as support for the price in the chart.

Using Fibonacci retracement on your crypto trades

The Fibonacci retracement tool is relatively easy to use. You just need to select low and high price swings that are relevant to your analysis and the price you are trading for.

Choosing the two points must be done carefully to get an accurate measurement. In an uptrend, you need to attach the tool to the lowest relevant price of the swing low and connect it to the highest relevant price of the swing high. Conversely, you need to connect it to the latest trend’s highest and lowest relevant prices in a downtrend. As simple as this may seem, if you don’t do it accurately, you will get the wrong result.

The chart above shows how to use the Fibonacci retracement in an uptrend. We drew the line from point 1 to point 2. The two points are the important high and low before the retracement. The price then reverses and bounces off the 61.8% (0.618) Fibonacci level to continue upwards.

We drew the Fibonacci line upwards in the example above. In the case of a downward trend, we will draw the line downwards. In other words, in an uptrend you should draw the Fibonacci line from the low of the last relevant swing to its high. In a downtrend, it is the other way around.

The information you get from the retracement levels will help you determine possible support and resistance points, and what you do with such data depends on your trading strategy.

Using Fibonacci Retracement in Trend Trading

Many traders use Fibonacci retracement levels in combination with the trendline and other technical indicators as part of their trend trading strategy. They use the combination to turn low-risk entries into an ongoing trend and form a confluence that helps make better trading decisions.

In trading trends, traders expect the trendline to form a resistance in the case of a downtrend, and support, in the case of an uptrend, causes the price to bounce off the trendline several times. Although there is no certainty that the trend line will perform as expected, drawing a Fibonacci retracement line can serve as an additional indicator to check the possibility of a trend continuation after the price has reached the trend line.

The chart above shows that the price jumped off the trend line several times. Let’s imagine a case where the trader is unsure whether the trendline will continue to serve as resistance before the third bounce in the image above. The trend line has a confluence with a strong Fibonacci line would have driven more confidence in the trader to execute the trade. The trend continuation that followed would have come as no surprise.

How you use Fibonacci Retracement depends on your crypto strategy

You can also use the Fibonacci retracement tool with other technical indicators, including candlestick patterns, oscillators, volume momentum, moving averages, etc. Some use it with price action to trade trend reversals and countertrend trading strategies. These traders do not wait for the price to reach Fibonacci retracement support or resistance, but rather use the levels to decide when to lock in the profit. Some others also consider the Fibonacci retracement tool confusing and a waste of time and prefer not to use it.

We used the 61.8% Fibonacci level in all the charts we used as examples. However, the levels to use depend on your strategy. You can create your crypto trading strategy around different Fibonacci levels as it works for you. It is up to you to figure out how to best use this technical tool to get the best crypto trading results.