Will this Fintech stock recover from the sharp decline?

Shares in the financial company SoFi Technologies (NASDAQ: SOFI) has fallen by almost 67% so far this year in the midst of broader market sales. In addition, the SoFi share has also been under pressure due to the extension of the student loan moratorium and investors’ concerns about the impact of a looming recession.

Economic snapshot

SoFi reported better-than-expected first-quarter results, with revenue of 69% to $ 330 million. The company’s loss per share was reduced to $ 0.14 from $ 1.61 in the previous quarter. The results for the first quarter were strengthened by strong membership growth and new products.

However, SoFi’s guidance for the second quarter was in line with analysts’ expectations. SoFi expects second quarter adjusted income growth in the range of 39% to 43%, after a 49% growth in the first quarter adjusted income.

Several extensions of the moratorium on federal student loan payments have been a burden on SoFi’s performance. Back in April, President Joe Biden extended the student loan moratorium until August 31. Due to such extensions, SoFi’s student loan volume is less than half of the levels before the pandemic.

Looking ahead, SoFi is optimistic about its long-term outlook given that it won a national banking charter earlier this year. The company believes that the recent opening of SoFi Bank gives it extra flexibility and the opportunity to further reduce capital costs. Due to its banking status, SoFi can use its own deposits to finance loans instead of relying on external capital and can hold loans for a longer duration, thus earning a higher net interest income.

Wall Streets Take

Recently, Piper Sandler analyst Kevin Barker lowered his price target for the SoFi stock to $ 8 from $ 10 and repeated a Buy rating. Barker cut its estimates for consumer finance companies to reflect “economic reality”.

Barker believes that consumer lending shares have fallen in recent months as the market has become increasingly concerned about a potential recession in the next 12-18 months. Baker feels that it is in the best interests of shareholders and companies to start building or preserving reserves and / or capital in order to be in a better position in the event of a potential economic downturn.

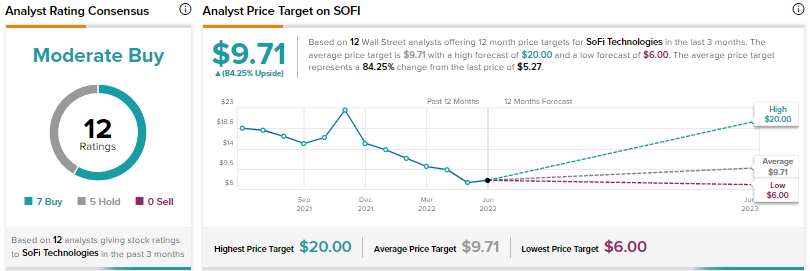

Overall, The Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on seven Buys and five Holds. The average SoFi price target of $ 9.71 implies 84.25% upside potential from the current level.

Conclusion

SoFi raised its guidance for the whole year after the strong momentum in the first quarter. With the recently approved bank charter, SoFi’s long-term outlook looks attractive. However, investors seem concerned about the impact of a looming recession on the company.

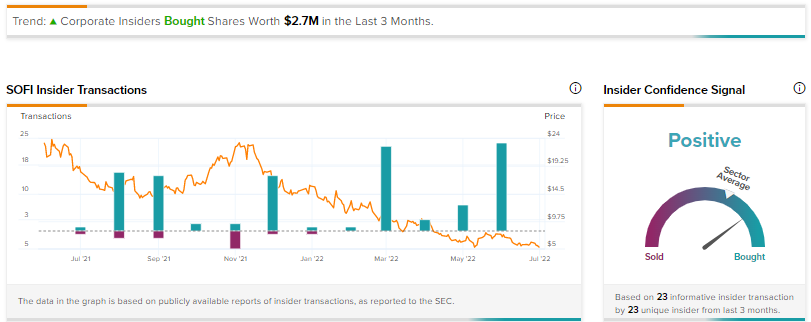

Meanwhile, insiders see the withdrawal of the SoFi share as an attractive opportunity to build their positions in this fintech company. According to TipRank’s Insider Trading Activity Tool, corporate insiders have bought shares worth $ 2.7 million over the past three months. SoFi scores a positive insider confidence signal based on 23 informative insider transactions.

Read the full revelation