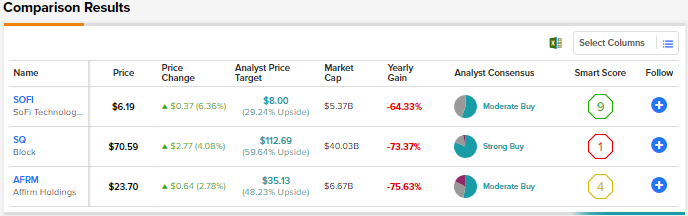

Which Fintech Stock Scores Wall Street’s “Strong Buy” Rating?

Fintech, or financial technology, stocks had a spectacular run in the earlier days of the pandemic driven by robust e-commerce spending, the rapid shift from cash to digital payments and the growing demand for innovative digital financial solutions and cryptocurrencies. But, like other growth stocks, fintech stocks have also been hit this year by macro challenges and fears that the economy will slide into recession. We will discuss the recent performance of three beleaguered fintech stocks, SoFi (NASDAQ:SOFI), Blocks (NASDAQ:SQ), and Confirm (NASDAQ:AFRM). Using TipRanks’ stock comparison tool, we’ll compare these fintech stocks to pick the one Wall Street thinks is the most attractive.

SoFi Technologies (SOFI) stock

Financial company SoFi’s positive results for the second quarter impressed investors. Revenue rose 57% to $362.5 million, while net loss narrowed to $0.12 from $0.48 in the previous quarter. The company ended the quarter with 4.3 million members, reflecting a 69% year-over-year increase.

SoFi’s banking business is also gaining momentum. The company secured a bank charter earlier this year by buying Golden Pacific. SoFi Bank generated net income of $25 million in the second quarter.

Also, the recent announcement by President Joe Biden on the federal student loan moratorium was a positive development for the company. Under the latest announcement, federal student loans up to $10,000 will be forgiven for borrowers earning less than $125,000 per year or households with an income of less than $250,000. The president extended the federal student loan freeze one last time to December 31, 2022.

Several extensions of the student loan moratorium have affected SoFi as student loans make up a significant part of the company’s loan portfolio.

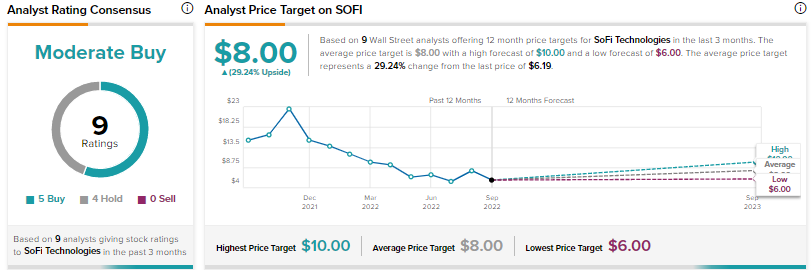

What is the price target for SoFi?

Mizuho Securities analyst Dan Dolev noted that the president’s extension of the moratorium was “in line to slightly ahead” of management’s estimate (they assumed it would extend to January 2023), which he sees as positive. The analyst believes that moving the repayment timeline up by one month could lead to a “pull-forward” in refinancing demand. Dolev reaffirmed a buy rating on SoFi stock with a price target of $8.

Overall, the analyst consensus is a moderate buy based on five buys and four holds. The average SoFi price target of $8 implies upside potential of 29.2%.

Block (SQ) Stock

The crypto winter affected Square’s bitcoin revenue, causing the company’s overall second-quarter revenue to fall 6% to $4.4 billion. Adjusted earnings per share fell 63% to $0.18. Excluding bitcoin revenue, the second-quarter top line increased 34% to $2.62 billion. Gross payment volume (GPV) grew nearly 23% to $52.5 billion.

Looking ahead, Block continues to improve its two ecosystems – Square (which offers various solutions to merchants) and CashApp (which includes peer-to-peer payments, bitcoin earnings and other solutions). Also, the company’s Afterpay acquisition earlier this year helped it expand into the lucrative buy-now, pay-later business.

Block continues to expand the reach of the Square ecosystem. Using innovative solutions, the company’s gross profit from mid-market sellers grew by 24% in the 2nd quarter. The Square ecosystem is seeing rapid growth in the food and beverage vertical. GPV from Square for Restaurants sellers more than doubled in the first half of 2022 compared to the same period last year. Block is also capturing growth outside the US, introducing 44 products in its international markets in the first six months of 2022.

Block also strengthens the Cash App business by expanding to new demographics and increasing customer engagement through various offers such as Cash App Borrow and RoundUps. While Cash App Borrow is the company’s first credit product, Round Ups allows customers to invest their extra cash from their Cash App balance into a stock or bitcoin every time they use their Cash App card.

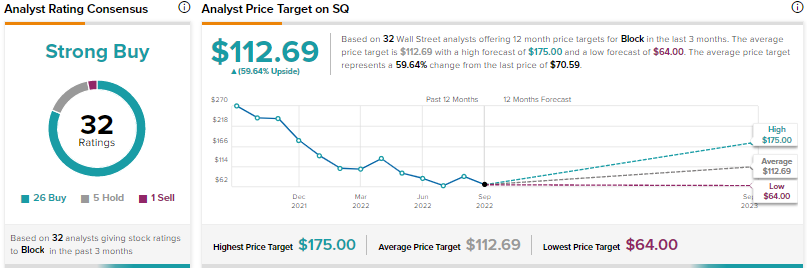

Will Block’s share price go up?

Andrew Bauch, an analyst at SMBC Nikko Securities America, believes that Block can see weaknesses from SMEs in a challenging economic backdrop. However, he expects this headwind to subside.

Bauch added: “We believe that if the past is precedent, periods of economic disruption have become stock-winning catalysts for differentiated [internet point of sale] providers like Block.” Based on his investment thesis, Bauch maintained a Buy rating on Block stock, but lowered his price target to $120 from $140 to reflect the post-earnings selloff and a tough macro environment.

On TipRanks, Block receives a strong buy consensus rating supported by 26 buys, five holds and one sell. At $112.69, Block’s average share price suggests 59.6% upside potential.

Affirm Holdings (AFRM) stock

Affirm offers a buy now, pay later payment option to consumers. By the end of fiscal year 2022 (June 30, 2022), active consumers on the company’s platform grew by 96% to 14 million. Also, the number of active merchants increased to 235,000 from 29,000, thanks to the rapid adoption of Shop Pay installments by merchants using Shopify’s (SHOP) platform.

In May, Affirm announced a multi-year extension to its partnership with Shopify, making it the exclusive pay-over-time provider for the Shop Pay Installments facility in the US. This partnership enables Shopify sellers to offer their consumers the opportunity to branch out. purchases up to $3,000 in four interest-free bi-weekly payments with no fees.

Affirm recently announced mixed results for Q4 Fiscal 2022 and disappointing guidance for Fiscal 2023. Affirm’s fiscal Q4 revenue grew 39% to $364.1 million, beating analysts’ expectations. Gross merchandise value (GMV) rose by 77% to $4.4 billion. However, the company posted a larger-than-expected net loss of $0.65 per share.

What is the target price for Affirm?

After the Q4 print, Bank of America analyst Jason Kupferberg cut his price target on Affirm stock to $38 from $45 and maintained a Buy rating. Commenting on the company’s Fiscal 2023 guidance, the analyst noted that the company will cripple Shopify and Amazon (AMZN) partnership. However, Kupferberg expects GMV growth at a slower pace than he expected.

Kupferberg remains bullish on Affirm as he believes the company is a “shareholder and long-term beneficiary in high-growth” buy-now, pay-later space and has an attractive long-term risk-reward profile.

Affirm earns a moderate buy consensus rating with nine buys, five holds and three sells. Affirm’s average target price of $35.13 implies 48.2% upside potential.

Conclusion

Subdued consumer spending and a potential increase in defaults and loan defaults could affect the performance of fintech companies in the short term. That said, Wall Street appears to be confident about the long-term outlook. Analysts are currently cautious about SoFi and Affirm shares.

Compared to SoFi and Affirm shares, analysts are more bullish on Block based on the huge growth opportunities for the CashApp and Square ecosystems. Moreover, they estimate a higher upside potential for the Block stock than the other two fintech stocks.

Mediation