Bitcoin (BTC) Price Prediction: Technical Analysis for Beginners

Bitcoin Price Prediction: Technical Analysis by Julius de Kempenaer, Senior Technical Analyst at StockCharts.com, Signals Downside Risk for Bitcoin (BTC). This is how it works.

Free market

Bitcoin, or better, the entire cryptocurrency market is the perfect example of a “free market” that is driven by supply and demand. Access to the market is easy and information is widely available. As a result, human emotions such as “Fear and Greed” are limitless. All in all, that combination of factors makes cryptocurrencies well suited for the use of technical analysis.

Fundamental analysis looks at external factors that can affect the price. In the stock market, analysts look at earnings (growth), sales prices, cost of goods etc. Based on all that information, they come up with a “real value” for the company. If the company’s stock is trading below what the fundamental analyst believes is fair value, it would be interesting to buy that stock.

In case the share price is above the fair value, it would obviously be better to sell.

In the crypto market, factors such as the number of new coins being mined, the amount of freely traded coins, the background of a specific project related to a cryptocurrency, etc. are used by fundamental analysts to determine the intrinsic value of a coin and decide whether to buy or sell.

Technical analysis takes a different approach. A technical analyst ONLY looks at the price. Ultimately, it is the price at which an investor buys and sells that determines profits and losses. And prices are determined by the buying and selling activity of investors in the market.

Fear and greed drive herd behavior

It is clear that investors are influenced by many (external) factors, of which news is the most important. Whenever any news about a market or security is published, investors will assess the price of the associated or related security.

Over the years, crypto had appeared in the news many times. Sometimes it was incredibly positive, causing prices to skyrocket and creating a herd feeling known as FOMO. Fear of missing out – “everyone is making money in crypto and I’m not, I have to participate.” And on the other hand, there were also stories about regulation, or about countries banning crypto mining and trading. This affected prices negatively.

Obviously, these events create a lot of emotion, and they drive investors’ buying and selling decisions.

Because herd behavior is not alien to human nature, all this buying and selling will create “trends” that can be seen on charts. And this is where technical analysis comes in.

Bitcoin Price Prediction: Technical Analysis and Charts

Technical analysts use charts to find trends in price and try to gauge whether that trend is more likely to continue or potentially reverse. Our toolbox at Stockcharts.com is filled with a variety of calculations derived from price. But we also use more subjective interpretations of specific trends and patterns as they form on charts. This is based on extensive historical studies showing that markets tend to react in similar ways in specific situations.

Charts help show trends in supply and demand

In the analysis of price trends, the tops and bottoms visible on a chart contain important information. They tend to serve as “support” or “resistance” levels after they form, and markets revert to these old levels.

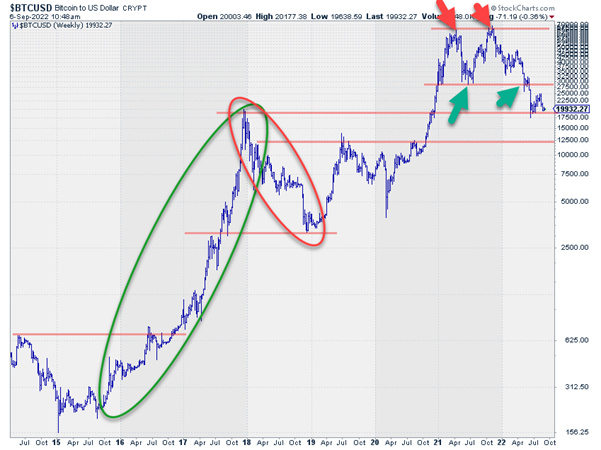

Translate “support” with “demand” and “resistance” with “supply” and reading a chart suddenly becomes much easier and makes more sense. In the BTC chart above, I have highlighted a major uptrend starting at the end of 2015 and ending at the end of 2017. And a downtrend starting at the end of 2017 and ending at the end of 2018.

Technicians define an uptrend as a series of “higher highs” and “higher lows.” A DOWNtrend is the reverse, a series of lower highs and lower lows. The two highlighted examples are a good example of each.

Further to the right of the chart we find some good examples of old tops and bottoms that act as support (always below the current market price) or resistance (always above the current market price). It never ceases to amaze me how these old tops and bottoms seem to act like magnets.

Bitcoin price prediction

In March-April 2021, the price of BTC peaked in the 65k range before dropping back to just under $30k. The rally out of the July-21 low took BTC back up and reached the 65k area again at the end of the year (see red arrows).

At around $65k, sellers (=offers) dominated the market and demand was simply not strong enough to push BTC beyond $65k. The extra supply in the $65k area created a lot of resistance and caused another top at the same level. Sellers started to push BTC back down until it reached the areas of the previous low, just below $30k.

A slight hesitation is visible as the old low began to act as support and attract buyers. But it didn’t take long for BTC to break below the support level around $30ki in June of this year.

Bitcoin Price Prediction: Pushing the Brakes

Breaking a support level, very often, also in this case, causes an acceleration of the movement. Within 3-4 weeks, BTC fell back to the level of the late 2017 peak around $20k and a new low formed at that level.

When buyers are not strong enough to hold the price at or above the support level, it is a sign of weakness. It indicates that sellers (supply) are still in control. After a brief rally, BTC has now, once again, arrived in the $20k range and is hovering around that level.

The price behavior in the coming weeks will be decisive for the development of BTC in the short term. The prevailing trend is down. A clear rhythm of lower highs and lower lows is visible from the top of Nov-21. This means that the upside potential for BTC is limited now as each previous top will attract new selling activity making it difficult for BTC to push higher.

About the author

Julius de Kempenaer is a senior technical analyst at StockCharts.com, a financial charting platform for online retail investors.

Do you have something to say about this bitcoin price prediction or anything else? Write to us or join the discussion in our Telegram channel. You can also catch us on Tik Tok, Facebook or Twitter.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.