Whale Watching 101 – Guppies vs Goldfish

- Bitcoin price is showing a significant increase in volume while trading below its 200-week moving average.

- Ethereum price hovers above the 200-week moving average, but shows bearish values on the chain.

- Ripple’s price on the chain could form the sell signal that high-cap investors are looking for.

A common rule among fishermen is that Guppy and goldfish can never mix.

This article uses on-chain calculations to gain perspective on the current cryptocurrency market. Although market sentiment and technicals suggest bullish potential, on-chain metrics are starting to paint a very different narrative.

Bitcoin price has a decision to make

The Bitcoin price is currently auctioning at $19,743 as the volume profile indicator shows a significant increase in transactions while the BTC price remains stagnant. The secular market movement comes after Bitcoin lost 20% of its market value last month.

The bears successfully breached the 200-week moving average (WMA) and caused bulls to jump ship near the psychological $20,000 level. The break has enticed retail traders to join the bears calling for an unwinding of the summer Bitcoin price low of $17,622.

BTC.USDT 2-Day Chart

On-Chain Metrics

Under the hood, the Bitcoin price is showing disconcerting evidence of bearish day trading. CryptoQuant’s Bitcoin Miners’ Position Index shows a significant increase in miners’ deposits to exchanges. On September 1, the indicator was almost 10 times compared to the average swing range.

-637979972367530427.png)

CryptoQuants’ Bitcoin Miners’ Position Index

According to Cryptoquant

“Higher value shows that miners are sending more coins than usual, indicating a possible sale. If miners send part of the reserve at the same time, it can trigger a price drop.”

Combining these factors could set Bitcoin price up for a bloody September. Invalidation of the bearish thesis can occur if the bulls can recapture the 200-WMA on a higher timeframe chart, such as weekly/monthly. The 200 WMA is currently 17% above the Bitcoin price.

In the following video, our analysts dive deep into the price action of Bitcoin, analyzing key levels of interest in the market. -FXStreet Team

The Ethereum price paints a different picture

Ethereum price is trading at $1,566 as the decentralized smart contract token hovers above the 200-WMA. As market sentiment blooms in a positive direction amid the upcoming consolidation, Ethereum price is showing a worrisome signal under the hood that counters the bullish long-term outlook.

ETH USDT 2-Day Chart

About chain measurements

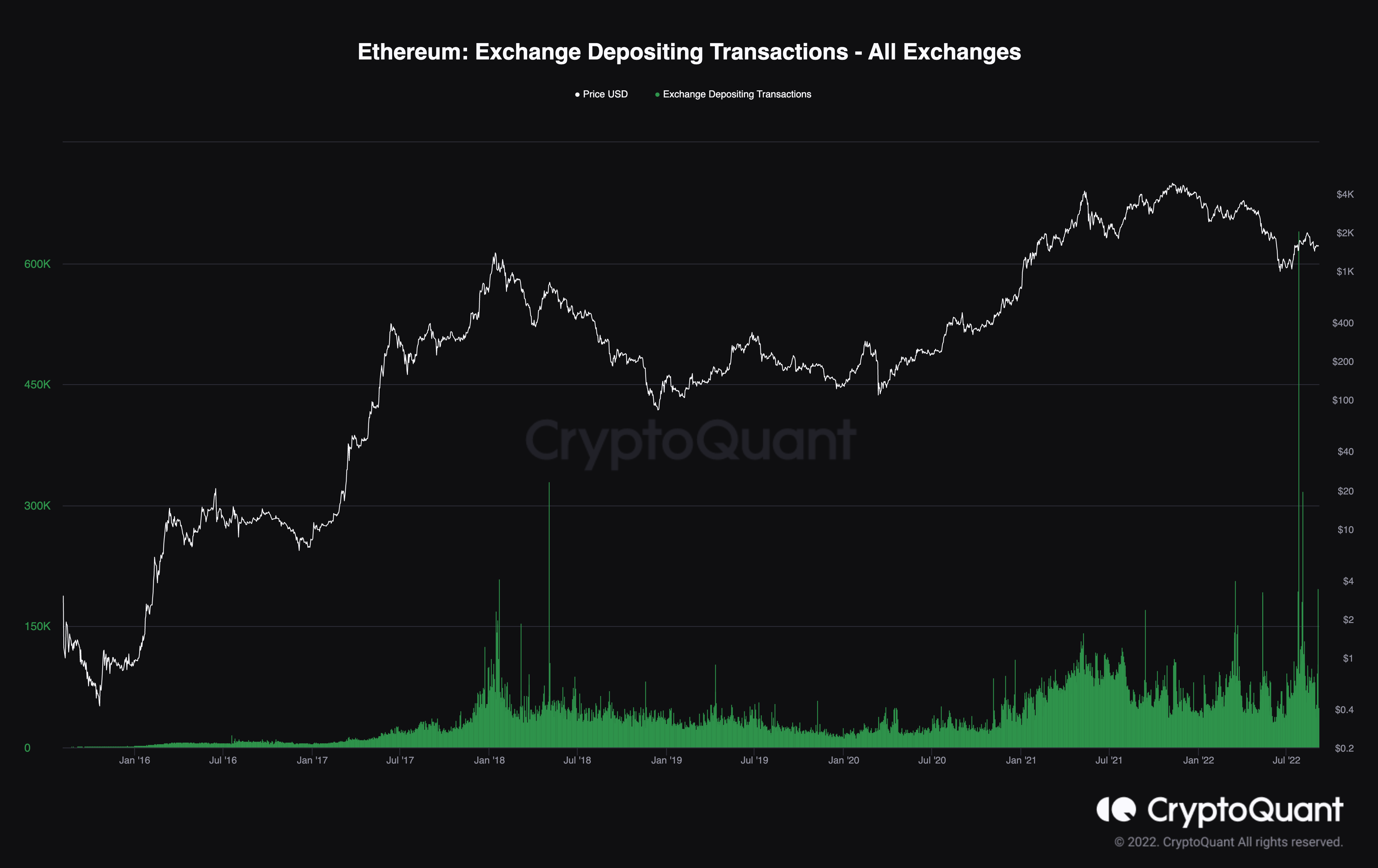

According to CryptoQuant’s Depositing Transactions on All Exchanges Indicator, Ethereum saw the largest number of deposits since its inception. On July 25, exchanges saw 640,000 transactions, nearly seven times the average daily range. In theory, more deposits on an exchange indicate a higher probability of sales. On September 3, the Ethereum price saw another 200,000 transactions.

Crypto Quants’ Indicator of Exchange Deposit Transactions

When combined, high-cap ethereum traders are clearly participating in the market and could significantly affect the Ethereum price in the coming weeks. A cautious trading mindset should be used based on confounding variables.

In the following video, our analysts dive deep into the price action of Ethereum, analyzing key levels of interest in the market. -FXStreet Team

Ripple price is on the move

Ripple’s XRP price may hint at a major unwind in the works. Last week, 1 billion tokens re-entered the circulating supply. The inflation of tokens is a result of Ripple’s escrow program. According to Ripple,

“XRP Ledger’s escrow system is designed to handle two use cases. What gives it its name is its ability to lock funds on the ledger subject to release into one of two accounts depending on whether one special condition occurs at a specific time.”

Ripple Escrow Program

Although the use of wording is subject to interpretation, there are several metrics on the chain that signal a sale is imminent. Santiment’s 365-day circulating supply indicator has shown an increase in active wallet transactions.

Santiment’s price, volume, off-exchange offers and 365 circulation indicators

The indicator’s momentum increases by 200 million coins every few days. If market conditions persist, the circulating supply will collide with the total supply beyond the exchange’s threshold, currently positioned at 99 billion tokens. This could be a chain signal whales are looking for to start unloading tokens.

In the following video, our analysts dive deep into the price action of Ripple, analyzing key levels of interest in the market. -FXStreet Team