Popular crypto trader outlines how Bitcoin (BTC) can overcome weeks of bearish price action

A popular cryptoanalyst and trader reveals what the leading digital asset Bitcoin (BTC) needs to do to regain a key support level.

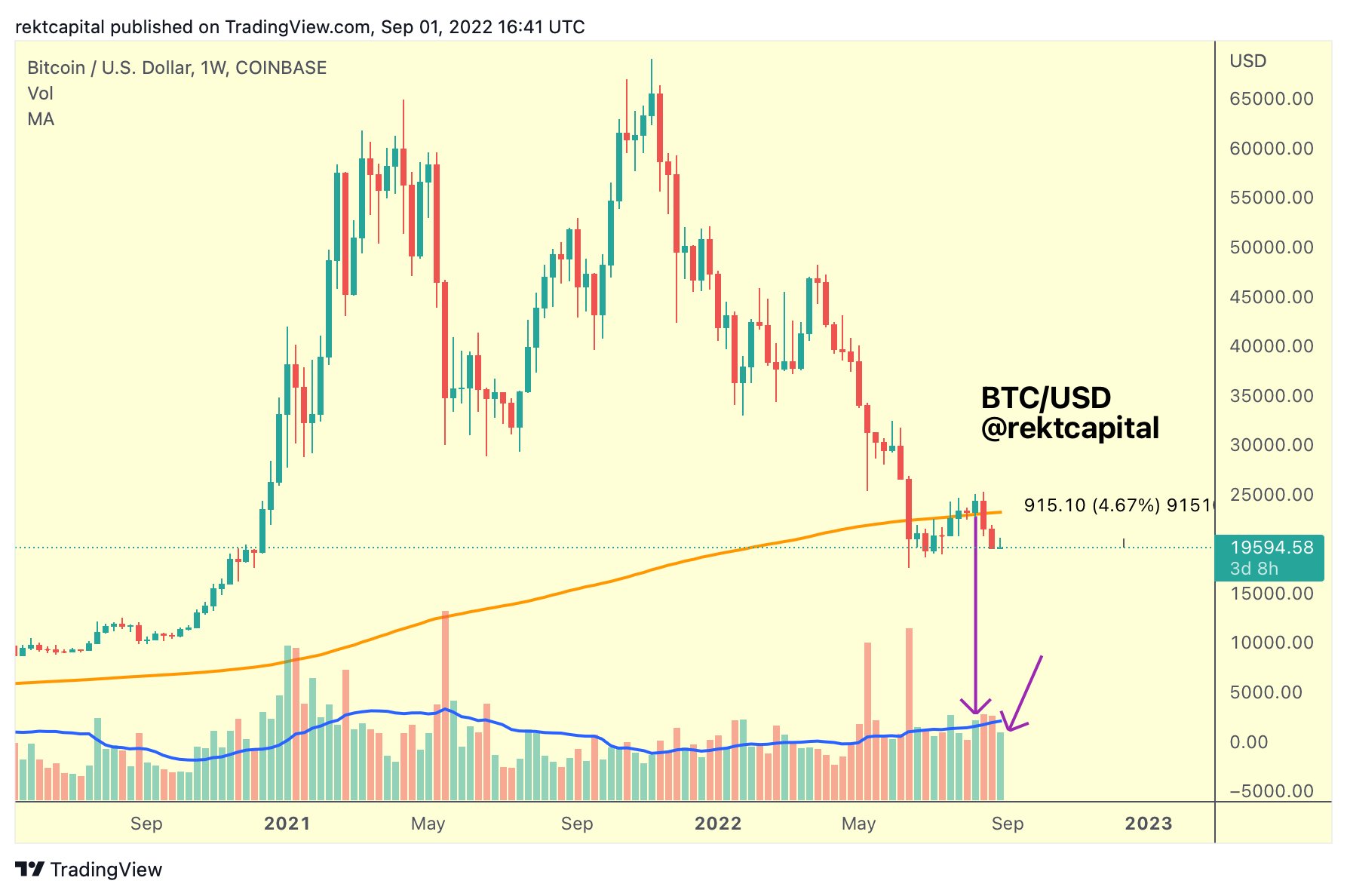

Pseudonymous analyst Rekt Capital tells his 328,000 Twitter followers that the top crypto asset by market cap missed its 200-week moving average weeks ago, but has yet to turn it into resistance.

The merchant says that if the king crypt could hold the area around $19,500, it could again see its 200-week moving average.

“BTC is struggling near the ~$19,170 support. But what’s interesting is that BTC is at a subtly higher low compared to late June. BTC lost its 200-week moving average weeks ago, but hasn’t turned it around resistance. If green support holds, BTC could return to the 200-week moving average.”

Direct Capital then notes how Bitcoin’s buying volume is now similar to what it was weeks ago. However, the trader says BTC’s price has been less affected by the purchase despite the token costing less.

“This week’s BTC buying volume is similar [the] the buying volume a few weeks ago. But weeks ago, [a] similar volume produced a movement of +10%, at higher prices. This week, similar buying volume has given a small reaction of +4%, at lower prices, and most of it has gone back.”

Recently, the analyst also outlined how Bitcoin was rapidly approaching the bottom of the bear market. He said BTC tends to bottom out a year after its previous peak in the bull market. It’s been about 300 days since Bitcoin hit its last peak in the bull market, according to the trader.

BTC is trading at $19,950 at the time of writing, a fraction of the gain on the day.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/Mirexon/Nikelser Kate