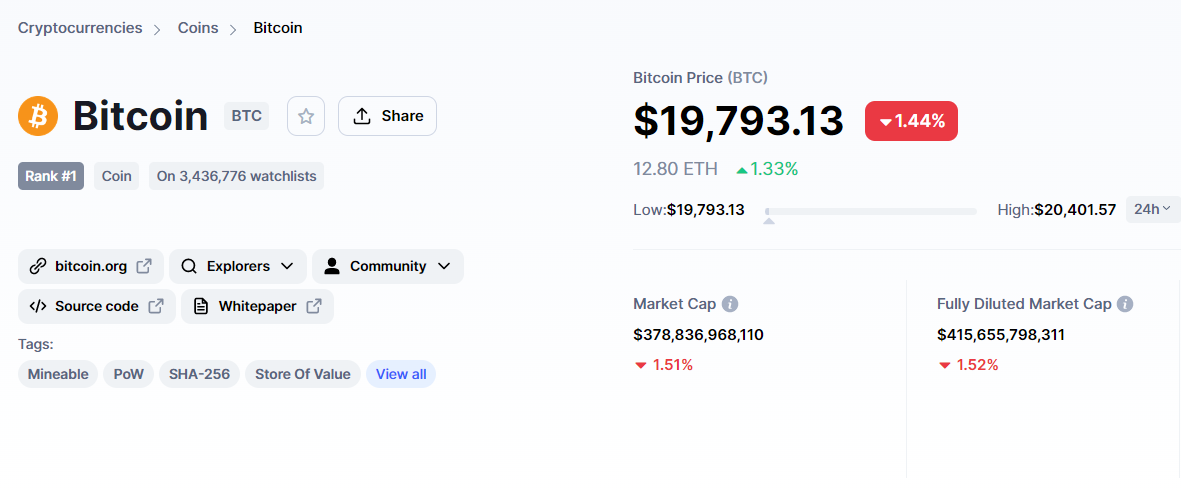

Bitcoin enters the “Extreme Fear” zone as it trades at $19,800

As Bitcoin Hit by New Unemployment Report, Investors in ‘Extreme Fear’ Zone

The Bitcoin Fear and Greed Index invented by the team of the alternative.me portal shows that today, September 3, the cryptocurrency market feels “extreme fear”. The index shows 21.

Until 1 September, this index hovered between 30 and just over 20.

Bitcoin pushed into the “extreme fear” zone.

Friday 2 In August, the leading digital currency dropped from the $20,000 level it had managed to hold for a while and fell slightly, reaching the $19,800 area. It had made several attempts to regain $20,000, but Bitcoin failed to get fixed at that price line.

Before that came the regular jobs report with US unemployment data. The figures in it turned out to be higher than expected – 3.7 percent against 3.5 percent, which hit the stock market and cryptocurrency one along with it.

However, the non-farm payrolls showed an additional 317,000 payrolls against the 350,000 expected. This indicates that the Fed Reserve is unlikely to pivot from its current hawkish strategy.

Fed Chairman Jerome Powell spread the word about the continuation of the US central bank’s hawkish policy on August 26 in his address to bankers. That day, Bitcoin began its current slide, falling below the $21,000+ level.

Although the aforementioned index shows a low value, the website’s team warns that the time of “extreme fear” in the market may present a good buying opportunity for the asset.

Bitcoin Fear and Greed Index is 21 – Extreme fear

Current price: $19,991 pic.twitter.com/3BjxqhnPCn— Bitcoin Fear and Greed Index (@BitcoinFear) 3 September 2022

Will Bitcoin Be Pushed To $15,000?

As covered by U.Today earlier, Chief Investment Officer of the AlphaTraI fund Max Gokhman believes that the hard jobs unemployment report could lead to a deeper Bitcoin decline and BTC could fall as low as $15,000.

He also mentioned that the stronger-than-expected numbers in the jobs report are likely to show that the Fed will continue its tight monetary policy, which is likely to kick Bitcoin harder down the price ladder.

Peter Schiff’s survey predicts a deeper fall

About a week ago, vocal Bitcoin critic, economist and fund manager Peter Schiff launched a challenge on his Twitter page to ask his army of followers if they expect Bitcoin to rise above $20,000.

However, he asked it in the form of two questions – whether Bitcoin will run out of buyers sooner or will it run out of sellers. The majority of voices there believed that BTC would run out of buyers. Therefore, Schiff used this result to support his bearish expectation that the flagship cryptocurrency will continue to decline.

Earlier this year, he tweeted that BTC is likely to test support below the $10,000 level.