The NFT industry’s fragmented financial sector makes it far more difficult and risky to sell NFTs and lend money to NFT holders, but UniswapEthereum’s most popular decentralized exchange (often called a “DEX“), aims to become a powerful player in fixing this problem. Uniswap Labs has made moves and expressed interest in the NFT space in recent months, and this could solve the biggest problem NFTs suffer from.

When the first version of Uniswap arrived in 2018, it was revolutionary for crypto. Thanks to Uniswap, crypto holders could exchange tokens from the comfort and security of their personal wallets, including hardware wallets. Uniswap provided the ability to buy or sell cryptocurrencies that are not listed on exchanges by giving their creators the ability to create “liquidity pools” filled with tokens that users could trade for, ushering in a new era of decentralized finance (DeFi). While this was great for “fungible” tokens (tokens that are all identical), it did nothing for “non-fungible“tokens, or”NFTs“, which was still a new idea at the time. Unlike crypto lending/lending apps, building NFT lending/lending apps is difficult due to the near impossibility of liquidating a repossessed NFT for a predictable price, which is mainly due to how fragmented the NFT industry still is.

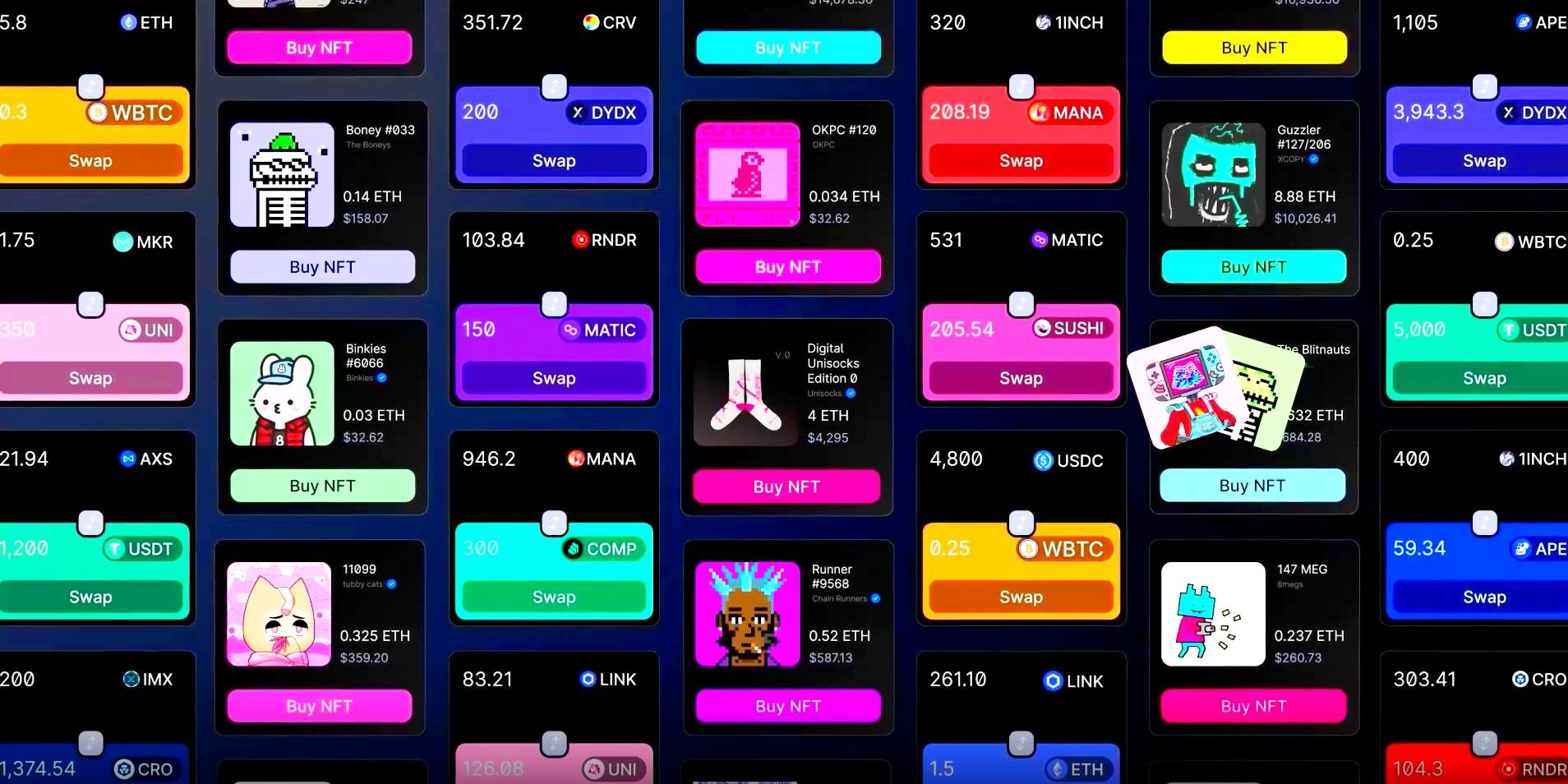

However, the NFT industry may not remain fragmented for long. On June 21, Uniswap Labs announced the acquisition of Genie, an app that combines (or “aggregates“) multiple NFT marketplaces into the same interface, solving the problem for merchants of choosing between NFT marketplaces royalty payment policies versus customer base size. August 23, Uniswap’s NFT Product Manager @Scott_eth posted on Twitter that Uniswap is now “in conversations“with 7 NFT borrowing and lending protocols to fix the fragmentation and”information asymmetry” issues across the industry. These two moves combined are important for the NFT industry, as Uniswap’s trading volume has surpassed Coinbase’s in the past, which CoinDesk reported on back in September 2020. Having NFT marketplaces and financial services alongside Uniswap’s hugely popular token exchange protocol could give the NFT industry an overload.

NFT liquidity is fragmented and Uniswap can fix that

The biggest problem facing the NFT industry is fragmentation.liquidity“, which (as an adjective) refers to the ability to convert an asset into cash/crypto, and (as a noun) usually relates to the amount of cash/crypto waiting in reserve to purchase an asset (such as tokens in Uniswap’s liquidity pools ). That’s where the term “liquidation” derived from: convert an asset into “liquid“cash/assets. NFTs are widely considered”illiquid” Assets because of how difficult they are to sell, and predicting the highest price an NFT will sell for at any given time is virtually impossible, making NFT financial services difficult to create and often much riskier to contribute to than conventional DeFi applications.

NFTs have great potential for financial services and passive income opportunities if their liquidity problems can be resolved. Loan liquidity can be more abundant using fractional NFTs, often called “F-NFTs“, which breaks an NFT into smaller identical tokens, which can then be purchased by many lenders taking a smaller risk rather than a single lender taking a large risk. NFT leases will soon also enter the market, which will increase the the financial services available to NFTs by providing a risk-free way to generate passive income from NFTs used in gaming and metaverse worlds.

While it is impossible to design a DEX that can instantly sell an NFT, Uniswap seeks to get as close to this goal as possible by connecting all NFT marketplaces to a single interface while implementing easily extensible lending and borrowing services for several services as well. Uniswap is likely to become a critical part of Web3’s financial system by acting as an all-in-one universal currency converter and NFT financial hub. Solving the problems NFT finance applications face before their best use cases are invented could take the industry by storm, and Uniswap is the right app for the job.

Source: Uniswap Labs, @Scott_eth/TwitterCoinDesk