Bitcoin Bearish Signal: 7-10 Year Old Coin View Movement

On-chain data shows around 5k BTC lying dormant since between 7 and 10 years ago was just moved, a sign that could be bearish for Bitcoin.

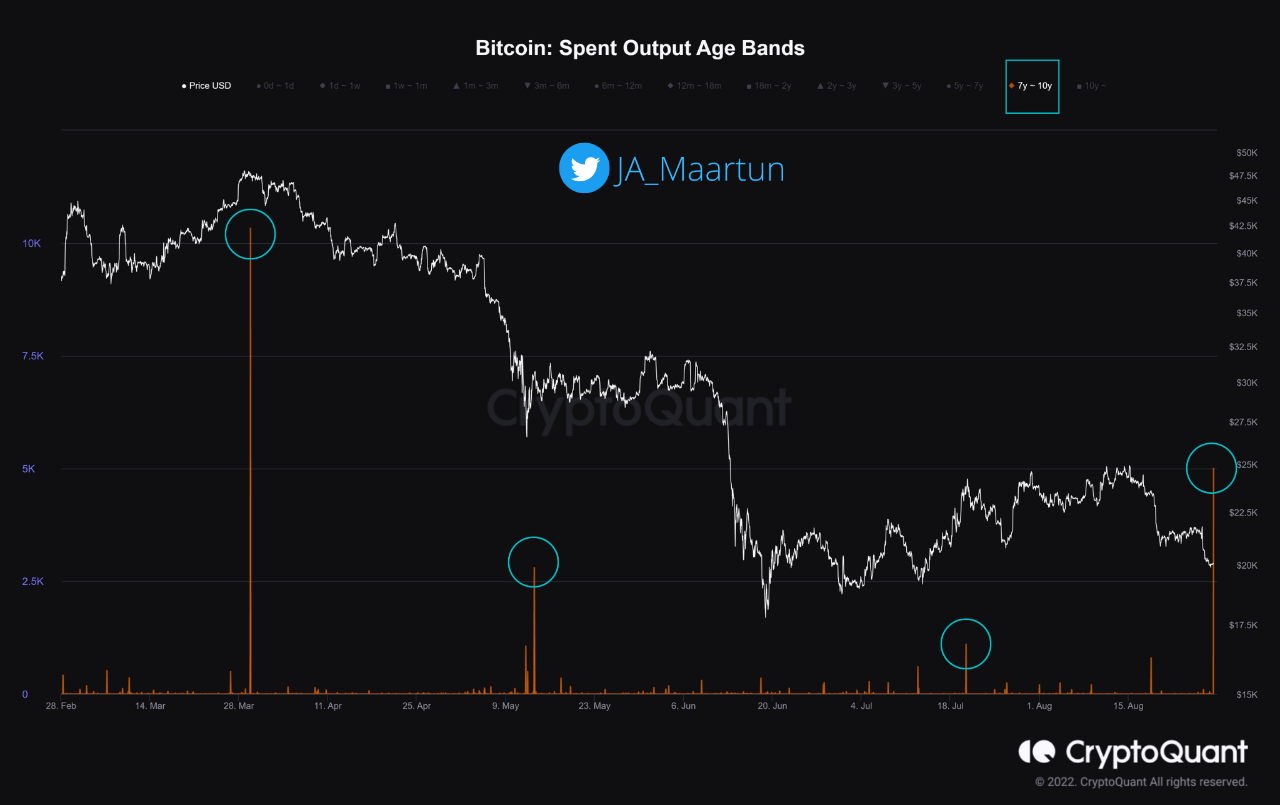

Bitcoin Used Output Age band shows movement of 7-10 year old coins

As pointed out by an analyst in a CryptoQuant post, when such old coins have moved before this year, BTC has seen a generally bearish trend.

The relevant indicator here is the “used production age bands”, which tells us about the selling behavior of the different age groups of coin holders in the Bitcoin market.

The metric works by checking through the chain history of each coin being sold to see when it was last moved before this. Based on this period of time that the coin had been dormant, the indicator puts the coin into a group and it is used counter as a top for that group.

The coin age group at hand here is the 7-10 year old cohort, which includes all coins that were kept stationary for some time in this area before being moved.

Now, here’s a chart showing the trend in Bitcoin spent outputs for this specific age range over the last few months:

Looks like the metric has registered a spike recently | Source: CryptoQuant

As you can see in the graph above, the used outputs from the age group of 7 years to 10 years Bitcoin have observed some significant peaks in the last few months.

The first of these came in March, coinciding with the crypto hitting a local peak with price declines shortly after.

Then came the next one after the coin’s value had already fallen sharply in May. The price continued to move sideways after that, until it finally saw another big drop.

There was also a small uptick in the indicator last month, with the price again setting a local top as it went down (but before going back up).

Today, the used outputs of coins aged 7 years to 10 years have again shown movement, with a rise amounting to a whopping 5k BTC.

Since the price of Bitcoin has recently fallen, it is possible that this latest increase in the metric could follow the same trend as the peak in May.

But the quant in the post notes that this time the transaction hasn’t been sent to exchanges (which investors typically use to sell), so it’s hard to say exactly what impact this might have on the crypto’s value. Still, the outcome of this is not likely to be bullish.

BTC price

At the time of writing, Bitcoin’s price is hovering around $20k, down 6% in the last week.

The value of the crypto has plunged down | Source: BTCUSD on TradingView

Featured image from Aleksi Räisä on Unsplash.com, charts from TradingView.com, CryptoQuant.com