The BTC price resets are causing Bitcoin addresses to incur extensive losses

The BTC price resets are causing Bitcoin addresses to incur extensive losses

Bitcoin address losses hit 1-month high as USD breaks highest since July

By Shashank Bhardwaj

Image: Shutterstock

Image: Shutterstock

Latest reports suggest that over 17.5 million Bitcoin wallets are in losses as of August 23rd, more than any other day in the past month. Bitcoin traders are under significant pressure as BTC/USD has been below $21,000 five times since August 19, according to data from Cointelegraph Markets Pro and TradingView.

Source: TradingView | BTC/USD 1 Hour Candlestick Chart

Source: TradingView | BTC/USD 1 Hour Candlestick Chart

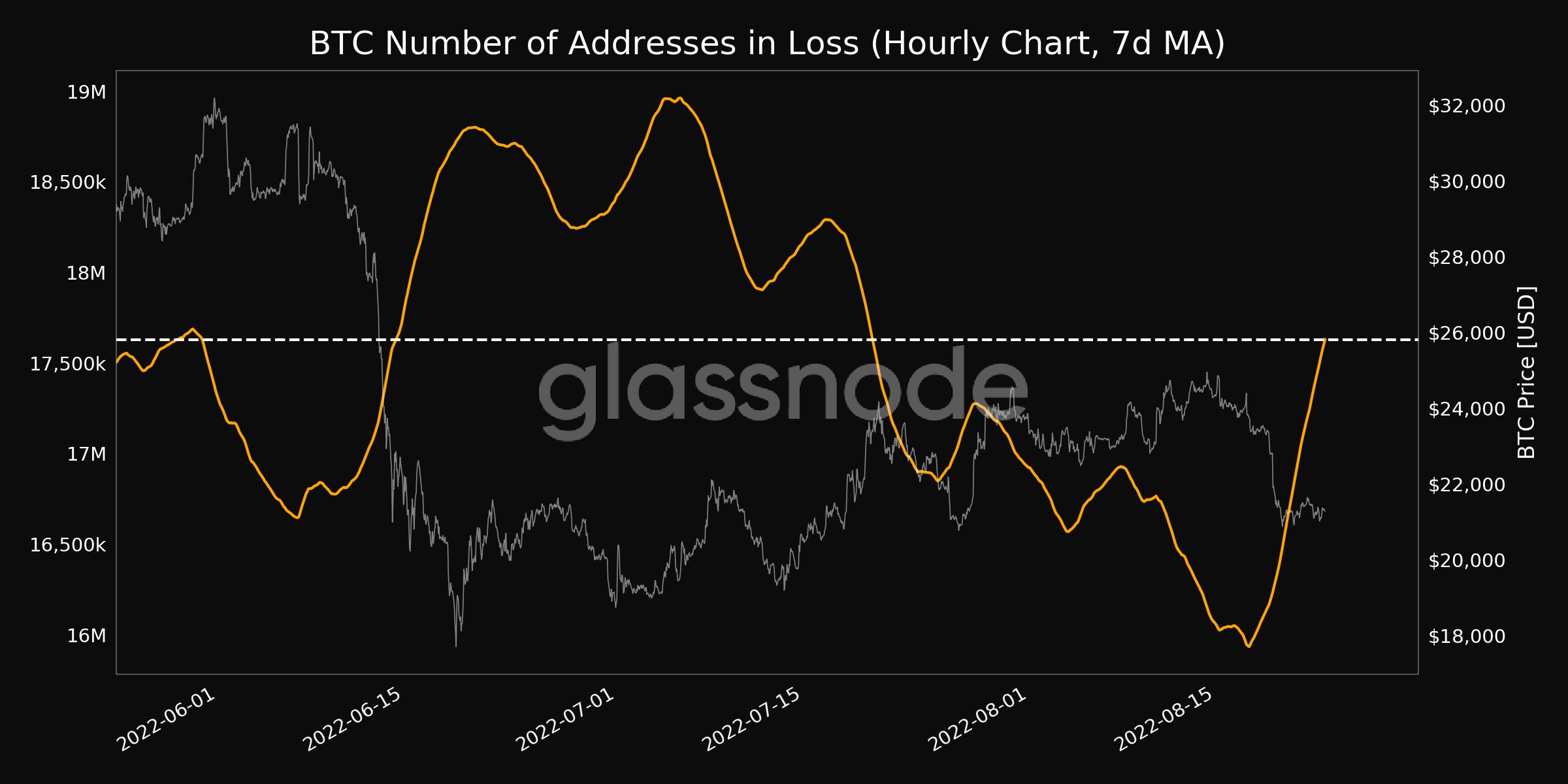

With Bitcoin at its lowest since the last week of July, those who recently bought their wallets are also experiencing red, to varying degrees. In addition, it is now clearer the extent to which investors added to positions to contribute to this month’s $25,500 highs, with more BTC addresses facing a combined loss than at any time since July 23.

Underwater addresses, i.e. those with assets that were bought above today’s price, have been very evident since last week’s sudden price drop. As of this writing, the seven-day moving average (MA) of wallets in the red is upwards of 17.5 million. This shows an increase of approximately 1.5 million in the last few days.

Source: Glassnode Twitter | Bitcoin 7-day addresses in loss chart

Source: Glassnode Twitter | Bitcoin 7-day addresses in loss chart

The monitoring resource, Coinglass, which covers the liquidation of positions on derivatives exchanges, also shows statistics that prove that the majority of losses incurred on August 1, with price movements above $21,000, are not that important. Meanwhile, August 19 sealed the total figure of $209.5 million in long position liquidations on exchanges, which is the highest since June 13. In addition, there were $30 million in short positions as well.