How Stacks has revolutionized the outlook of Blockchain’s leading network

The blockchain world started back in 2009 with the release of the Bitcoin Whitepaper. Since then, this world has skyrocketed in public understanding, community support, capital investment and industrial applications. What started as a singular cryptocurrency has evolved into multiple ecosystems of incredible proportions, used in seemingly every industry, from finance and cybersecurity to gaming and telecommunications.

The cryptocurrency that started it all, Bitcoin, has continued as a shining example of what is possible within the blockchain. At its peak, Bitcoin had a total market capitalization of 872 billion, demonstrating the vast amount of capital that has flowed into this financial asset from around the world.

Still, while Bitcoin is a leading cryptocurrency, many people in the blockchain community prefer to use Ethereum, a major network competitor, when building any kind of decentralized application. Usually, the main reason for this is that Bitcoin is notoriously difficult to build on since it has an incredibly simple core architecture. Ethereum, on the other hand, offers a variety of developer tools that have led to developers from all over the world flocking to this medium.

This has been the case for several years and there are now over 4,000 applications on Ethereum. However, another Layer-1 blockchain ecosystem known as Stacks is set to change this, with their new consensus mechanism and connection to Bitcoin providing a new way to engage with this legacy blockchain network.

What are stacks?

Stacks is a blockchain in itself, and acts as a Layer-1 ecosystem. Although this is nothing new, the consensus mechanism they use is completely different from all other blockchain systems. Typically, blockchain ecosystems use either Proof-of-Work (like Bitcoin) or Proof-of-Stake (like Ethereum) to process transactions and lock them into the system.

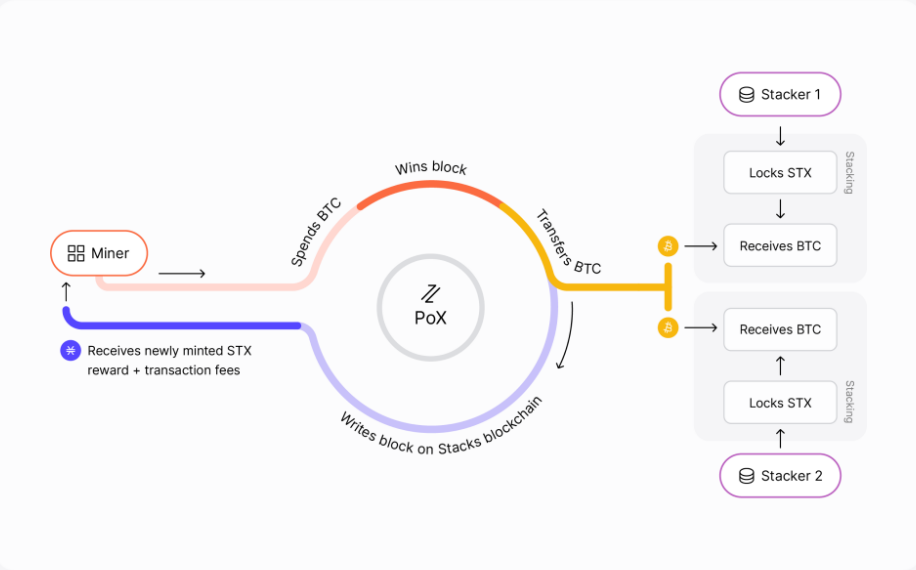

However, Stacks uses a new consensus mechanism that they invented known as Proof-of-Transfer (POX).

With POX, an active transaction takes place between two distinct blockchains. In this system, block producers (those who validate transactions) are selected when cryptocurrency on a separate blockchain is transferred to a list of predetermined addresses. Typically, with Stacks, this uses Bitcoin to Bitcoin addresses.

Using this system, each block has a singular miner, just like with Bitcoin’s established Proof-of-Work system. By using this system, Bitcoin users have a new opportunity to spend their BTC and generate more from mining, without having to go through the incredibly energy-intensive process of Bitcoin mining.

Similarly, those on the Stacks blockchain can lock their STX tokens and start receiving BTC in return for the time in the system, with this movement from one blockchain to another creating a stacking cycle that validates transactions.

POX is the entire system behind Stacks, with this invention laying the foundation for all the major advances this blockchain has made since its launch.

Where did stacks come from?

Stacks has had a long journey to become the blockchain titan that it currently is. The path started way back in 2013, when Muneeb Ali and Ryan Shea founded the company while they were both studying in the computer science department at Princeton University. Fast forward to 2017, and Ali was completing his Ph.D. thesis, focusing on the structure and development of the new Internet.

Stacks released a public alpha of the Blockstack browser in 2017, already receiving a huge influx of public and investor support, and at the end of the year marketed a $47.4 million token offering launch. With the launch of Stacks 1.0, the blockchain network was created, with their early goal of enabling developers to build decentralized applications that they could then scale.

The blockchain network picked up traction immediately, with over 360 applications developed using Stacks over the next 12 months. With their growing exposure, developer following, and passionate community, Stacks was able to raise $23 million USD for their coin offering. Alongside a huge amount of capital, this marked the first ever SEC-qualified coin offering in US history and demonstrated the extent to which Stacks pushed the boat out.

Throughout much of 2019, Stacks 2.0 was tested and developed, until January 2020 when it was released. This marked another turning point for Stacks, as they introduced several new features that would later become the basis for further success.

The main features associated with Stacks 2.0 were:

- Advanced Smart Contract Language – The team behind stacks redeveloped their main smart contract language, publishing Clarity – which is suitable for both security and predictability when creating smart contracts.

- POX – Proof of Transfer was released with Stacks 2.0, which was a new mining mechanism proposed and provided by the team at Stacks. This is the basis of stacking and provides a new way of working with blockchain mining.

- stacking – Using POX, staking allows users who hold bitcoin to earn coins by participating in their consensus algorithm.

The mainnet of Stacks 2.0 was developed throughout 2020 and 2021, and went live in early 2021. With the community support that Stacks has, their tools unlocked over $1 trillion USD of capital on the Bitcoin network, with their new consensus mechanism providing an invaluable opportunity for the Stacks community.

In 2022, Stacks has continued to aim to improve its development, scale its communities, and bring a new method of interacting with the Bitcoin network into the mainstream. If their 136,000 Twitter followers is some kind of public intrigue, their mission seems to be going well.

Beyond Bitcoin with Stacking

Typical Bitcoin mining is a proof-of-work system, where computers must solve incredibly complicated mathematical problems to validate transactions. Solving these problems requires a huge amount of energy, and the average transaction takes the equivalent of 50 days of energy use in the average American home.

With the huge energy requirement, only very few people around the world actually have the means to mine bitcoin, making the availability to process transactions incredibly slow. Typically, Bitcoin can only process around 3-7 transactions per second, which is far too low for any financial system.

Compared to Visa, a centralized financial system, which offers 1700 TPS, Bitcoin simply cannot keep up. This has been a major problem, limiting the potential of Bitcoin as it cannot scale quickly or efficiently. Similarly, those who own Bitcoin cannot do much with their currency. While other POS cryptocurrencies allow their users to stake cryptocurrency to earn annual returns, Bitcoin just doesn’t have that option. Simply put, Bitcoin seems more like a buy-and-forget investment than anything else.

Nevertheless, the arrival of Stacks has caused a complete revolution in how people engage with and use Bitcoin. With the Stacking system, users of Bitcoin can actually use their own Bitcoin to validate transactions at a much higher speed, allowing the Bitcoin blockchain network to release a number of transactions due to the presence of Stacks users.

Stackers using this system follow four steps:

- Locking in – People who own STX tokens will lock in their tokens to the network, and choose a period of time they want to keep their money there.

- Pool or alone – Users choose for themselves whether to stack their currency alone or add to a pool with others, allowing even someone with a small amount of cryptocurrency to get involved.

- BTC Address – By adding a BTC address to their STX, they then start receiving BTC as a reward for holding their STX.

- Cycle ends – After the selected time period, STX is unlocked and the user gets STX back while having BTC rewards.

At the same time, miners will go through the opposite process to validate transactions:

- Transfer – Miners actively transfer BTC to the registered BTC wallet addresses of those who stack.

- Winner – Randomly selected (with respect to a proportion of the investments), one user will be chosen to validate the transaction block of Bitcoin.

- Profit – The winner will earn the transaction and can then commit a new block to Stack’s blockchain.

- Receive – The miner will then earn newly minted STX from the transaction, which was minted during and from the POX process.

With this system, both the BTC miner and the STX stacker are put at an advantage, with the proof-of-transfer system freeing Bitcoin from the energy-intensive and monotonous traditional POW mining process.

A big future impact

With the arrival and popularization of Stacks, Bitcoin suddenly has a method to increase scalability without having to compromise any of its security features through sidechain partnerships. As Stacks is an L1 ecosystem as its own blockchain system, the ingenious use of POX radically improves the scalability of Bitcoin. Nevertheless, Bitcoin is still able to maintain its own ecosystem structure, continuing without being compromised.

The biggest advantage of working through Stacks is that it uses the Bitcoin network, allowing users and developers to take advantage of the amazing security systems that Bitcoin has in place. With the huge development of Bitcoin, it is practically impervious to hacking attacks, which makes this a huge advantage of working with Bitcoin.

Moreover, the POX system offered by Stacks also makes Bitcoin mining an accessible and easy-to-do activity, dramatically increasing the real-world applications of BTC for those who currently hold this cryptocurrency. Over time, this will increase the use of Bitcoin, making it a more attractive cryptocurrency beyond just being the first.

By combining the scaling potential of Stacks with the strict base infrastructure of Bitcoin, the latter suddenly becomes an increasingly feasible blockchain network to use for development. With this in mind, we are likely to see a major shift in the approach and understanding of Bitcoin over the next decade.

If Stacks continues on the upward trajectory it is currently experiencing, Bitcoin may well and truly push forward to become the perfect blockchain system.