Does sentiment shift slowly signal a cryptocurrency recovery going forward?

The crypto market has lost momentum after the extended weekend in the United States. Bitcoin and other major cryptocurrencies have recorded losses during the current trading session and may continue to decline in the short term.

Related reading | TA: Ethereum regains strength, shows early signs of fresh rally

At the time of writing, the total market value of crypto is $ 860 billion with sideways movement in recent weeks. This calculation has been on the downside since the end of 2021, but took a serious loss in April-May 2022, as shown in the chart below.

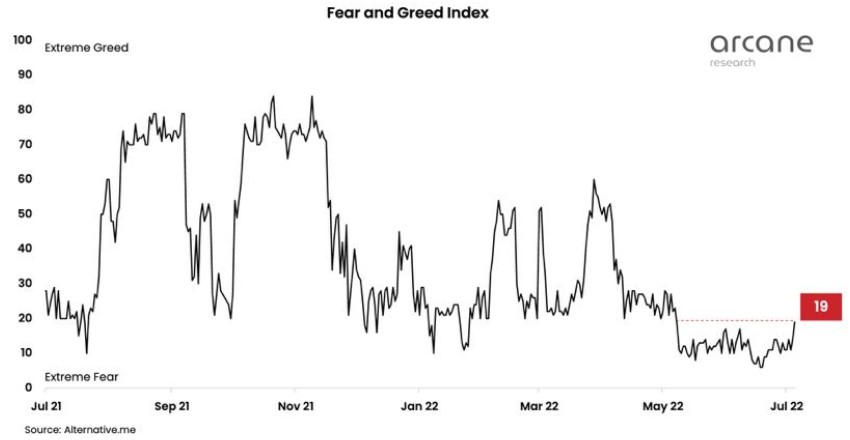

As a consequence, the general sentiment about the crypto market went down and registered extreme fear levels on the Fear and Greed Index. The price of Bitcoin and other major cryptocurrencies often finds a local bottom or peak when the index is close to 10 or 80, respectively.

The crypto market found a bottom in June when BTC’s price traded close to $ 17,000 and pushed the fear and greed index to extreme levels. Since then, the number one cryptocurrency has pushed the market slightly upwards, forming a new range between $ 18,600 and $ 21,000.

These levels stand as the main area of resistance along with $ 22,000. Market participants seem more positive about a likely breach above these levels, according to a recent report from Arcane Research. The first stated the following about the change in market sentiment in recent weeks:

The mood in the crypto market has been depressed for several months, but we see a slight improvement this week. After the fear and greed index climbed to 19 yesterday, we are at the highest point in two months. While we are still comfortable in the “Extreme Fear” area, we are now pushing towards the “Fear” area, and the market is a little more optimistic (…).

Ready for more crypto cons?

The total market value of crypto and the performance of the altcoin market is tied to BTC, ETH and major cryptocurrencies. As NewsBTC has reported, the sector is currently affected by macroeconomic factors; rising inflation, and interest rate hikes from the US Federal Reserve (FED).

The influence of these factors on the market must be curbed before the incipient asset class can be decoupled from traditional finances. In the meantime, any bullish momentum will remain receptive.

Related reading | Cardano releases new update on Testnet, how will the price respond?

If the price of Bitcoin fails to push above $ 22,000 soon, the market may see a decline in the fear and greed index. Data from Material Indicators and their Trend Precognition Indicators suggest that it is likely to see a re-test of lower levels. Via Twitter, the analysts wrote:

BTCUSDT and ETHUSDT were both rejected at a 21-day moving average, and now we see the Trend Precognition A1 Slope Line roll over on the D-chart indicating a short-term loss of momentum.