Bitcoin is the economic equivalent of Esperanto

Tevarak / iStock via Getty Images

In my opinion, Bitcoin (BTC-USD) should be avoided because it serves no economic purpose and does not solve any identifiable problem. If someone insists on buying it, I think they would be wise to follow the advice of a particular colored in wool Bitcoin bull, and invest less than 5% of the capital in this or other digital assets.

Bitcoin is for global finance just as Esperanto is for languages

For those of you who may not be aware of it, Esperanto was formed in the late 19th century, in the hope that it would be a “universal second language.” Thus, it was a system designed to solve a non-problem, because the world already had a number of “other languages” that served different purposes well for centuries. Latin for medicine, French for diplomacy, and of course English for trade. This is the reason why in 2017 there are between 30,000-180,000 L2 users of Esperanto (“L2” means a person’s second language). To put this number in context, there are around 170,000 people who speak Irish as their first language and around 1.2 million poor souls who were committed to learning it as a second language. It is my belief that most of my readers have never heard a single syllable of either Irish or Esperanto. I think in the coming years it will become obvious that Bitcoin is the economic equivalent of this: an over-constructed “solution” to a problem that has already been solved.

Overconstructed “solution” to a non-problem

When I first started talking to different Bitcoin lovers, the trench screen and the stomachs years ago, I was told that Bitcoin would be a different kind of money, one that is much harder to manipulate. When I pointed out that in order to be money, something has to be a store of value, an account unit and a medium of exchange, and that Bitcoin was too volatile to function as any of these things, I was hit by a boom. of acronyms that only made sense to those inside the club. In fairness to my Bitcoin-loving colleagues, they have withdrawn from this position, and now claim that Bitcoin offers a way to solve the various problems associated with banking.

As a writer on this forum, I have a responsibility to tell you what my biases are in case they are not clear yet. I am a relatively wealthy citizen of the “developed world” who has access to a multitude of banking and quasi-banking services such as PayPal (PYPL). As a result, I did not know that there were problems with banking services, and I therefore do not see the “solutions” presented by Bitcoin advocates as solving an unmet need. I see that this “solution” is a squeaky “me too” which does not really add much value, and which can actively be worse. Feel free to check out Dan Olson’s work on YouTube for a thorough look at how Bitcoin is actively making things worse.

The Best of the Bull Case

So I admit that I’m biased, and I admit I’m wrong, because it’s happened often enough before. For that reason, I want to seek out and be as generous as possible with the most affordable Bitcoin bulls I can find. For that reason, I will highlight the most insightful person I have met. In my experience, Andy Edstrom offers the most compelling case for investing in Bitcoin. He’s done public interviews, and you’re welcome to look him up on your Google (GOOG) (GOOGL) machines to dive deeper into his insight.

He also wrote a book that defended the idea of investing deeper in Bitcoin in case you are interested. In a nutshell, he suggests that Bitcoin will probably not replace the fiat currency in the first place, but is the electronic equivalent of gold. Bitcoin is a great resource to buy because inflation will be a problem in the future, gold is traditionally the preferred hedge against this eventuality, given that gold surpassed everything in the very inflationary 1970s, and bitcoin is the “new gold” because it has more advantages over the yellow metal.

Furthermore, Edstrom points out that the gold market is currently worth between 10-11 trillion dollars, and Bitcoin is worth a few hundred billion, so Bitcoin will rise in prices as “more of your inflation hedging dollars” will flow out of gold and into Bitcoin. Also, Bitcoin is in many ways superior to gold. For example, you can not counterfeit Bitcoin so you can add tungsten to gold. I guess this is a problem for people who do not buy gold coins or bars from the likes of Johnson Matthey or reputable mints in Australia, Canada or the United States? But most obviously, gold is difficult to transport physically, while it is theoretically possible to keep hundreds of billions of dollars in wealth on a USB key.

Although I think this is the best argument for Bitcoin available, there are a number of issues with it in my view. First, and most importantly, gold is not an inflation hedge. Furthermore, there is growing evidence that what we are experiencing is not inflation of the type we experienced in the 1970s. For example, price increases can just as easily be explained by a left shift in aggregate supply caused by a global shutdown, and a right shift in “stimy check” made aggregate demand possible. In fact, a compelling argument can be made to suggest that recession-induced disinflation, or even deflation, is in the cards.

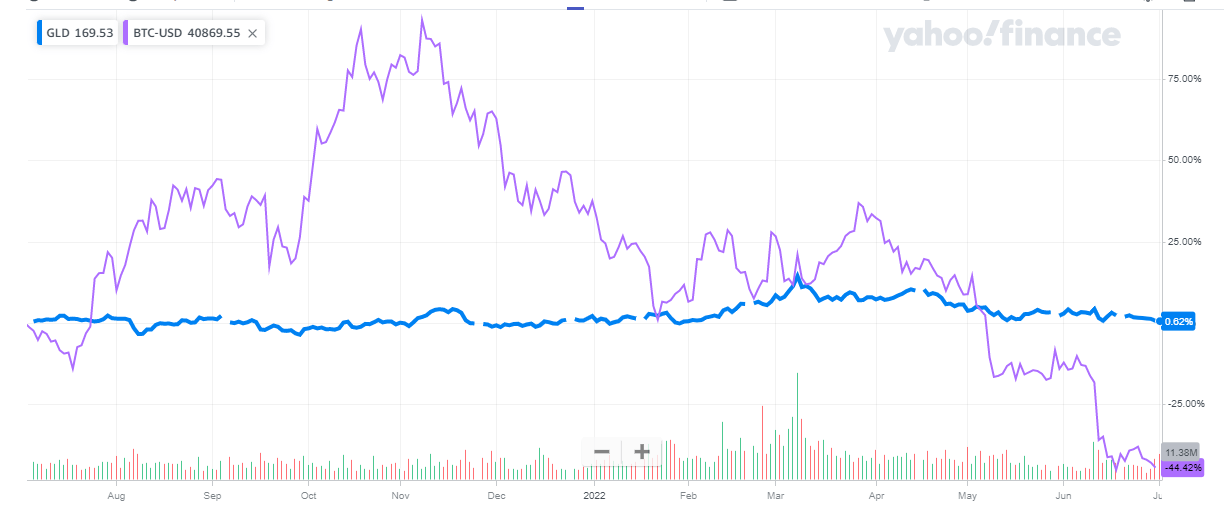

Finally, the volatility of Bitcoin disqualifies it from being considered a hedge in my view. Consider the following graph that compares the price of Bitcoin in US dollars with the price of the world’s largest gold broth ETF:

Bitcoin V gold (Finance.Yahoo)

Compared to the very choppy price movement of Bitcoin, gold simply looks sleepy. So if you were someone who was willing to invest in an asset like gold, with its negative 2% carry (1% for storage, 1% for insurance), you are one who cares about preserving your fortune in the face of a constant change, money supply growing world. I do not agree with the point of view, but I understand it. In my opinion, it is a heavy lifting to get the conservative lover of “hard money” to switch to the roller coaster which is Bitcoin. Therefore, I am very skeptical that Bitcoin will be in a position to replace gold as (any) inflation hedge anytime soon.

We should also note that Bitcoin has proven to be a very ineffective defender against the harmful effects of inflation. In my opinion, if you are writing a dissertation on the behavior of a machine such as the global financial system, for example, and the machine behaves the exact opposite of what you anticipated when these circumstances seem to arise, you will probably need to develop a new theory of how the world works. Although the recent fall in the price of Bitcoin does not “prove” that it is a bad asset choice, further than the rise in prices “proved” that it was a solid choice in the past, we must note that when Bitcoin was in what is supposedly its most fertile ground , it failed.

Finally, one of the reasons I found Erdstrom so affordable is the fact that he, a colored Bitcoin bull, accounts for between 3-4% of a Bitcoin portfolio. That’s it. In my limited experience with this community, people who love Bitcoin REALLY love Bitcoin and would rate 10x Erdstrom’s figure for being too cheap and conservative. This highlights another risk here. Many of the people who advocate for Bitcoin are so distrustful of more traditional markets that they invest huge amounts of their portfolios in Bitcoin. In my opinion, this will not end well.

Submit the charters

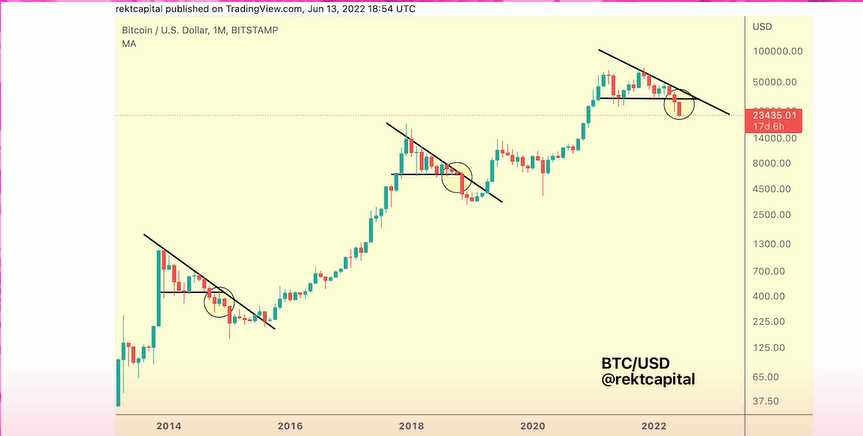

I also think it is reasonable to point out that we have been on this road before. There are many people who map Bitcoin’s price changes in the hope of gaining some insight into what the future brings. A subsection of these people makes their views freely available online, and if you are interested, I recommend checking out their work. As I did with Erdstrom, I will try to summarize their views. The general perception is that we have been here before, and that those who bought when others sold did well over time. Each and every one of them I have seen points out that every beef market inevitably takes a breather before prices inevitably rise again.

Price history of Bitcoin (Real Vision Crypto)

That’s great, but even if we take the history above as a kind of guide, we’re led to the conclusion that Bitcoin is pretty much dead money for the next few months as consolidation continues in my opinion. If the future does not reflect the past because the market begins to conclude that this is a terrible hedge against inflation, for example, this leg up can never come. To put yourself in the state of mind that is open to the possibility that the future will be significantly different from the past, you can go through Bertrand Russell’s parable of the inductive Turkey, or you can enjoy the following graphic to get the point. The market sometimes (often?) Seems to deceive us by defying our expectations of a future that we “only know” is just around the corner.

An example of the fallibility of technical analysis (Forex Training Group)

Conclusion

Under the most optimistic scenarios, I think Bitcoin is dead money for at least several months as it consolidates. Moreover, even the most eager, sensible Bitcoin bull I could find advocates for a 3-4% position in the cryptocurrency. I’m not a fan of gold as an asset class for a number of reasons, but it has at least a physical form. Given how it is done in this period of supposedly high inflation, I think the “Bitcoin is inflation hedging” argument joins the “Bitcoin is the new money” argument as a non-starter. I may regret this call in a couple of years when the price may well rise again, but I think Bitcoin is a bubble that should be avoided. If you insist on participating, I recommend that you take the advice of Mr. Erdstrom and keep your exposure below 5%. If I am wrong, investment in Bitcoin will grow massively. If I’m right, you’ll be glad you limited your exposure.