Bitcoin and Ethereum hit as the crypto market bears selling

Share this article

Several leading assets suffered double-digit losses as Bitcoin and Ethereum fell.

Bitcoin and Ethereum Correct

The cryptocurrency market’s recent rally appears to have stalled.

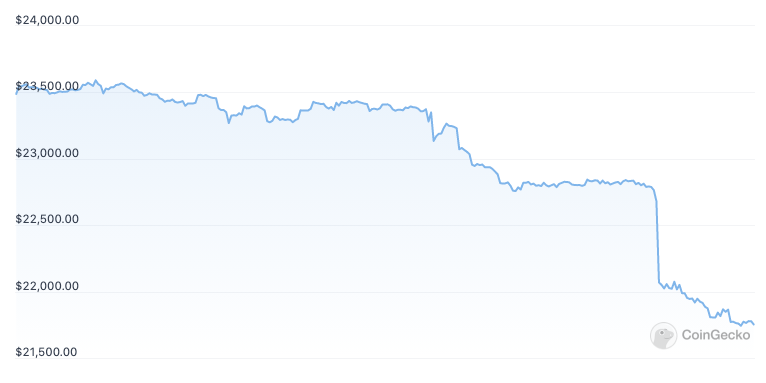

Bitcoin and Ethereum were down early Friday in a broader selloff that has hit several of the market’s top cryptocurrencies. Per CoinGecko data, Bitcoin is down 7.3% in the past 24 hours, falling from around $23,500 to $21,750 at press time. Ethereum has lost 6.2% and is trading at $1,730. The leading cryptocurrencies have rallied in recent weeks, helped by renewed confidence in the market and widespread anticipation of Ethereum’s upcoming Proof-of-Stake “Merge”. However, both assets have fallen in the past week as momentum wanes.

Many other major cryptoassets were also hit in the downturn. When Bitcoin and Ethereum bleed, other cryptocurrencies with lower market caps tend to drop in market value at a faster rate as panicked market participants rush to exit their positions. Dogecoin, Polygon, NEAR, Solana, and Avalanche have all posted double-digit losses in the past 24 hours.

One exception to the correction has been Gnosis, which is up 5.2% despite the market taking a hit. Gnosis Safe announced that it would send a new token called SAFE to early adopters on Thursday, which likely explains why Gnosis is holding up against volatility.

After the cryptocurrency market rebounded from its June lows through July and early August, many market participants had pinned their hopes on the bullish rally continuing into the fourth quarter. Arguably, the strongest catalyst for a potential surge ahead is Ethereum’s Merge event, scheduled to air around September 15th. However, with growing concerns about Ethereum’s censorship resistance in the wake of the Treasury Department’s move to sanction Tornado Cash, the previously busy merger story has begun to lose steam in the past week.

The latest decline saw the global cryptocurrency market capitalization lose around 6.8%. The space is now valued at $1.08 trillion, down roughly 64% from its November 2021 peak.

Disclosure: At the time of writing, the author of this piece owned ETH, NEAR, MATIC and several other cryptocurrencies.