Jamie Dimon Warns About Financial Projections – Bitcoin Magazine

Watch this episode on YouTube or Rumble

Listen to the episode here:

“Fed Watch” is a macro podcast, true to bitcoin’s insurgent nature. Each episode we question mainstream and Bitcoin narratives by examining macro current events from around the world, with an emphasis on central banks and currencies.

In this episode, Christian Keroles and I dive into the surprise interest rate cuts from the People’s Bank of China (PBOC) and read through some of Jamie Dimon’s recently leaked comments on global economics and geopolitics.

China’s surprise rate cut

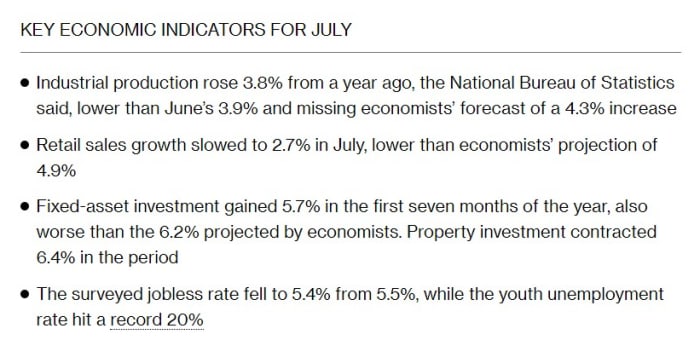

After a brief look at the bitcoin chart, we begin to discuss the economic figures for July 2022 from China. I read a Bloomberg article headlined “China shocks with rate cuts as data shows ‘alarming’ slowdown.”

The ups and downs in the data release made the Chinese economy worse than last month and well below estimates. After decades of industrial production rising in China by high single or even double digits, it is underperforming bearish estimates of just 3.8% year-on-year.

Other important metrics for the Chinese economy are retail sales growth as they attempt to break out of the middle-income trap and become a consumption-led economy. Growth was abysmal at just 2.7%, against a forecast of 4.9%.

The property and real estate sector was down 6.4%, which is probably a rosy reading. In recent episodes, we’ve shown how the Chinese real estate market, like new home sales, has crashed by 30% month-on-month in recent months. This is absolutely devastating for a sector built around pre-sales and which is caught in a slow-motion credit default.

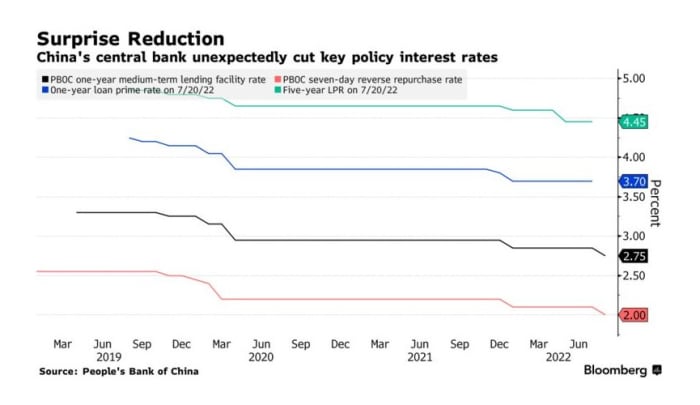

The latest update for China this week is that the PBOC also cut its two short-term policy rates, each by 10 basis points. It’s not much, but it puts them in direct opposition to other central banks, which follow a path of tightening.

As you can see in the chart below, the PBOC has been consistently cutting rates long before COVID. This recent weakness may be due to their zero-covid policy, but the data shows that China is only experiencing a reversal of the trend – a trend that is heading towards a financial crisis.

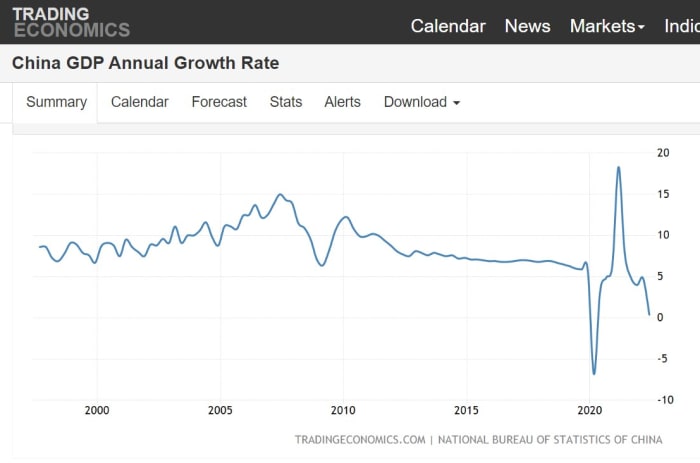

In the chart below, we can see the growth rate over the last 25 years of Chinese gross domestic product. Growth changed fundamentally in China during the global financial crisis and has been declining ever since. COVID was a massive shock, but now things are back on trend towards a crisis.

I know Jamie Dimon is not the most popular man in the Bitcoin community, but he is a heavyweight in the world of banking and finance. That’s why we should at least examine what he said when some of his comments about high-net-worth clients leaked this week. I will also note that Jamie Dimon is the CEO of JPMorgan Chase and the Wall Street banks influence the Federal Reserve. It is likely that this is similar to what we would hear from a frank conversation with Jerome Powell.

On the coming recession, Dimon estimated the outcomes to be 10% soft landing, 20-30% mild recession, 20-30% harder recession and 20-30% somewhat worse. That means he thinks there’s about a 50% chance of a hard recession or worse. It is significant but mixed, depicting a high level of uncertainty at the top of banking and finance.

He was also uncertain about the path of the consumer price index and Fed policy. Important here because Powell is probably also uncertain.

Dimon was much more confident about other things, such as China. He said, “China has serious problems,” and “Autocratic leadership may work in certain things, but does not work in the long run.” Following that up with, “I think it’s a mistake to say that America has the short end of the stick.”

We might think of Jamie Dimon as the stereotypical Davos man, friendly to the World Economic Forum and their agenda, but in these comments he blasts environmental, social and governance (ESG) principles and recommends pumping more oil in the US. He suggested that more, rather than less, oil from the United States is better for the environment.

Finally, Dimon made some comments about the “woke capitalism” that is the hallmark of the ESG movement. It was a little unclear what his direct thoughts were, but he certainly prefers to abandon policies that tear us apart and hurt the economy. Instead, he will focus on coming together and supporting each other.

That does it for this week. Thanks to the viewers and listeners. If you like this content, please like, subscribe, review and share!

Don’t forget to check out the “Fed Watch Clips” channel on YouTube.

This is a guest post by Ansel Lindner. Opinions expressed are entirely their own and do not necessarily reflect the opinions of BTC Inc. or Bitcoin Magazine.