Does Future FinTech Group (NASDAQ:FTFT) Have a Healthy Balance Sheet?

David Iben said it well when he said: ‘Volatility is not a risk we care about. What we care about is avoiding a permanent loss of capital.’ It is only natural to consider a company’s balance sheet when examining how risky it is, as debt is often involved when a business collapses. We can see that Future FinTech Group Inc. (NASDAQ:FTFT) uses debt in its operations. But is this debt a concern for shareholders?

When is debt a problem?

Generally speaking, debt only becomes a real problem when a company cannot easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company cannot meet its legal obligations to repay debt, shareholders may walk away with nothing. Although less common, we often see indebted companies permanently draining shareholders because lenders force them to raise capital at a difficult price. Of course, debt can be an important tool in businesses, especially capital-intensive businesses. When we think about a company’s use of debt, we first look at cash and debt together.

See our latest analysis for Future FinTech Group

What is Future FinTech Group’s debt?

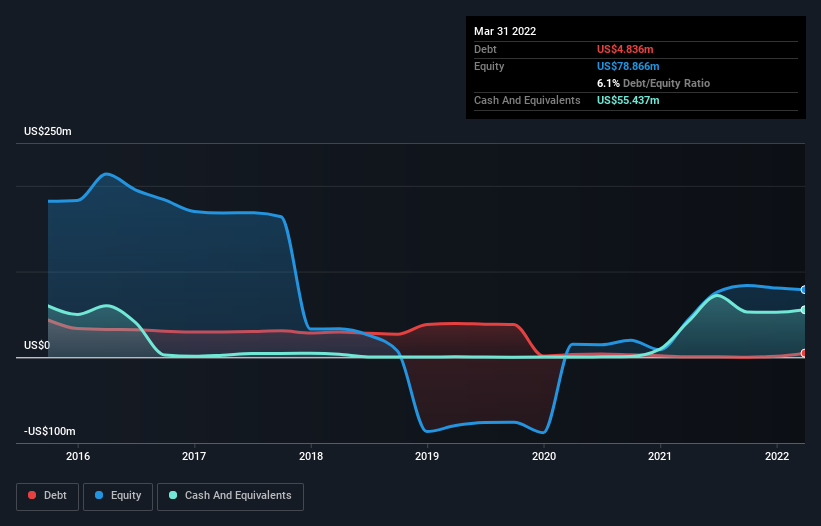

You can click on the graphic below for the historical numbers, but it shows that as of March 2022, Future FinTech Group had $4.84 million in debt, an increase of $494.6,000, over a year. But it also has $55.4 million in cash to offset this, meaning it has $50.6 million in net cash.

How healthy is Future FinTech Group’s balance sheet?

The latest balance sheet data shows that Future FinTech Group had liabilities of USD 10.2 million due within a year, and liabilities of USD 3.66 million due after that. Offsetting this, it had USD 55.4 million in cash and USD 15.5 million in receivables due within 12 months. So it boasts $57.1 million more liquid assets than Total commitments.

This excess liquidity is a good indication that Future FinTech Group’s balance sheet is almost as strong as Fort Knox. With this in mind, we think the balance sheet is as strong as a bull. Simply put, the fact that Future FinTech Group has more cash than debt is no doubt a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when analyzing debt. But you can’t look at debt in total isolation; since Future FinTech Group will need earnings to service that debt. So if you’re interested in finding out more about earnings, it might be worth checking out this graph of the long-term earnings trend.

In the last year, Future FinTech Group was not profitable at the EBIT level, but managed to increase its revenue by 16,073%, to 29 million USD. It’s practically the hole-in-one for income growth!

So how risky is the Future FinTech Group?

We have no doubt that loss-making companies are generally more risky than profitable. And in the last year Future FinTech Group had an earnings before interest and tax (EBIT) loss, truth be told. In fact, at the time it burned through $19 million in cash and posted a $13 million loss. With only $50.6 million on the balance sheet, it appears that capital will need to be raised again soon. More importantly, Future FinTech Group’s revenue growth is hot to trot. While unprofitable companies can be risky, they can also grow hard and fast in these pre-profit years. When analyzing debt levels, the balance sheet is the obvious place to start. But ultimately, every company may contain risks that exist off the balance sheet. For example, we have identified 3 Warning Signs for Future FinTech Group which you should be aware of.

At the end of the day, it is often better to focus on companies that are free of net debt. You can access our special list of such companies (all with earnings growth results). It is free.

Do you have feedback on this article? Worried about the content? Contact with us directly. Alternatively, you can email the editors (at) simplywallst.com.

This article by Simply Wall St is general. We provide commentary based on historical data and analyst forecasts only using an objective methodology, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell shares, and does not take into account your goals or your financial situation. We aim to provide you with long-term focused analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the shares mentioned.

Discounted cash flow calculation for each share

Simply Wall St does a detailed discounted cash flow calculation every 6 hours for every stock on the market, so if you want to find the intrinsic value of a company, just search here. It is free.