Weekly Waves: EUR/USD, US30 and Bitcoin

-

EUR/USD is showing a strong bearish decline at the moment. Let’s review the Elliott Wave patterns to understand why the price action made such a strong reversal.

-

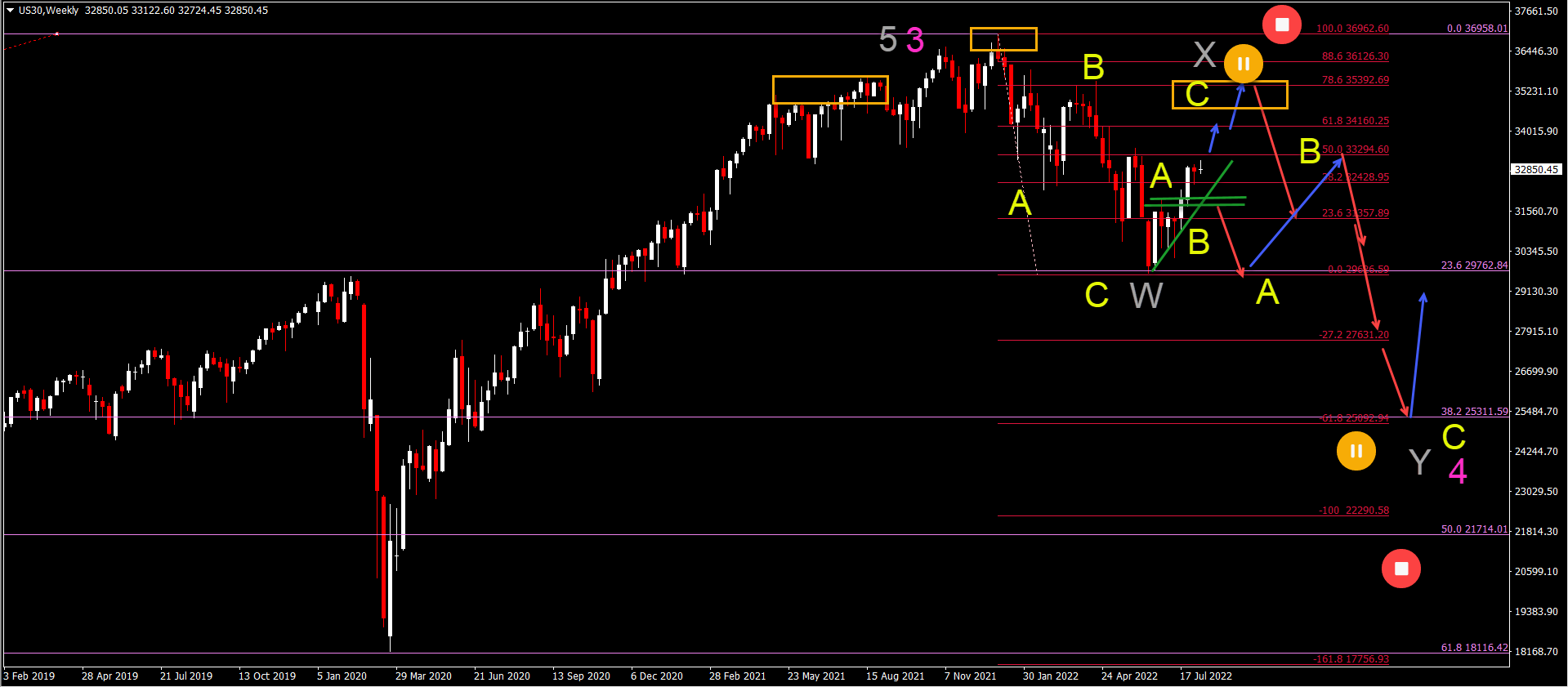

The weekly US30 chart shows bullish price action, but the rally looks like a rise before another decline.

-

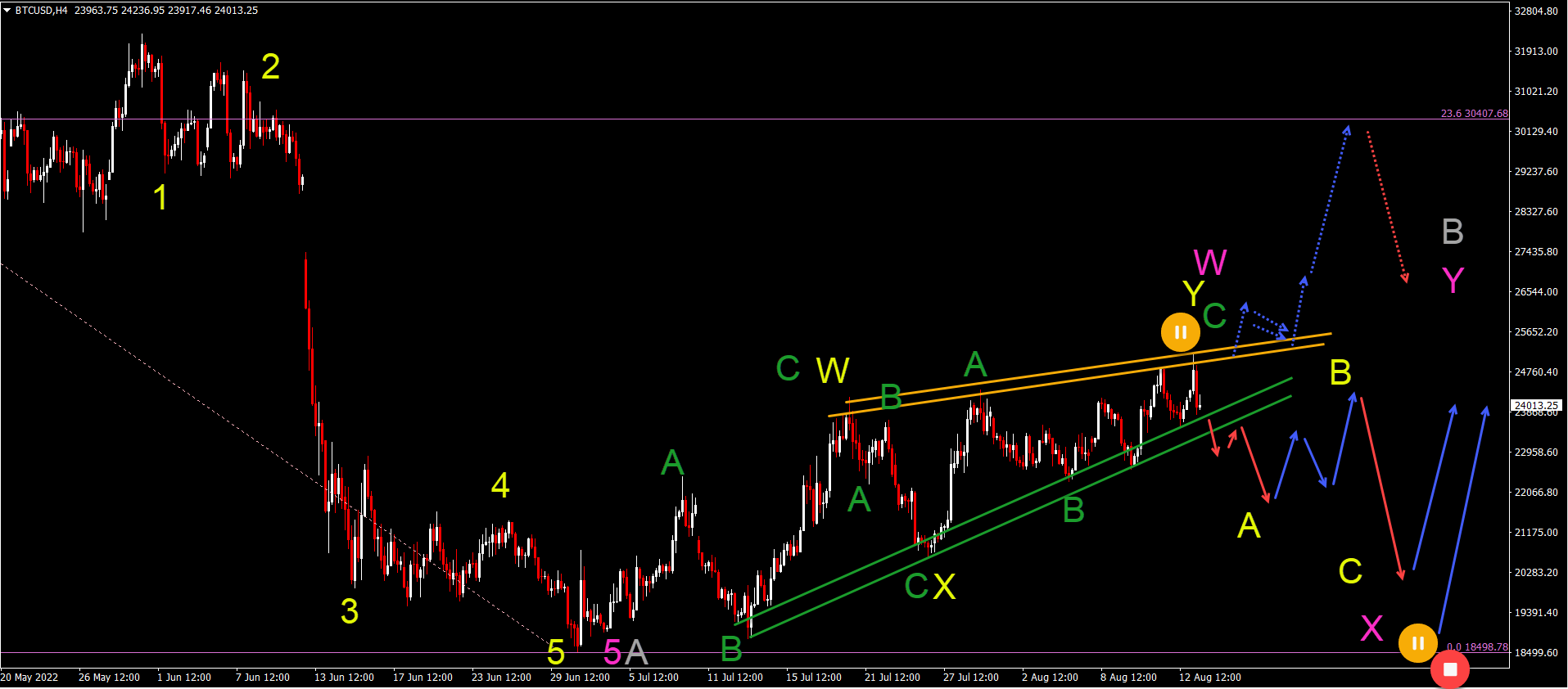

BTC/USD rising wedge indicates the end of the bullish rally, unless the price action manages to break above the resistance trend lines (orange).

Our weekly Elliott Wave analysis reviews the EUR/USD 4-hour chart, the US30 (DJI) weekly chart and the Bitcoin cryptocurrency 4-hour chart.

EUR/USD bearish ABC in major bullish correction

-

The EUR/USD bullish price action was marked as a bullish correction, so the choppy and weak uptrend is what we expected.

-

The bullish price action appears to have completed an ABC (yellow) pattern.

-

However, the bullish correction may still be alive because we believe a larger WXY (pink) is taking place in wave 4 (grey).

-

Non-technical reasons to expect a longer correction include the fact that August is usually a choppy month, a small pause in inflation (from a month-to-month perspective), and the decline in the year-over-year inflation rate last month.

-

Therefore, we now expect a wave X (pink). To confirm this Elliott Wave pattern, we should see an ABC (yellow) wave within wave X (pink).

-

A bullish bounce can take place at the 50% or 61.8% Fibonacci retracement level.

-

The bullish bounce can take the price up to the head and shoulders level (orange boxes).

-

A bearish pullback to resistance could see price decline to challenge the deeper Fibonacci support levels, and most likely we should see a bullish reversal in these support zones.

US30 rally expected to reverse at resistance

-

The US30 chart may have some room for a small rally.

-

Even if the price action has reached the 50% Fibonacci level, the price action can rise as high as the head and shoulders level (orange boxes).

-

A bearish bounce is expected in this resistance zone. A break above that would probably change the bearish perspective.

-

A bearish breakout (red arrows) below the support (green lines) may indicate that the rally is finished.

-

A larger bullish ABC (yellow) pattern should complete wave X (grey).

-

A bearish ABC (yellow) should then take price action down to the 38.2% Fibonacci retracement level into a larger wave 4 (grey).

-

A larger complex correction may emerge so that wave Y (grey) completes a larger wave X of wave 4.

-

Finally, when the bearish correction completes wave 4 (pink), a new uptrend may emerge in wave 5 as long as the price action remains above 50%.

-

A break below the 38.2% and especially the 50% Fibonacci retracement level indicates a strong downtrend.

BTC/USD should rally after ABC down

Bitcoin (BTC/USD) is building a rising wedge reversal pattern:

-

A bullish breakout would then start a potential rally (dotted blue arrows) towards the 23.6% Fibonacci retracement level.

-

A breakout below the support lines (green) could initiate a bearish correction lower (red arrows).

-

A larger ABC (green) pattern has likely completed wave Y (yellow) of wave W (pink).

-

Now an ABC (yellow) is expected to unfold in wave X (pink).

-

Once wave X (pink) is complete, another bullish rally should take the price back up within wave Y (pink) of wave B (grey).

The analysis is done with indicators and a template from the SWAT method simple wave analysis and trading. For more daily technical and wave analysis and updates, sign up to our newsletter