With US Inflation Slowing to 8.5%, Will Bitcoin’s Rally Extend?

For the first time since April this year, inflation in the US has fallen. According to the latest data release, the CPI fell slightly to an annual rate of 8.5% and was relatively flat compared to June. Expected CPI for July was 8.7%.

Well, a fall in inflation is no doubt a good thing, as it will help dilute the Fed’s hawkish stance, and ultimately lead to a fall in interest rates. The major indices that closed in the red on Tuesday reacted positively to the aforementioned development. Futures for the Dow Jones Industrial Average jumped 400 points [1.2%]. At the same time, S&P 500 futures rose by 1.7%, while Nasdaq 100 futures rose 2.4%.

In fact, the crypto market that was trading in the red until a few hours also managed to turn green.

So, will the price increase for Bitcoin continue?

Well, Bitcoin’s correlation with the broader market has been falling lately. In fact, according to one of Kaiko’s recent analyses, the king’s recent correlation with bonds and technology stocks has hit a quarterly low. This means that the markets have not necessarily moved in step and replicated each other’s movements.

But according to Kate Kurbanova – co-founder and COO of risk management platform Apostro – a “strong correlation” still exists between the broader traditional stock market and the digital currency ecosystem. In a text comment to Watcher Guru, the manager talked about the transfer of shock from one industry to another. She said,

“A key downside is the fact that correlation poses a systemic risk as it allows the transmission of shocks from one industry to another. This is literally what has played out so far, and the divestment safe haven is particularly neutralized.”

What will be next?

Just as we have seen shocks transfer from an industry so far, going forward, the tables may turn and we may notice collective liquidity injections.

However, the same cannot necessarily be realized immediately, because the crypto market’s correction has been delayed. Recent pumps have more or less been tied to the hype associated with The Merge. Then, with Ethereum and everything rallying, even Bitcoin has followed suit.

Read more: Altcoin seasonal index tops: Ethereum, Cardano, XRP to rally?

Furthermore, in the last couple of days, currency inflows have been on the rise. Per data from CryptoQuant, only 10.8k BTC were sent to exchanges on August 7th. However, Tuesday’s figure was an inflated 36.7k BTC, highlighting the changed sentiment.

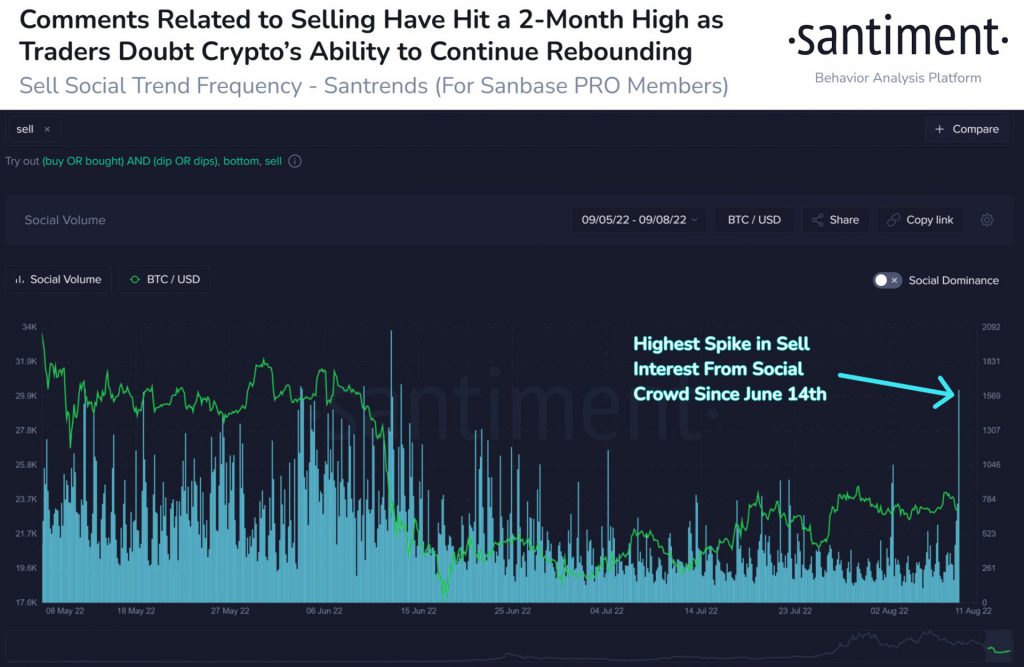

Supporting the same was one of Santiment’s latest analyses. It revealed that the number of “sale” mentions on social media platforms such as Twitter, Reddit and Discord has reached a 2-month high. According to the analysis platform,

“The crypto community doesn’t seem to believe that Bitcoin and other assets will continue to rise back to prosperous levels.”

According to the factors mentioned, yes, it seems that the pump is temporary and Bitcoin will likely continue to lose value, despite the positive data release.