Top NFTs Prove Resilient to Price Volatility | 2022 Q2 NFT Industry Report

After a wild bull market that saw NFTs emerge as a controversial force in the crypto world, many have been waiting for the bubble to burst. These strange digital images can’t continue to cost hundreds of thousands of dollars each, can they? With the entire market in a serious negative downtrend, it is now time for the ride to end.

Or is it?

Despite the severity of the crypto macro situation – an entire chain collapsed, the founders of VC firms are on the run, and the most famous CEXs file for bankruptcy – NFTs have proven to be relatively resilient.

The data show that:

But in light of the entire market, this is only a small part of the picture.

This report will summarize and analyze the aggregate data for the NFT industry in Q2 2022, including the general overview of the NFT market, NFT investments and funding, and a segmentation analysis of on-chain data performance. It will also track key data from BAYC, CryptoPunks and Goblintown.

Q2 NFT Market Overall Overview

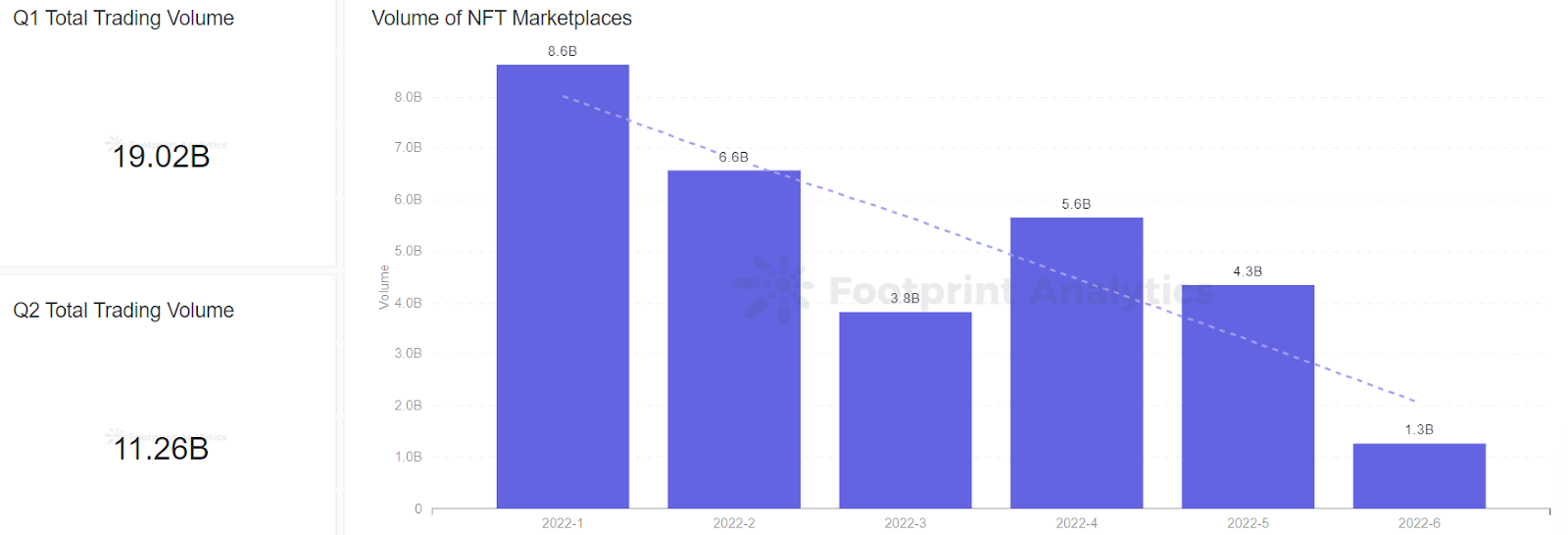

NFT trading volume in Q2 is down 41%

At the beginning of the year, crypto asset prices were affected by policy and fell, and investment capital poured into the NFT market for collectibles, games and art. This drove the NFT market to unprecedented active trading volume, reaching a new high of $8.6 billion.

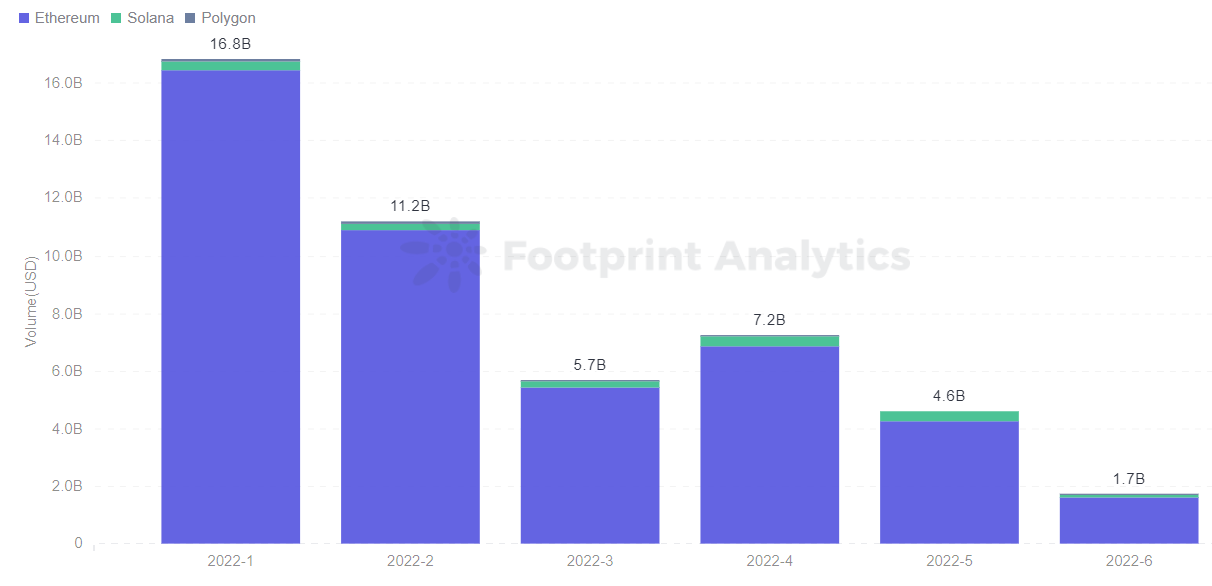

Many believed this could lead to widespread use of NFTs and lead to record-breaking transactions in the 2nd quarter. By mid-May, however, the crypto market faced significant challenges and the NFT market cooled. NFT trading volume fell from $19.02 billion in Q1 to $11.26 billion in Q2.

Footprint Analytics – The volume of NFT marketplaces

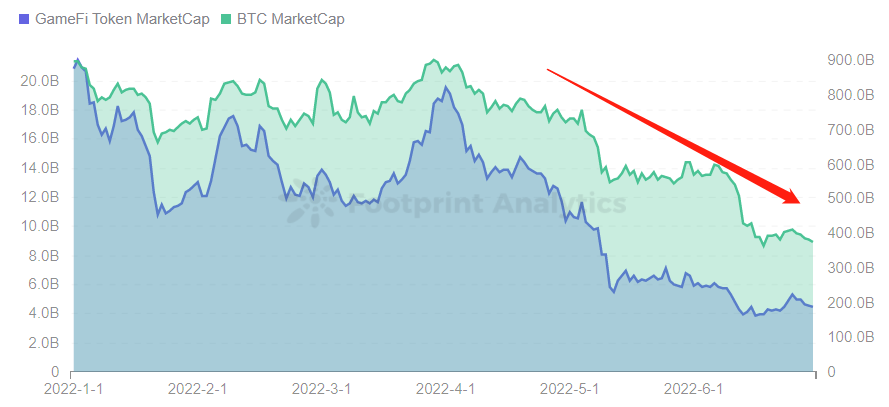

In terms of market value, GameFi tokens are positively correlated with the change in BTC market value, with GameFi Token’s market capitalization falling 76% from Q1 to Q2. For NFTs, the market cap tends not to react quickly, with a 39% drop from Q1 to Q2.

Footprint Analytics – GameFi Token MC vs BTC MC

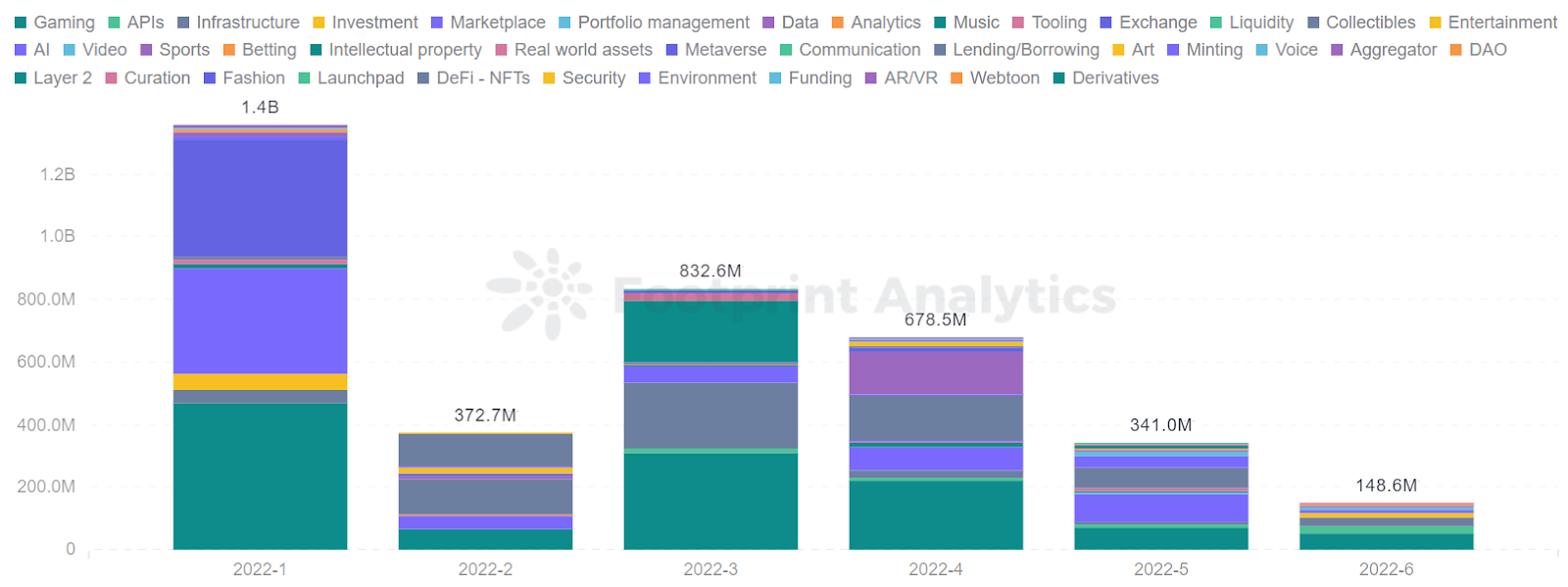

Compared to the 1st quarter, NFT funding in the 2nd quarter is down 57%

Q2 NFT funding accounted for 8% of total Q2 investment, and Q2 NFT investment was $1.168 billion. Compared to the 1st quarter, it is down 57%. In terms of funding categories, games received more than the NFT category in terms of funding amount, followed by NFT Marketplace.

The biggest change from Q1 to Q2 is in the metaverse category. The metaverse investment boom has stalled. As can be seen from the performance of Sandbox project data, it is not easy to build a virtual world. As a result, many metaverse-related projects are still in the concept hype stage.

Footprint Analytics – NFT’s Investment Funding Category Distribution

Footprint Analytics – NFT’s Investment Funding Category Distribution

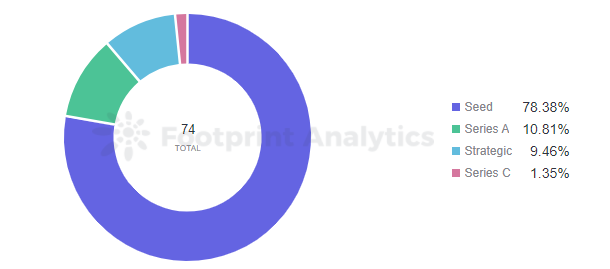

There were more seed rounds than any other, and the proportion of other funding rounds is below 10%. However, from the perspective of independent NFT funding projects in each chain, Solana’s NFT market Magic Eden has performed particularly well. It completed a $130 million Series B funding round in late June, creating a rare bear market breakout for NFT funding.

Footprint Analytics – NFTs – Funding rounds in Q2

NFT’s data performance in the Ethereum, Polygon and Solana ecosystem

According to Footprint Analytics, the total transaction volume of NFTs in the Ethereum ecosystem is more than 80% of many blockchains. Moreover, Ethereum has the most NFT projects, and the aggregation effect of main projects is obvious, including BAYC, Otherdeed and CryptoPunks.

- On-chain NFT trading volume comparison

Looking at NFT trading volume on Ethereum, Polygon and Solana, Q2 has a 60% decrease in NFT trading volume compared to Q1. Ethereum is still the most prosperous and most transactional ecosystem on the chain of NFTs, but high gas fees and congestion problems are still shortcomings of Ethereum.

As a result, Solana and Polygon are not far behind in the NFT industry. Especially after OpenSea started introducing projects at Solana, trade volume increased by 12% in Q2 compared to Q1. It will be the last contender to challenge Ethereum for the NFT crown.

Footprint Analytics – Monthly NFT volume by chain

- Marketplace NFT Volume comparison

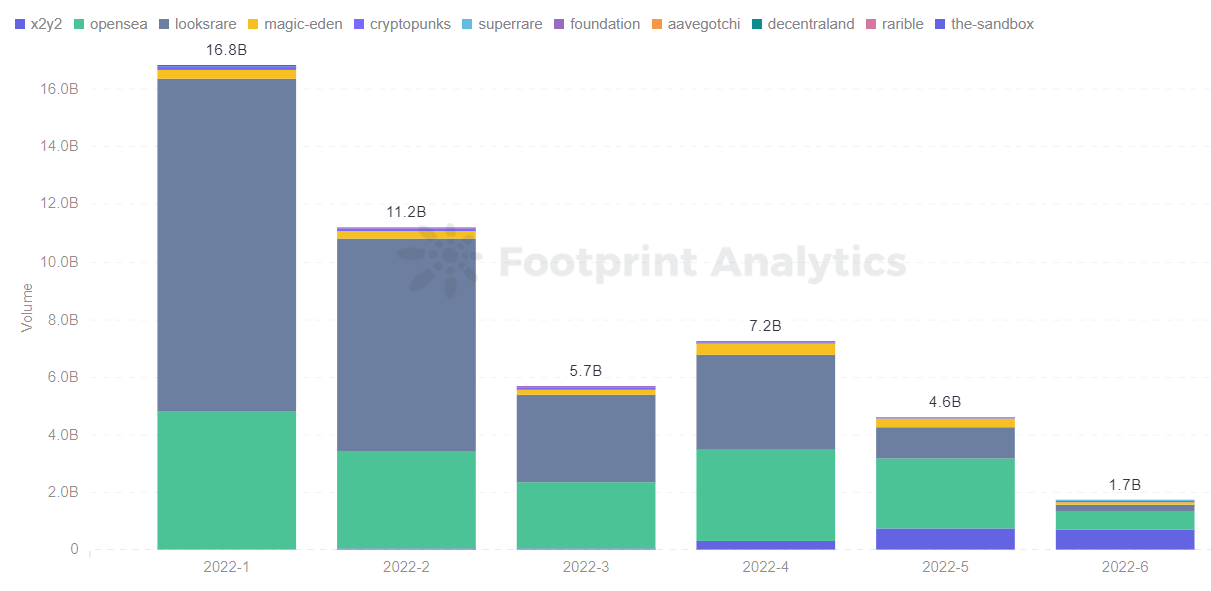

As we enter the second quarter, and especially in June, the market for offering NFT transactions was no longer dominated by OpenSea.

X2Y2 has begun to shake OpenSea’s dominance. Like LooksRare, it is a new NFT trading platform that started to challenge OpenSea early in the year. They go straight to the pain points of OpenSea’s centralization, irrelevance of platform revenue to users, high fees and unissued tokens, gradually splitting OpenSea’s position in the NFT trading market.

Magic Eden trading platform is gradually revealed, opening the floodgates for Solana NFT and enriching the NFT multi-chain trading market.

Footprint Analytics – Monthly market ranked by volume

- Marketplace active address and volume

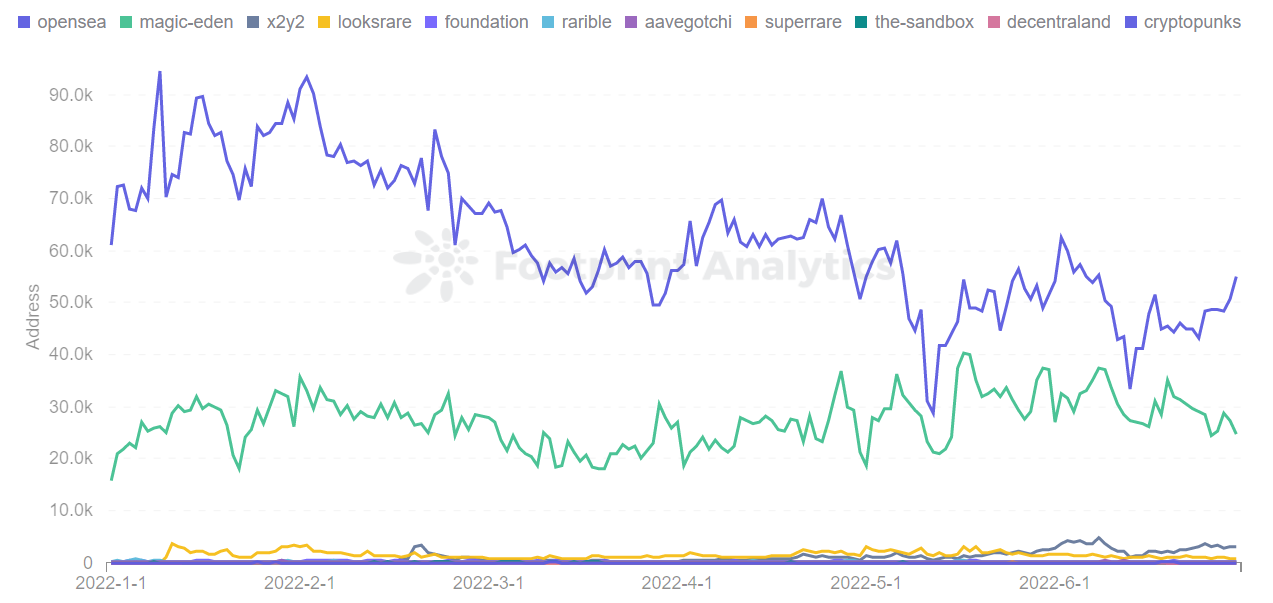

As can be seen from the chart of the two major trading platforms, OpenSea’s competitor LooksRare did not gain significant user volume while stimulating NFT transactions and gaining some market share. Most users are still active on the OpenSea platform, with more than 50,000 daily active users during Q2.

Footprint Analytics – Daily Market Ranked by Volume (USD)

Footprint Analytics – Marketplace daily active user

Footprint Analytics – Marketplace daily active user

If there are more sellers than buyers, this indicates that people are selling their assets. If there are more buyers than sellers, there will be more newcomers who want to enter the NFT ecosystem than those who want to dispose of assets.

As a result, the data shows that after the bear market setback, fewer users entered the NFT ecosystem in Q2 than in Q1.

Footprint Analytics – Buyers and Sellers

NFT plans to see this quarter

BAYC volume and floor pass CryptoPunks’

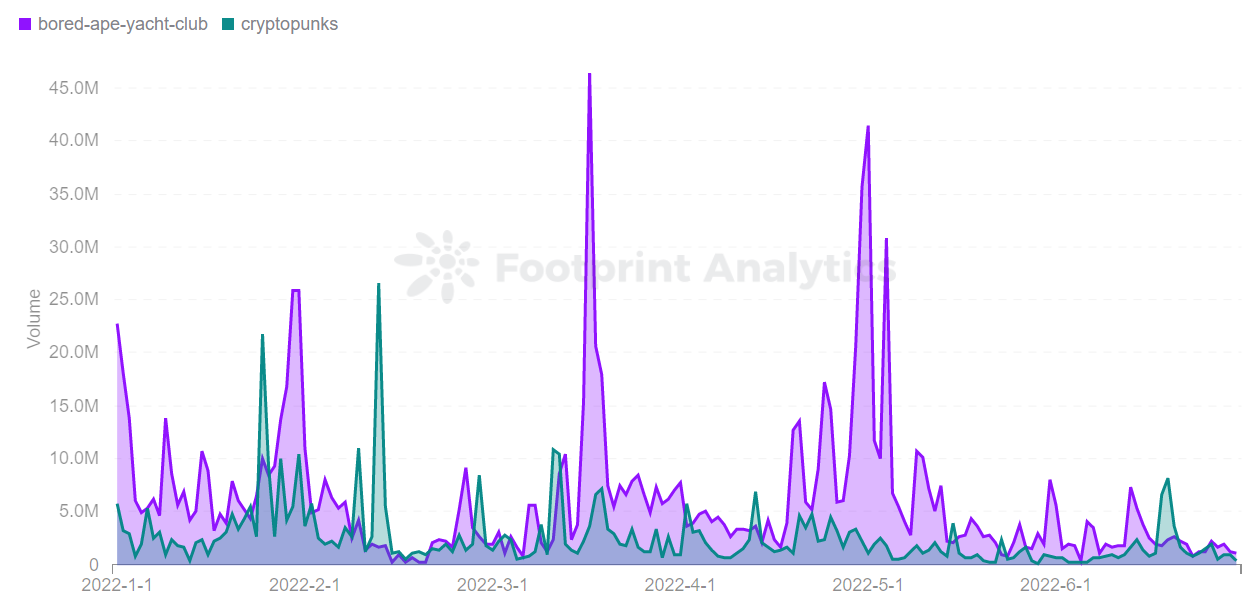

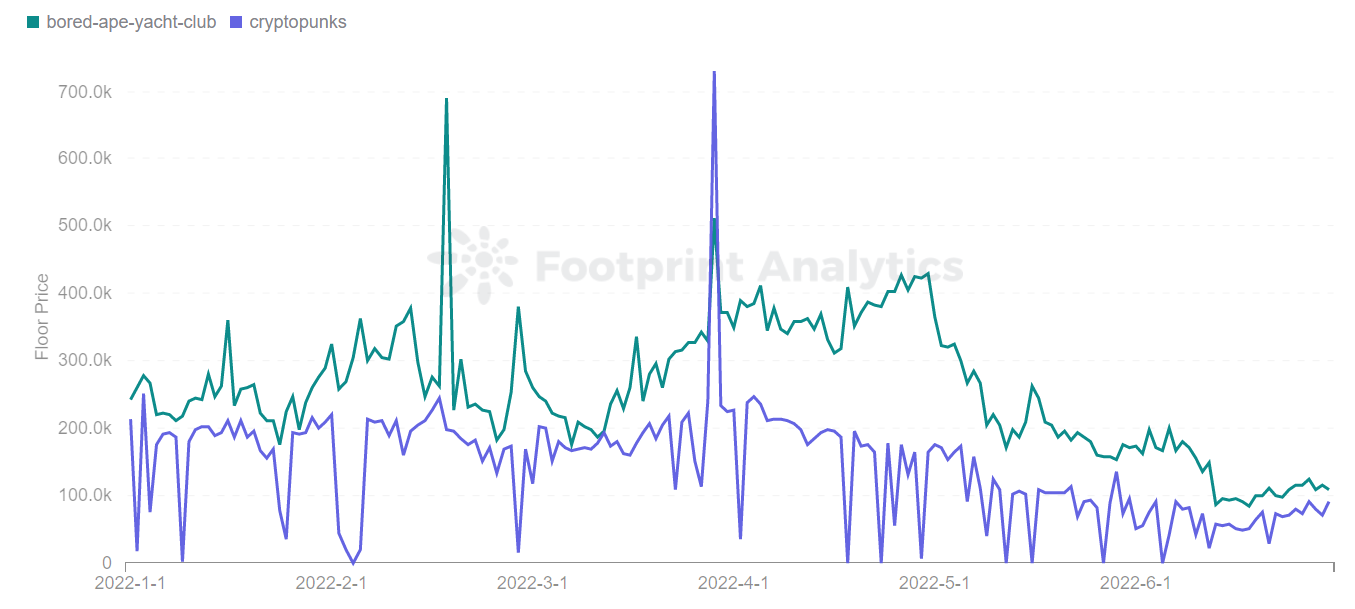

For many years, Punks have been known as the foremost “blue chip” NFT asset because of its long history and dedicated community. However, due to the purchase of the intellectual property rights of CryptoPunks and Meebits by Yuga Labs, the BAYC development team, the trading volume and floor price of BAYC series NFTs have again increased significantly, repeatedly beating CryptoPunks.

With the collapse of the crypto market, investor demand for NFTs also fell to a corresponding extent, which greatly affected its overall trading volume and bottom price decline. As can be seen from the chart, after mid-May, both Bored Ape Yacht Club and Cryptopunk’s volume and floor price decrease.

Footprint Analytics – Bored Ape Yacht Club vs Cryptopunks Volume

Footprint Analytics – Bored Ape Yacht Club vs Cryptopunks Floor Price

Footprint Analytics – Bored Ape Yacht Club vs Cryptopunks Floor Price

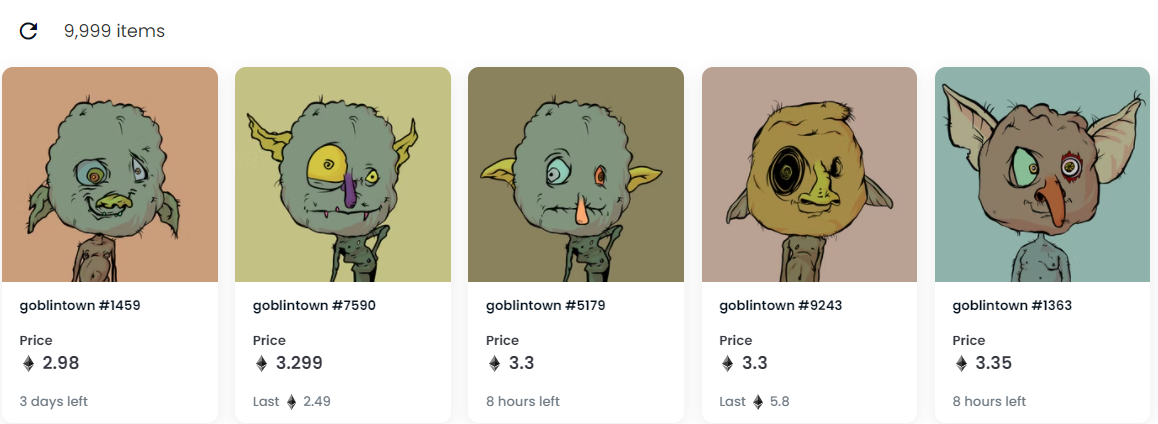

Emerging Project: Goblintown

The downturn in the market has not stopped new NFT projects from emerging.

Goblintown, a collection of ugly, absurd-looking Goblins avatars, became the NFT project in the second quarter. The first minting began on May 21, with 9,999 pointy-eared avatars being distributed for free or a gas fee on the chain. The project quickly generated market interest. On June 1, the daily trading volume reached $11 million, with a market capitalization of $127 million.

Compared to BAYC, Goblintown brings a sense of rebellion through differentiation and secondary interpretation, but with some artistry. But in terms of market capitalization and transaction volume, the king of NFTs is undoubtedly BAYC.

Screenshot source – goblintownwtf collection

Summary

Although the NFT market has cooled, the prices of some top projects have remained relatively stable, and new projects continued to emerge in Q2. In other words, the current downward pressure that has already brought down an entire chain, several VC firms and a few CEXs has not caused the NFT market to implode.

This means that although the prices of NFT projects may still fall, it is unlikely that we will see any “NFT bubble” as many believed. If anything, it shows that NFTs, of all categories of cryptoassets, are the least in a bubble of all.

July. 2022, Vincy

Data Source: Footprint Analytics – NFT Q2 report

This piece is contributed by Footprint Analytics society.

Footprint Community is a place where data and crypto enthusiasts around the world help each other to understand and gain insights about Web3, the metaverse, DeFi, GameFi or any other area of the new world of blockchain. Here you will find active, diverse voices that support each other and drive society forward.

Disclaimer: Views and opinions expressed by the author should not be considered financial advice. We do not provide advice on financial products.