Crypto Investors Accumulate These Digital Assets As Market Hits ‘Wall of Worry’: Analytics Firm Santiment

Crypto insight firm Santiment reveals that the behavior of a group of investors could be a negative sign for the market.

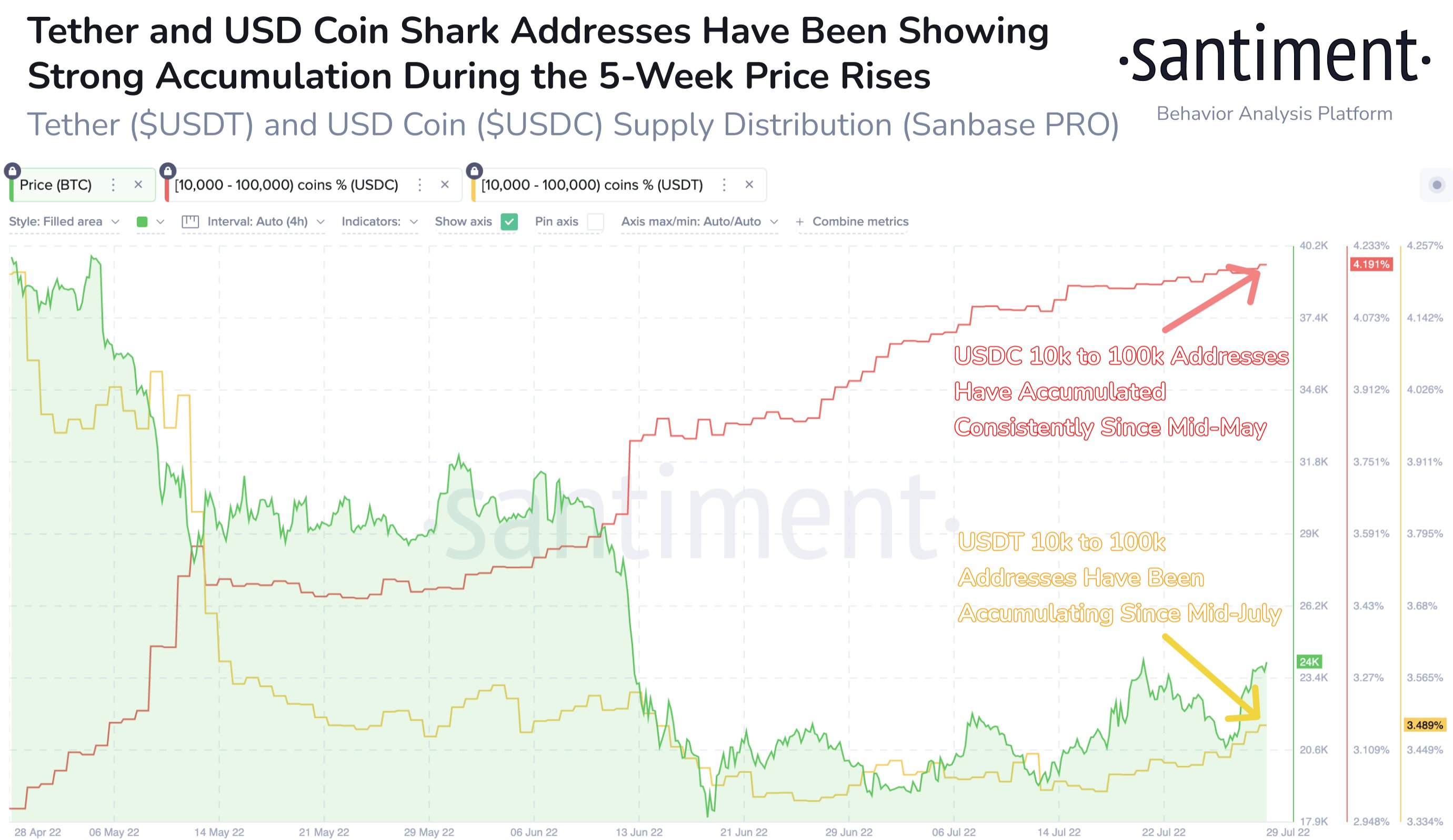

According to Santiment, sharks, or entities that hold between 10,000 and 100,000 of a particular crypto asset, stablecoins Tether (USDT) and USD Coin (USDC), are accumulating even as crypto asset prices rise.

The market intelligence firm says this is an indication of the doubts investors have about the sustainability of the latest crypto market rally.

“Tether and USD Coin shark addresses have been accumulating coins as crypto prices have risen. This accumulation indicates a disbelief in the rally, and a reluctance to buy in, also known as a ‘wall of worry’.”

Santiment says the sharks are reluctant to buy into a bullish thesis for cryptoassets after the latest rebuttal.

“What we see here is that in the last 2-3 weeks (despite the price growth of Bitcoin, Ethereum and others) they have not been so keen to part with their stablecoins, even though they have done the opposite. This can be interpreted as disbelief at this price increase, reluctance to buy in.”

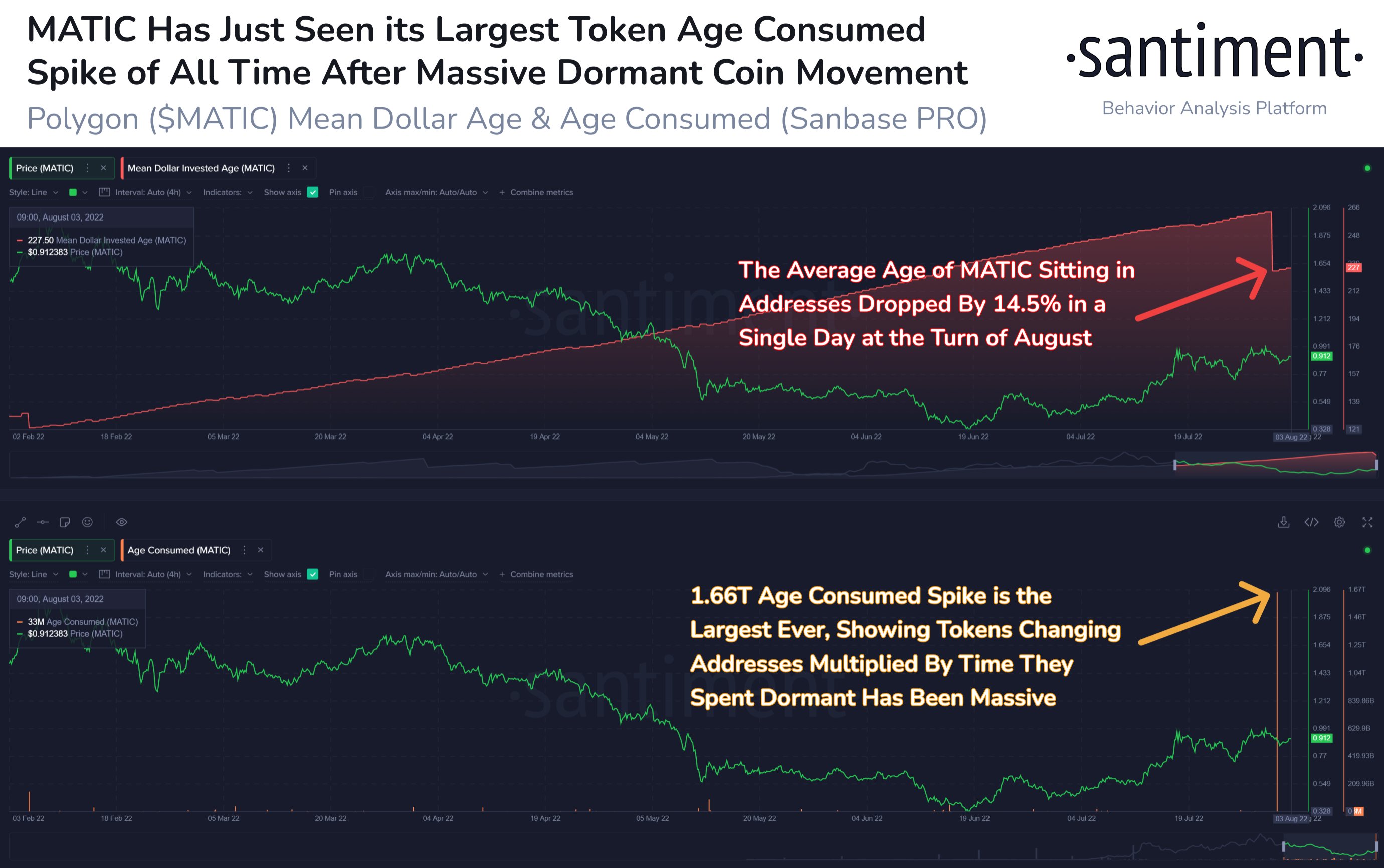

The crypto analytics firm also takes a look at the addresses of Ethereum (ETH) scaling solution, Polygon (MATIC).

According to Santiment, the Token Age Consumed metric for Polygon, which is typically used to detect local peaks, has hit an all-time high. The metric measures the amount of tokens that change address on a specific date multiplied by the time that has passed since the previous movement.

“MATIC’s symbolic age has been consumed [metric] has reached an all-time high, indicating that older addresses have moved assets quickly. We can also see that Polygon’s average dollar age has also decreased, confirming that older, dormant addresses have just moved a large chunk of coins.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Joeprachatree/Boombastic