Sphere 3D Seeks Bitcoin Miner Ramp As Gryphon Merger Deal Closes (NASDAQ:ANY)

artiemedvedev

A quick overview of Sphere 3D

Sphere 3D (NASDAQ: ALL) recently reported its Q1 2022 financial results on May 16, 2022 after agreeing to close its proposed merger with Gryphon Digital Mining.

The company seeks to grow its Bitcoin (BTC-USD) mining and will continue to work with Gryphon as it builds out its mining capacity.

Until we see more data on the company’s installation of more miners and on the prospects for a rise in the price of Bitcoin, I am on hold for Sphere in the short term.

Sphere 3D Overview

Toronto, Canada-based Sphere 3D was founded to provide a variety of data center products and services.

It has since changed its focus to become net carbon neutral Bitcoin and other cryptocurrency mining company with operations in North America.

The firm is led by CEO Patricia Trompeter, who was previously co-founder and managing partner of Ceres Capital Ventures.

The global market for Bitcoin mining is currently undergoing significant change, with the recent bans on mining in China causing a large amount of the country’s hash power to leave the network as these operators look for more suitable locations.

Many mining companies have relocated to the United States, due to its largely predictable regulatory and legal environment and business-friendly approaches in a number of states.

The market value of mining depends on the price of Bitcoin, since most of the value that goes to the miner is a function of the flow Bitcoin reward rate of 6.25 Bitcoin per successfully mined block.

At a price of $25,000 per Bitcoin, the annual mining reward for the entire industry will be approximately $8.21 billion.

Key industry participants include:

-

Bitfarms (BITF)

-

Argo Blockchain (OTCQX:ARBKF)

-

DMG Blockchain (OTCQB:DMGGF)

-

Hive Blockchain (HIVE)

-

Hut 8 Mining (HUT)

-

HashChain technology

-

DPW Holdings

-

Layer1 technologies

-

Riot Blockchain (RIOT)

-

Marathon Digital Holdings (MARA)

-

Second

Sphere 3D’s recent financial results

-

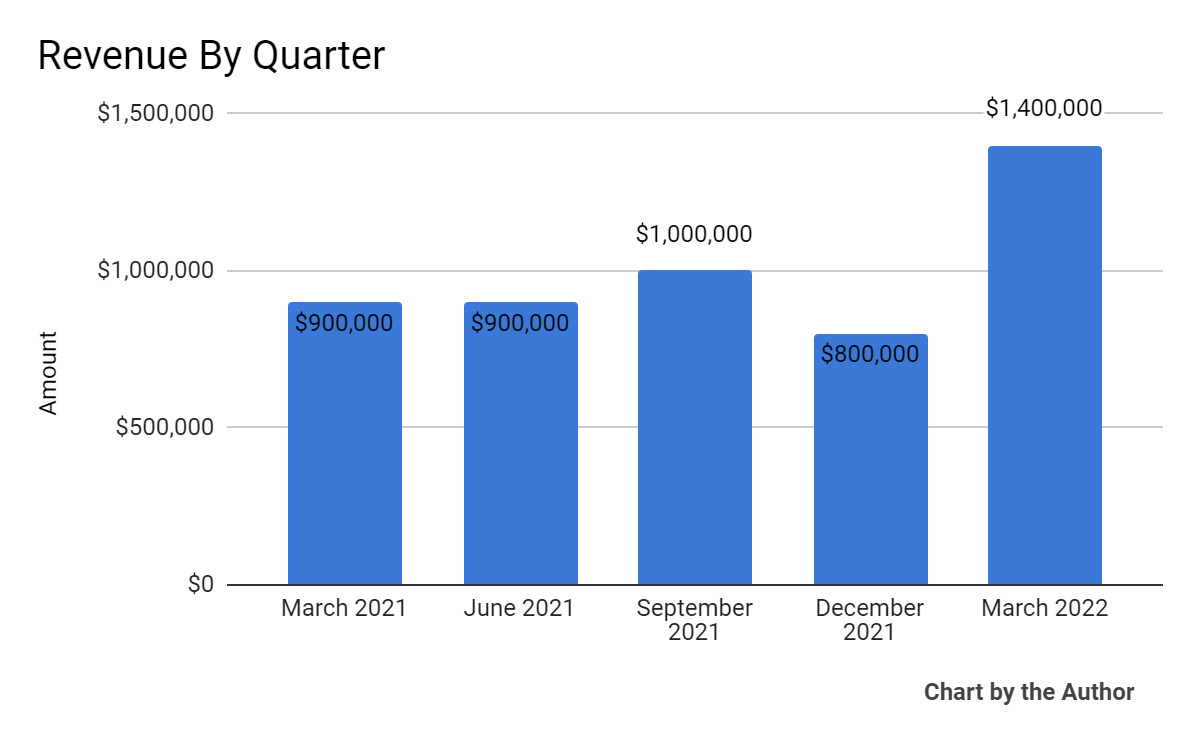

Total revenue per quarter has been uneven as the firm has operated a relatively small number of mining computers:

5 quarter total revenues (Seeking Alpha)

-

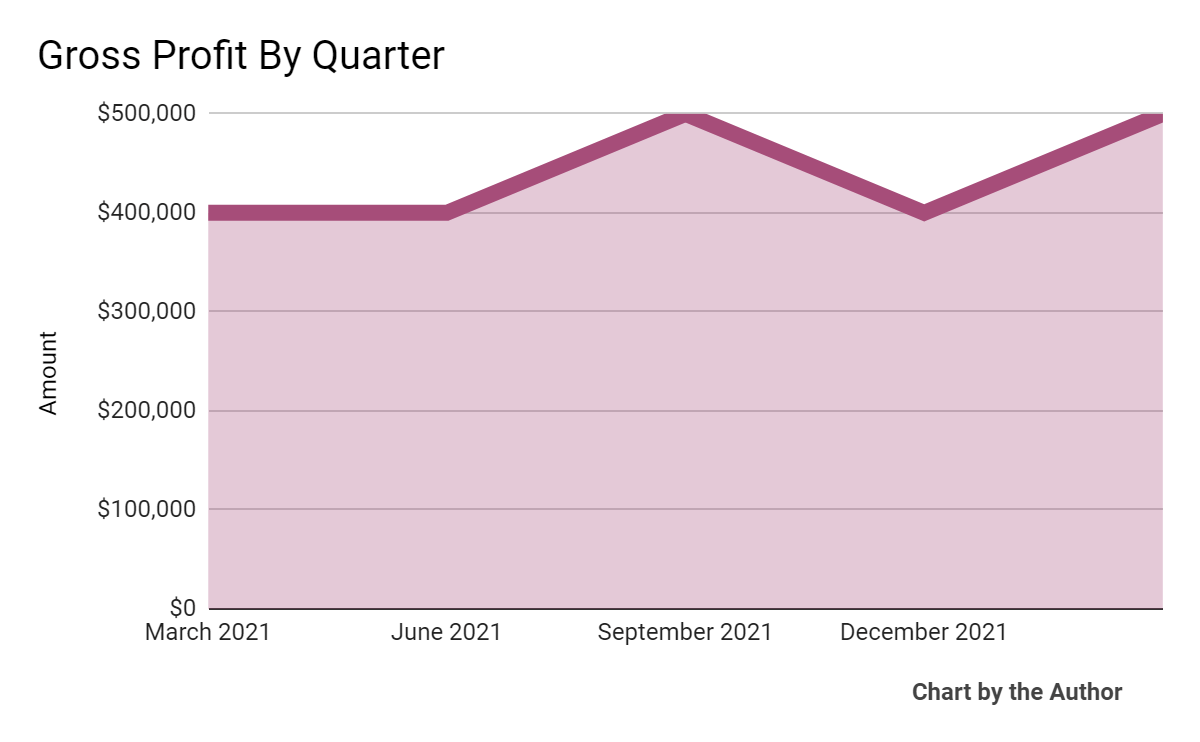

The gross profit per quarter has followed roughly the same path as the total income:

5 quarterly gross profit (Seeking Alpha)

-

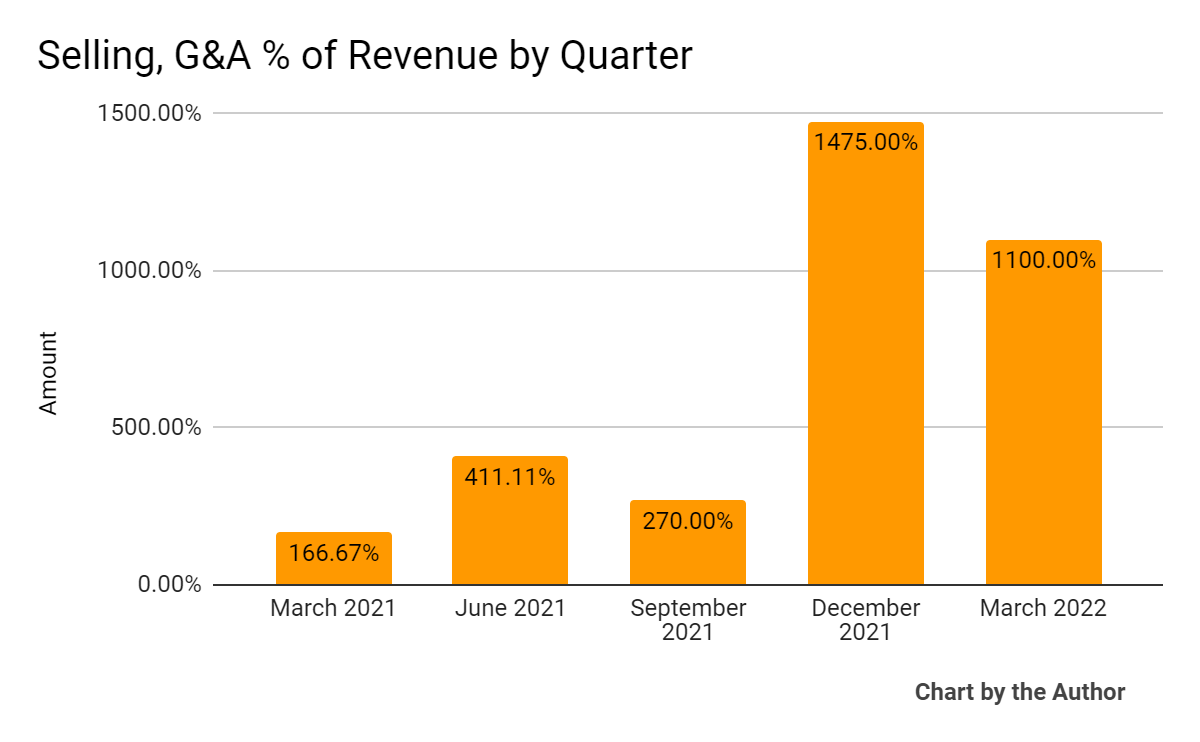

Selling, G&A expenses as a percentage of total revenue per quarter have remained quite high:

5 quarter sales, G&A % of revenue (Seeking Alpha)

-

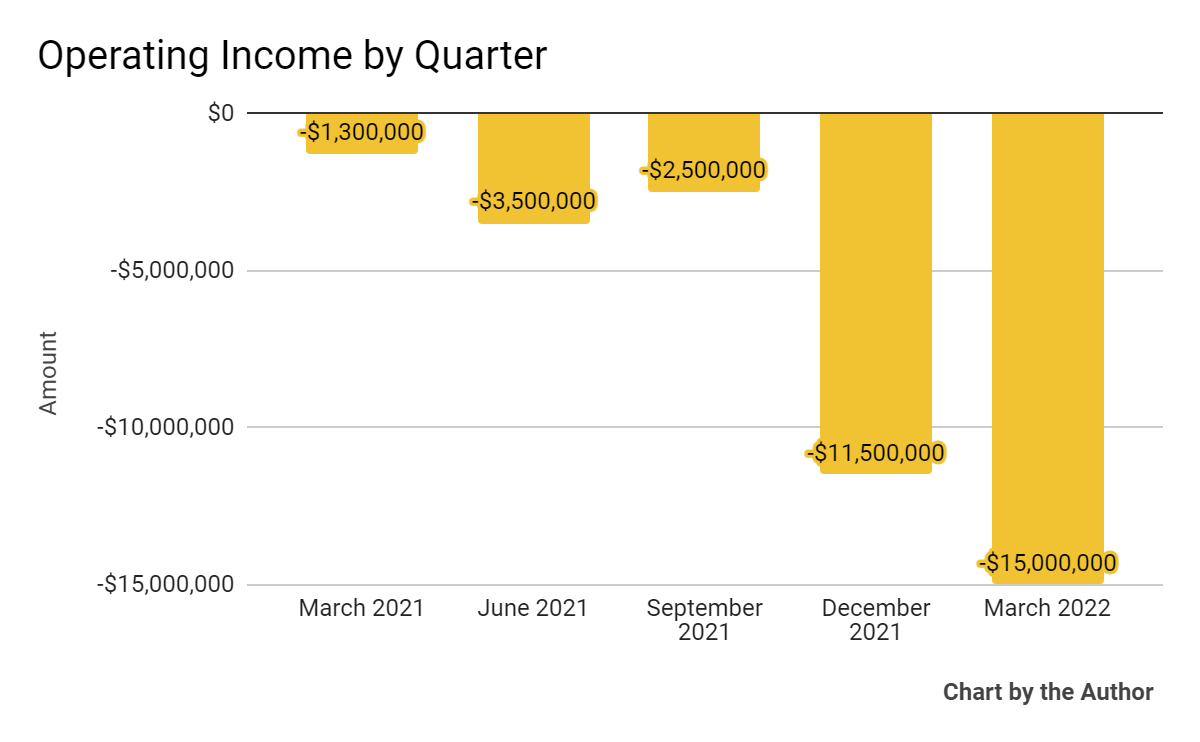

Operating losses have worsened as the firm has run capital- and expense-intensive cryptocurrency mining operations:

5 quarterly operating income (Seeking Alpha)

-

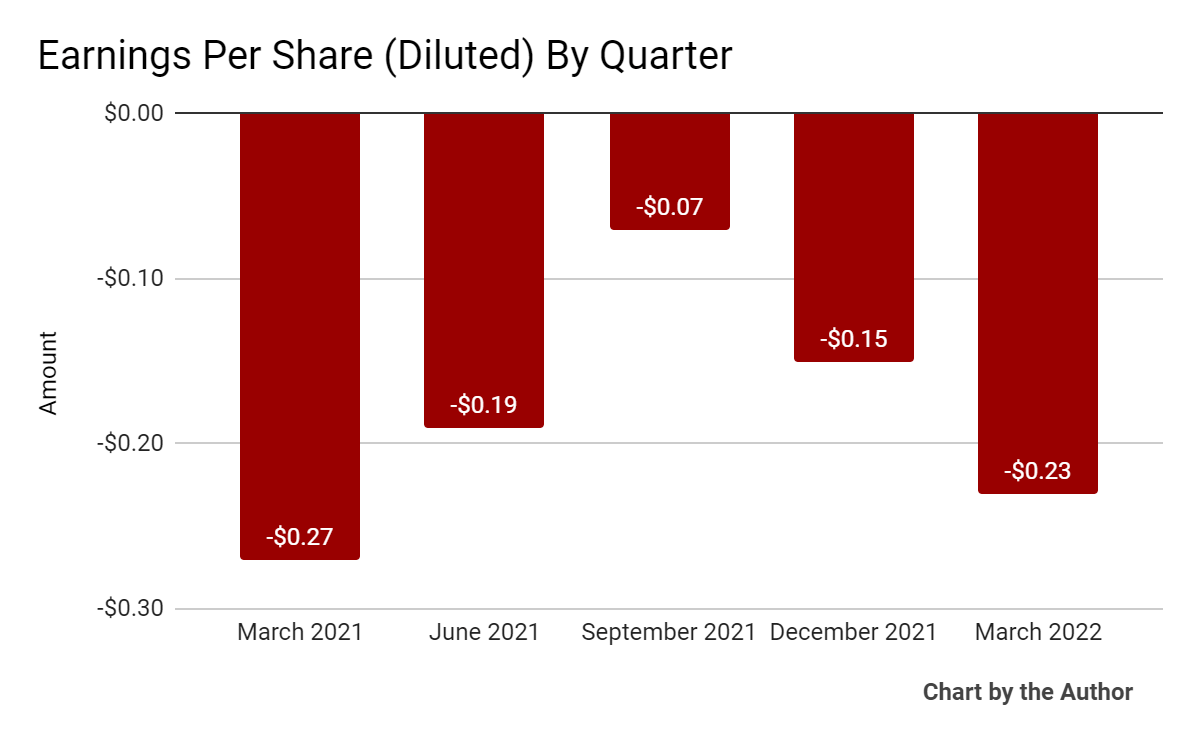

Earnings per share (diluted) have remained negative as the chart below shows:

5 quarterly earnings per share (Seeking Alpha)

(All data in the charts above are GAAP)

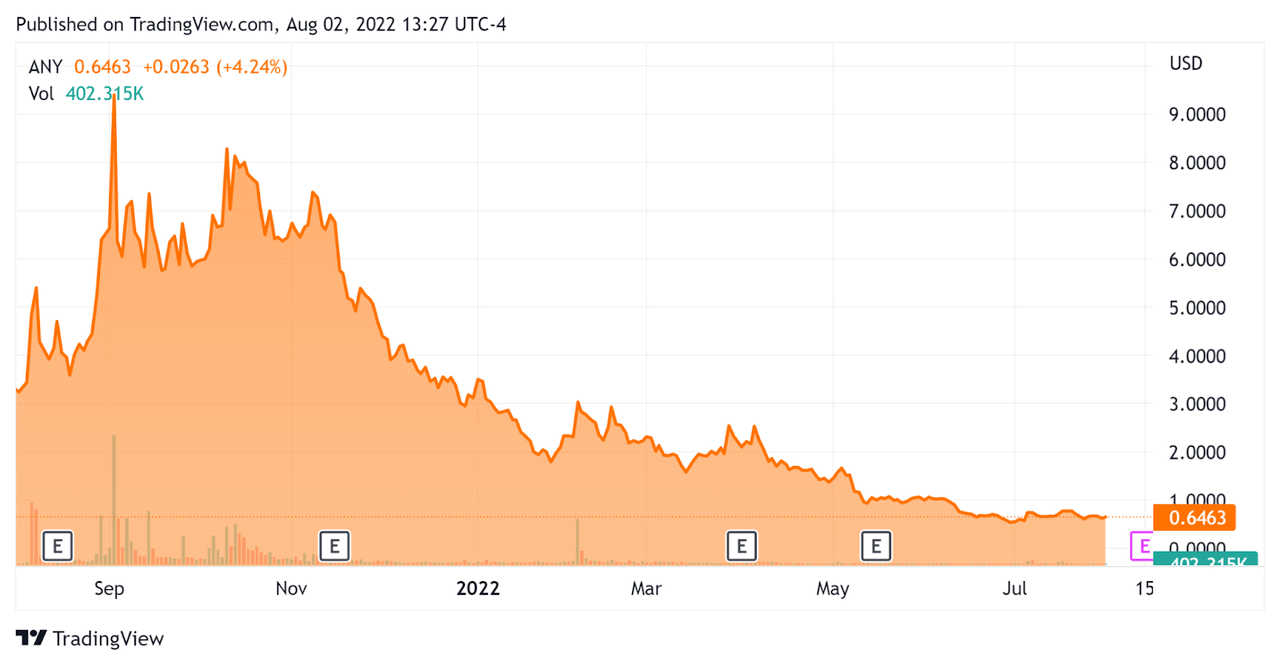

Over the past 12 months, ANY’s share price has fallen 80.7% compared to the US S&P 500 index’s fall of around 5.9%, as the chart below shows:

52-week stock price (TradingView)

Valuation and other calculations for Sphere 3D

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Group value |

$56,690,000 |

|

Market value |

$40,000,000 |

|

Enterprise Value / Sales [TTM] |

13.65 |

|

Income growth [TTM] |

-13.10% |

|

Cash flow from operations [TTM] |

-$43,500,000 |

|

Earnings per share (fully diluted) |

-$0.64 |

(Source – Seeking Alpha)

Commentary on Sphere 3D

In its latest earnings announcement (Source – Seeking Alpha), covering Q1 2022 results, management highlighted its expansion plans to receive contracted delivery of 60,000 Antminer S19j Pro mining computers by the end of 2022.

It is likely that the company will receive these miners in time as the overall supply of miners has increased in recent months due to a decrease in Bitcoin price reduces demand in some respects.

At the date of the results announcement (May 16, 2022), the company had not received its first test shipment of 12 NM440 Bitcoin miners as part of the order of 60,000 NM440. The company has the right to terminate contracts.

As for the financial results, total revenues were $1.4 million, of which digital mining represented half for its first quarter of operations. Bitcoin mining computers.

Sphere generated high and increasing operating losses during the quarter as it attempted to increase the installation of its received miners. It also purchased an additional 125,000 credits for certified emission reductions.

In particular, the firm will not directly manage its data center activities, but will use Gryphon Digital Mining under a master service agreement.

On balance, the company ended the quarter with $25.7 million in cash and equivalents and $7.8 million in debt, of which $1.1 million was long-term.

Looking ahead, management’s primary goal is to bring online as many miners as they can while operating efficiently through their relationship with Gryphon.

There is some question as to whether having mining computers managed by an external party provides the most efficient results.

In terms of valuation, the market still values the company at an EV/Revenue multiple of nearly 13.7x despite a bear market in cryptocurrency prices.

The primary risk to the company’s outlook is how quickly it can bring its previously ordered mining computers online and deal with the volatility of cryptocurrency prices.

A potential upside catalyst would be a rise in the price of Bitcoin, lifting up the share price in the process.

Another question is whether management intends to keep it mined Bitcoin as much as possible in its treasury, to sell a significant part of it or sell all, and minimize exposure to keep risk.

Until we see more data about the company’s installation of more miners and about the prospects for a rise in the price of Bitcoin, I’m on hold for Sphere in the near future.