Top Bitcoin analyst says these calculations indicate BTC may be near the bottom of the bear market

A Bitcoin (BTC) trading veteran says BTC’s 200-week moving average (200WMA) and relative strength index (RSI) are flashing positive signals.

Pseudonymous analyst Plan B says his 1.9 million followers that BTC’s 200WMA is showing a bottom, but he needs the RSI to confirm.

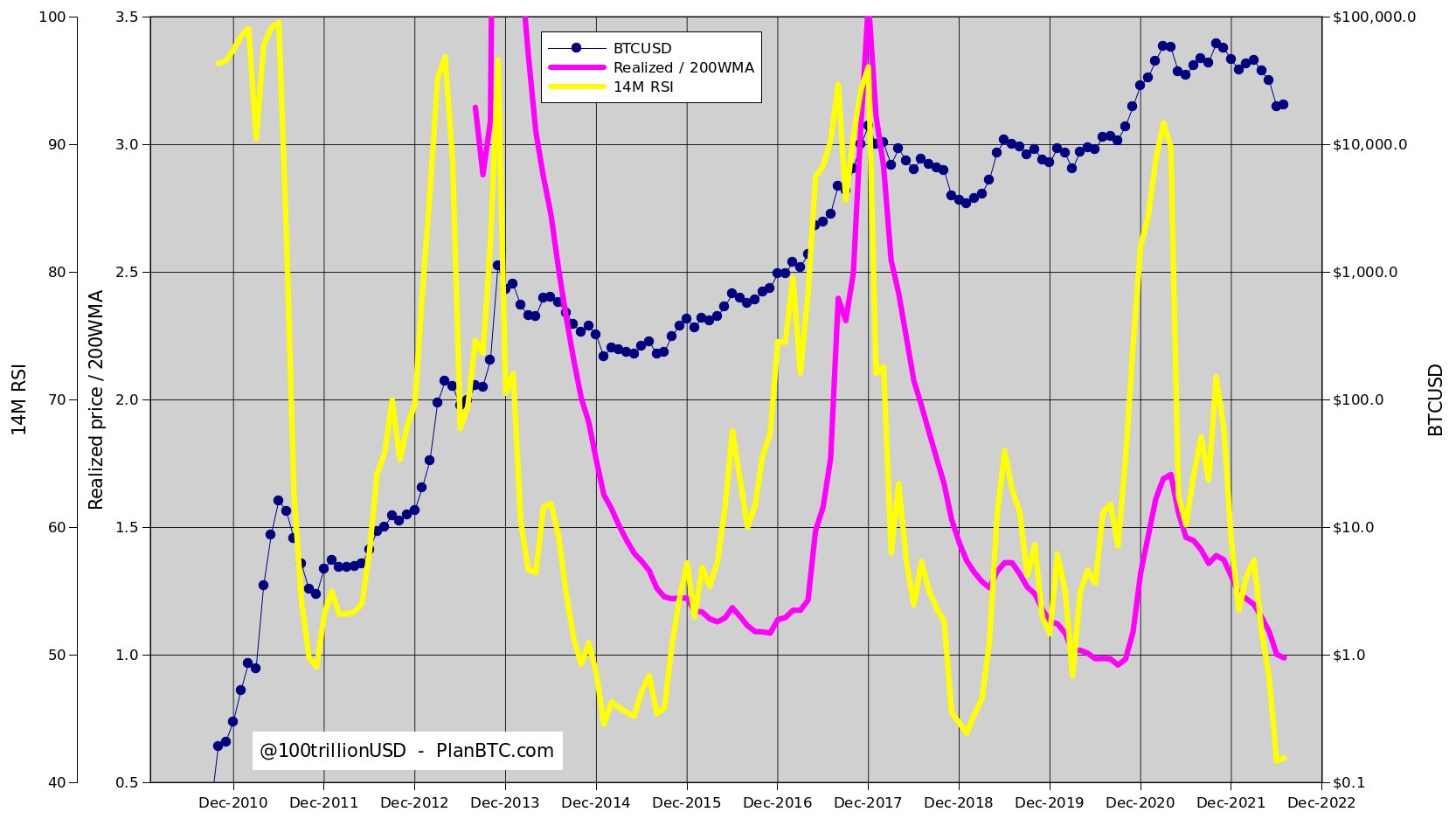

“About this chart:

1) Realized/200WMA shows how small the bull market in 2021 was compared to 2013 and 2017

2) Summer 2021 (after mining ban in China) BTC still looked bullish, RSI rises again

3) But Nov/Dec 2021 RSI broke: end of the bull

4) Now Realized/200WMA shows the bottom. Will RSI confirm?”

Weekly moving averages are technical indicators that help investors and traders smooth out volatile price data by creating a constantly updated average price. Bitcoin’s relative strength index is a calculation that analyzes the crypto-asset’s candlestick oscillation over 14 periods.

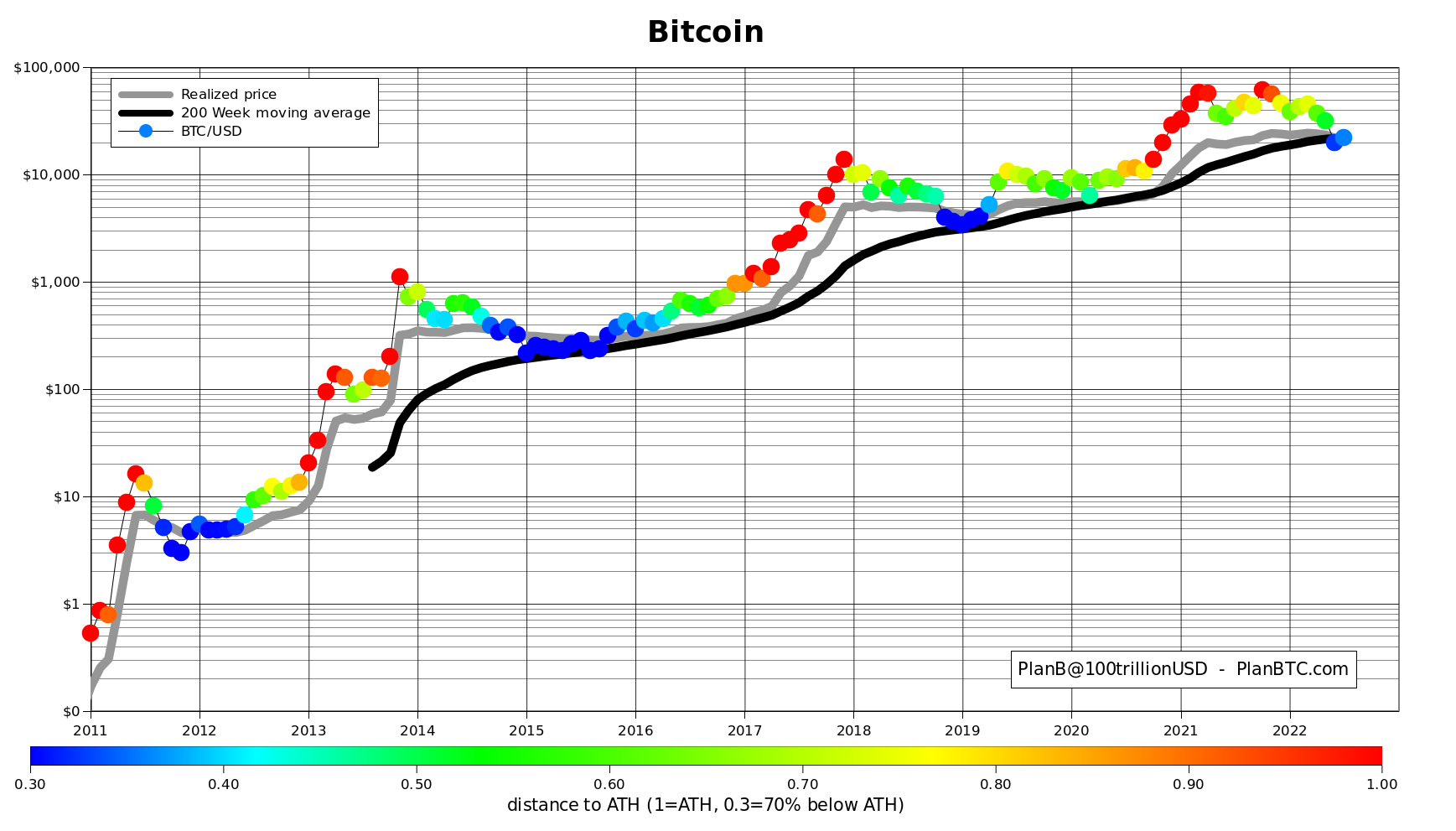

Looking closer at BTC’s 200WMA, Plan B says the largest crypto asset by market capitalization is right where it should be.

“Bitcoin bounced back nicely to 200WMA and realized price levels (both at ~$22,000). Let’s see if it holds.

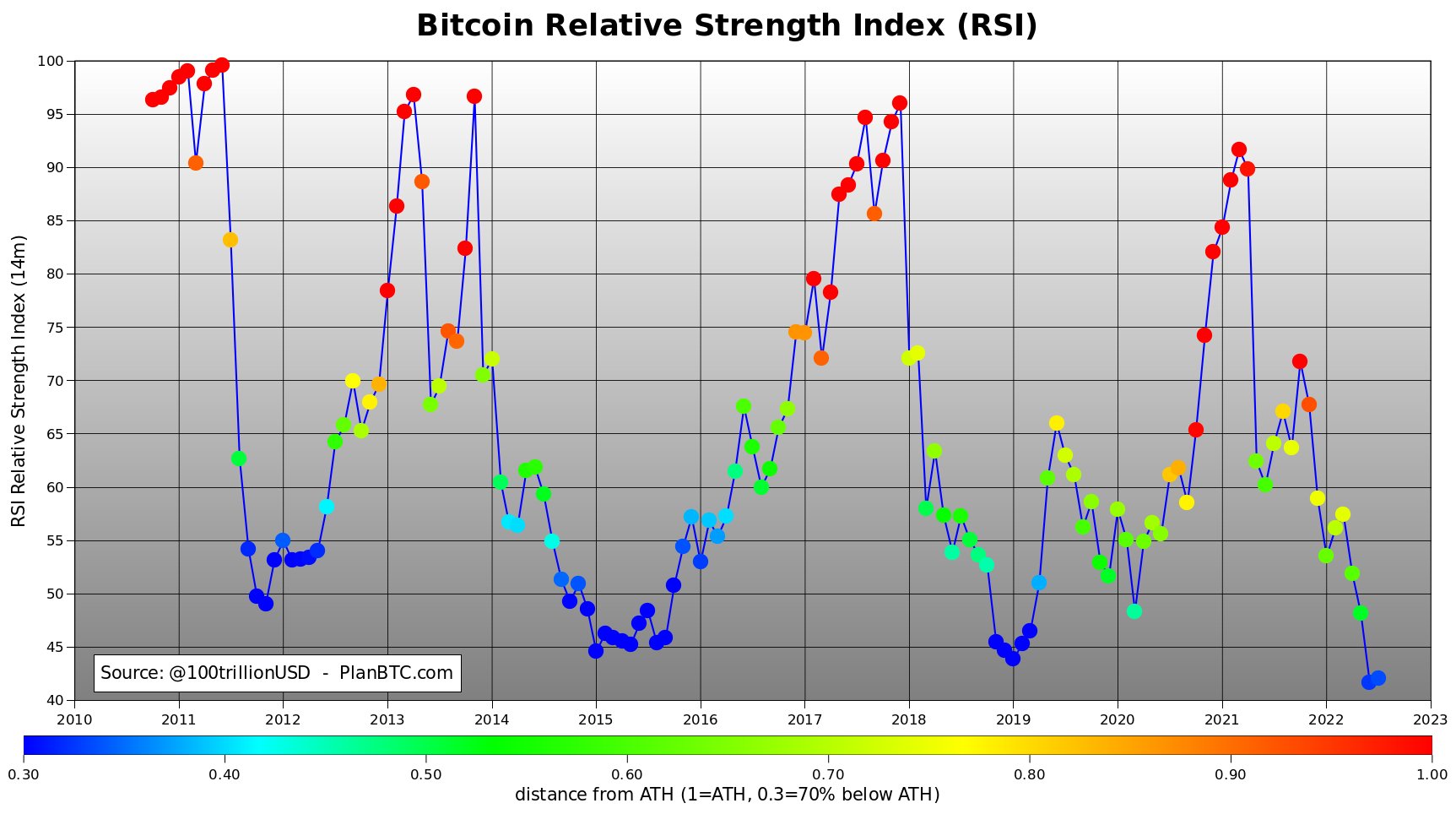

Btw BTC $24,800 would turn the RSI back to 45.

The merchant too says BTC’s current RSI is just below the 45 level mentioned above. Plan B seems to think it is time for the RSI to turn bullish.

“Bitcoin Relative Strength Index (RSI) Reversing?”

Plan B too opinion polls his over 1 million followers, asking the question: How much will Bitcoin be worth in four years?

“85% think we will see a new one [all-time high] next 4 years”

Bitcoin is trading at $22,085 at the time of writing, up 6% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/Antonio Ognibene/Sensvector