Bitcoin, Ethereum, Dogecoin Price Analysis

Bitcoin Analysis

Bitcoin’s price rallied during Monday’s final hourly light, with buyers making another strong move to close the daily session only marginally in the negative [-$35].

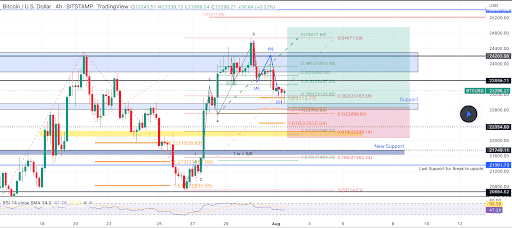

The first chart we look at this Tuesday is the BTC/USD 4HR chart below from howard2535. BTC’s price trades between the 0.5 fibonacci level [$22,695.85] and 0.382 [$23,163.56]at the time of writing.

The overhead targets on bitcoin for bullish BTC market participants are 0.382, 0 [$24,677.69]and 1 [$25,217.88].

Bearish traders are again trying to break the 0.5 fib level with a secondary target of 0.618 [$22,228.14]. The third target for BTC bears is 0.786 [$21,562.24].

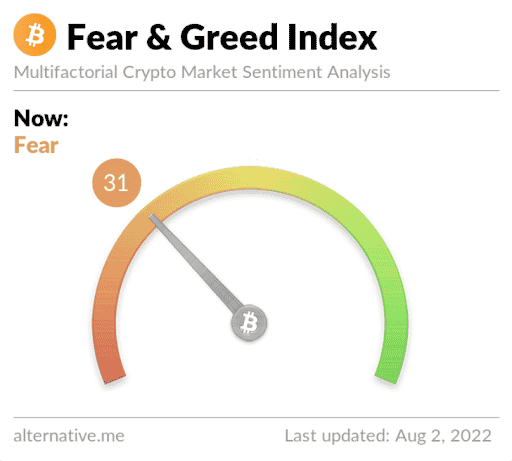

The Fear and Greed Index is 31 Fear and is -2 from yesterday’s reading of 33 Fear.

Bitcoin’s moving average: 5-day [$22,959.58]20 days [$21,809.27]50 days [$23,782.11]100 days [$31,392.66]200 days [$39,707.52]Year to date [$34,571.23].

BTC’s 24-hour price range is $22,879-$23,499 and its 7-day price range is $20,783-$24,581. Bitcoin’s 52-week price range is $17,611-$69,044.

The price of bitcoin on this date last year was $39,156.

The average price of BTC for the last 30 days is $21,588.1 and +17.8% for the same duration.

Bitcoin’s price [-0.15%] closed its daily candle worth $23,259 on Monday and in the red for the fourth day in a row.

Ethereum analysis

Ether’s price sold off nearly 3% on Monday, and when traders settled on the daily candle ETH was -$49.92.

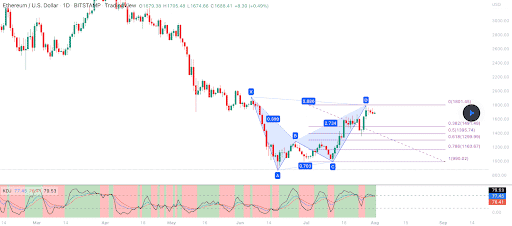

The other chart for analysis this Tuesday is the ETH/USD 1D chart below of XTrendSpeed. Ether’s price rejected several times at the $1,800 level as shown below and has reversed course to the downside. Ether’s price trades between 0.382 [$1,491.48] and 0 [$1,801.45]at the time of writing.

Bullish Ether traders still have a primary overhead target of 0.382 [$1,801.45]. Those looking for further upside still need to break that fib level and secure candle close confirmation on the daily time frame to signal to market participants that there may be further upside on the chart to come.

Conversely, bearish Ether traders look to push ETH’s price below 0.382, followed by a secondary target of 0.5 [$1,395.74]and a third target of .618 [$1,299.99].

Ether’s moving average: 5-day [$1,623.58]20 days [$1,390.64]50 days [$1,433.68]100 days [$2,130.04]200 days [$2,845.61]Year to date [$2,392.34].

ETH’s 24-hour price range is $1,606.12-$1,704.68 and its 7-day price range is $1,367.93-$1,759.5. Ether’s 52-week price range is $883.62-$4,878.

The price of ETH on this date in 2021 was $2,606.99.

The average price of ETH for the last 30 days is $1,369.38 and +57.76% for the same time frame.

Ether price [-2.97%] closed its daily candle on Monday worth $1,630.15 and in the red for the fourth day in a row.

Dogecoin Analysis

Dogecoin’s price was not a victim of the macro on Monday, with buyers pushing the price up by $0.00035 for the daily trading session.

Today’s final chart for analysis is the DOGE/USD 1D chart below from Clarion_Star. DOGE’s price trades between the 0 fib level [$0.0512] and 0.236 [$0.1218].

The overhead measures for DOGE bulls are 0.236, 0.382 [$0.1653]and 0.5 [$0.2007].

Bearish traders are looking to send the DOGE back down to test a full retracement of the 0 fib level and to inflict further damage if they succeed in breaking this level to the downside.

Dogecoin‘s Moving average: 5-day [$0.0669]20 days [$0.066]50 days [$0.069]100 days [$0.097]200 days [$0.138]Year to date [$0.113].

Doge’s 24-hour price range is $0.066-$0.071 and its 7-day price range is $0.060-$0.072. Dogecoin’s 52-week price range is $0.049-$0.351.

Dogecoin’s price on this date last year was $0.203.

The average price of DOGE in the last 30 days is $0.066 and its +4.05% over the same period.

Dogecoin price [+0.51%] ended its trade on Monday worth $0.068460 and in the green for the second time in three days.