Marathon Digital: Bitcoin Mining Titan With Huge Growth Plans (MARA)

Nature

Cryptocurrency is an exciting and unique asset class. As a contrarian investor, I aim to buy when others are “non-believers” like in 2016, before the bull market of 2017. Additionally, I sell when everyone is buying. For example in min pprivate investing group, I told everyone I sold my Bitcoin in February 2021. Although I didn’t time the peak and could have held on for ~30% more gains, I also missed the 66% decline from the November 2021 all-time highs. However, now the technical charts say that Bitcoin has bottomed out (for now) and the asset has even had its best month since 2021, with the price up ~20% compared to July.

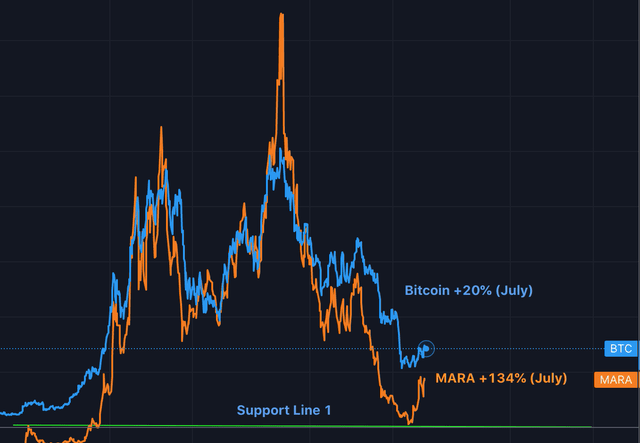

Marathon Digital (NASDAQ: MARA) is a leading Bitcoin mining company that serves as a leveraged way to play Bitcoin. As I mentioned earlier, the price of Bitcoin rose 20% in July (blue line), but Marathon Digital (orange line) is up a whopping 134% in the same period.

Marathon Digital (Orange) vs Bitcoin (Blue) (created by author TradingView)

The technicals are showing bullish momentum signs for Crypto, which is why I think it’s worth diving into Marathon Digital Holdings. A company that has courageous management and big plans for future growth. Let’s dive into my business model, growth plans and price targets for the juicy details.

Business model

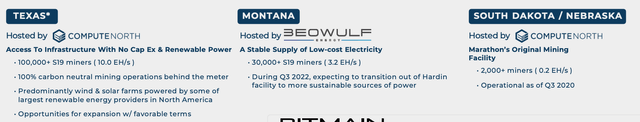

Marathon Digital aims to build one of the largest Bitcoin mining operations in North America. Mining is based in Texas (hosted by Compute North), Montana (hosted by Beowulf) and South Dakota/Nebraska (hosted by Compute North).

Bitcoin mining (Investor presentation)

In Texas, the company is expanding and is expected to deploy over 100,000 S19 miners. An S19 is a purpose-built mining computer (manufactured by Bitmain). In the Texas facility, the S19s can mine Bitcoin at a rapid 10 EH/s (10 Exahashes per second), where one exahash equals one quintillion hashes. For the uninitiated, “Hash Rate” is basically the speed of mining calculated in “Hashes Per Second”. This is how fast the mining computer can solve the encrypted puzzle for that block.

To add some realism to this whole setup, I’ve included a picture of one of the machines so you can visualize what the setup will be like. Imagine 100,000 of these machines bolted together in a huge warehouse.

Antminer S19 (Bitmain)

Green mining is a competitive advantage

A central element of the company’s strategy is the focus on Bitcoin Mining powered by renewable energy sources. For example, the largest facility in Texas has 100% carbon neutral mining. This is mainly driven by wind and solar farms across the US. They also plan to exit the Hardin facility in the third quarter of 2022, to an area with more sustainable power. Mining from renewable energy sources is a big deal, given global Bitcoin Mining uses more electricity than the country of Argentina! This corresponds to 150 terawatt hours of electricity per year.

Given the international fight against climate change and the number of ESG (Environment, Social, Governance) funds, Bitcoin mining must become sustainable. For example, Shark Tank investor Kevin O Leary reported in 2021 that he will not buy “Bloodcoin” referring to Bitcoin mined from non-renewable energy sources, in a direct quote he stated;

“We have compliance with major institutions, we have agreements about how assets are made, whether carbon is burned, whether there are human rights involved, whether it’s made in China.” – Kevin O Leary

This leads to a powerful conclusion which all Bitcoin is not equal. Bitcoin mined from sustainable sources could potentially be worth more than Bitcoin mined from other less “green” or unverifiable sources. Bitcoin ETFs, institutional investors and even companies looking to hold Bitcoin on their balance sheet are therefore likely to be inclined to buy “pure coins”. As Marathon Digital has verified carbon neutral locations in the US, this may give them a competitive advantage.

Reduce mining costs

Part of management’s strategy is to “de-risk” the business by becoming more resilient to potential falls in the price of Bitcoin. Management plans to do this by leveraging its scale to negotiate favorable contract terms and be nimble as Bitcoin rises and falls. Another method they can “de risk” operations and improve their margins is by cooling down the machines in an efficient way. As all that computing power generates huge amounts of heat and thus cooling is a key power consumer.

Immersion of the miners via a dielectric liquid is something the management has talked about in the past. The company estimates that this could result in greater efficiency and the ability to overclock (run the GPU faster than standard speed) by up to 40%. However, it should be noted that setting up such an immersion cooling system is expensive and the proof that it will work has not been defined.

Growth strategy

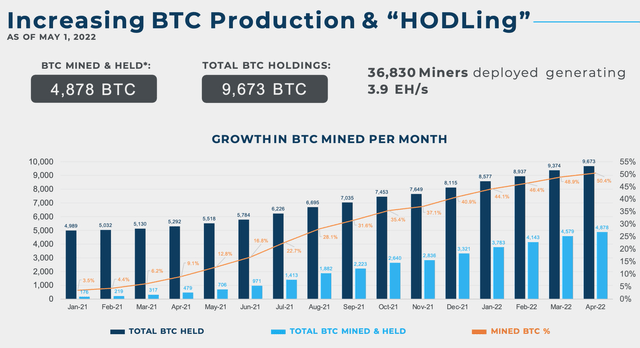

Marathon Digital’s growth strategy involves improving Bitcoin production by increasing hash rate (the speed of mining). As you can see from the chart below, the company has increased its Bitcoin production over time and is holding the asset given the volatility. It was interesting to see that the company has a sense of humor when they referred to “HODLing” Bitcoin, perhaps appealing to their private investor base.

MARA Bitcoin Mining (Investor presentation)

As of the first quarter of 2022, MARA produced 1259 Bitcoin which was an increase of over 1098 BTC in the previous quarter and was higher than other Bitcoin mining companies in the industry. At the time of writing, the company has 36,830 miners deployed at a rate of 3.9 EH/S. As mentioned earlier, the Texas facility currently has up to 10 EH/S mining speed, and the company estimates that it can increase its total hash rate to 23 EH/S, which is fast.

Management also has bullish growth plans to scale its Bitcoin miners from ~37,000 machines to over 200,000 machines by Q2 2023. These are bold plans, but historically management has struggled to keep up with its own goals. The good news is that they recently won a victory in late July 2022 when they secured capacity for approximately 200 megawatts from Applied Blockchain (NASDAQ:APLD).

The Value of Bitcoin Holdings?

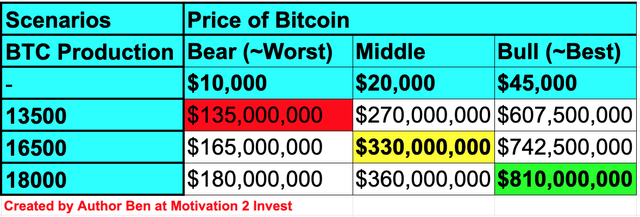

Knowing where the price of Bitcoin will be in the future is extremely difficult to predict, and knowing its true value is largely impossible to calculate. However, we can look at a few scenarios with different Bitcoin prices and then estimate the value of Marathon’s holdings from this. In the table below, you can see that I have extrapolated its total Bitcoin held at 9,673 Bitcoin per Q122 with different growth rates and scenarios for Bitcoin’s price.

In the “worst” case (red), the company produces only slightly more Bitcoin than in Q122, and Bitcoin is split in half at $10,000 (July 2020 price). Given the ecosystem that has built up around Bitcoin over the past couple of years and the number of companies that have added Bitcoin to their balance sheets since then, I consider this scenario unlikely, but not impossible. That would value the fund’s holdings at just $135 million.

Given the “Best” scenario, Bitcoin shoots back to the April 2022 level of $45,000 and the company increases its production rate to result in 16,500 Bitcoins held at a value of ~$810 million. Again, I don’t think this issue is likely to whet investors’ risk-off appetite in the short term, but in the longer term it is a possibility. So if we take the middle scenario of $20,000 for the price of Bitcoin, which is slightly less than the $23k BTC price at the time of writing, and then increase production steadily, MARA will have 16,500 Bitcoins valued at ~$330 million. With a market cap of $1.38 billion at the time of writing, this would value it at four times the value of Bitcoin.

Bitcoin Estimates MARA (created by author Ben at Motivation 2 Invest)

If I convert the previous calculation over to an approximate price target, I get ~$8/share in the worst case, ~$13.50/share in the mid range and $27/share in the high end. Given, current price is ~$13/share. I consider the stock to be a “HODL”, I mean “HOLD” at the time of writing.

Risks

Economic perspective

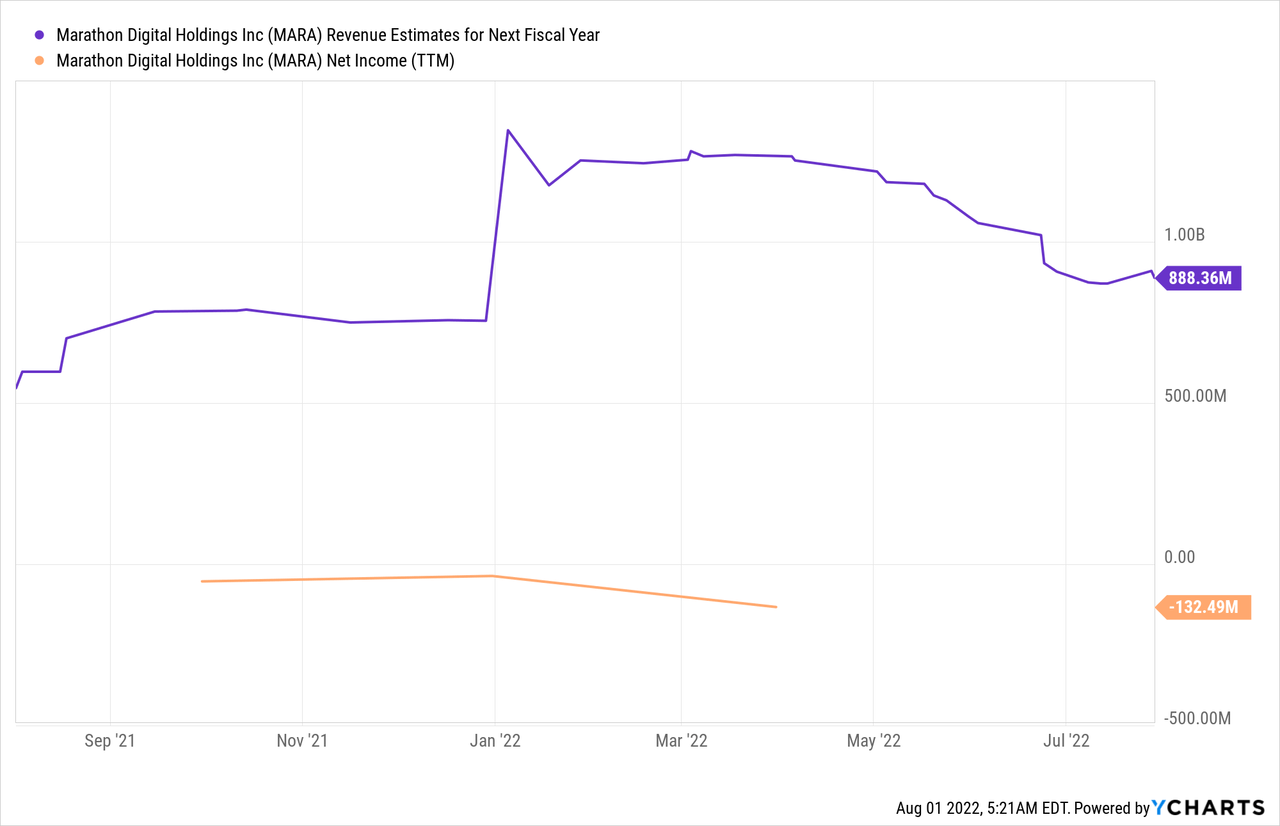

Marathon Digital has bold plans, but remember that this is based on future estimates. Over the past 12 months, the company produced just $193 million in revenue, with $13 million in gross profit and -$46 million in operating income. Given that the company has a market cap of ~$1.38 billion, this is a price to sale ratio of ~6.83 according to Seeking Alpha. This isn’t exactly cheap, but it’s 83% cheaper than the 5-year average price.

The company has a strong cash position of $336 million in cash and short-term investments. However, $729 million in long-term debt is quite high given the negative net income.

Recession

In theory, Bitcoin should be a hedge against inflation, but so far that correlation has not played out. Historically, Bitcoin and Bitcoin mining stocks have traded as risky growth stocks. The rising interest rate environment has caused a large devaluation in many growth stocks, and therefore the appetite for private investors has been dampened. Block (SQ)(Square) saw its Bitcoin trading revenue in its cash app plummet last quarter.

When people “feel rich” they like to invest in speculative assets, but when people have living costs like food and energy pushed by inflation, saving money becomes a priority.

Final thoughts

Marathon Digital is an established player in the crypto mining industry. The management is brave and expects great growth in the future. The success of this stock will be based on two factors, the first is the management’s ability to execute its growth plans, the second is the price of Bitcoin. The many scenarios I presented show that the stock is trading in a medium scenario for both Bitcoin price (after the recent rally) and production estimates. However, the economics are still based on future estimates and thus the stock is suitable for a place in one’s speculative portfolio or as a trading vehicle, but after the recent rally it may be worth holding on until the next Q2 2022 earnings report.