Science & Tech Spotlight: Non-Fungible Tokens (NFTs)

Why this matters

Revenues from NFTs could exceed $ 130 billion by 2030, and NFTs could help boost the digital economy. But despite media attention and celebrity recommendations, they are poorly understood, and the current market is the subject of speculation and fraud. The lack of NFT expertise in the federal workforce also makes it difficult to deal with statutory and regulatory challenges.

The technology

What is it? A non-fungal token (NFT) is a digital identifier, similar to a certificate of ownership, representing a digital or physical asset. In general, a non-fungible asset is unique and cannot be exchanged with others. An NFT, like an original painting, has its own unique value. On the other hand, fungible assets are interchangeable, such as dollar bills or units of a cryptocurrency.

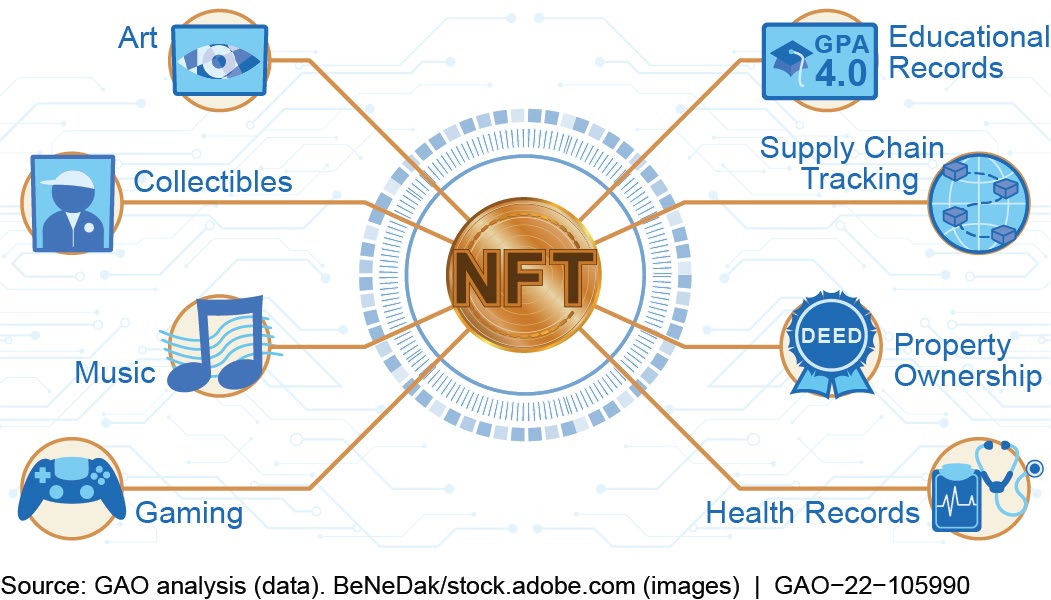

The most widespread use of the technology is currently for digital collectibles, such as NFT for a digital collage that sold for $ 69.3 million in March 2021. The use of NFTs for other applications is growing (see Fig. 1). NFTs can, for example, enable a decentralized marketplace for music or other creative work, so that creators can collect revenue for digital assets directly and automatically, instead of through a third party.

Figure 1. Examples of common and new digital and physical NFT applications.

How does it work? NFTs are generally dependent on the following technologies:

- ONE blockchain is a decentralized digital ledger that uses cryptography – such as data encryption – to improve the security and duration of transactions.

- An NFT marketplace is a website where you can create, sell and buy NFTs – like other online platforms that allow users to do business with each other.

- ONE digital wallet is a contactless payment application that can store payment methods, identification cards, NFTs and more.

To create, or “mint”, an NFT, the creator uploads a digital file, such as a picture, image or piece of music, to a marketplace. The marketplace executes a code to create a unique identifier – NFT – and adds it to a blockchain, which verifies, stores and tracks it. Once created, NFT can be sold, destroyed or stored as a registration indicating ownership. Buyers usually buy digital currency NFTs, but legal tender, other assets or credit can also be used.

Most NFTs are not the asset itself. In the case of a physical asset, they represent ownership of the asset. For digital assets, they represent ownership of the unique code associated with or associated with the asset’s metadata – information about the asset, such as the creation date, size, or where it is stored on the Internet. In the case of a digital image, others may be able to see the asset or even download a copy, but NFT proves which digital image is the original and can, along with other information, show who owns NFT.

NFTs rely on smart contracts – data code that automatically executes a transaction when set conditions are met. For example, a smart contract may stipulate that the original creator will receive a percentage of all subsequent sales of NFT.

How mature is it? NFTs were first created in 2014 for digital images, but interest in them increased in 2021. One company estimated that 360,000 people had 2.7 million NFTs between February and November 2021. According to a market research company, the NFT market size was 50, $ 1 billion in 2021 and may reach $ 130 billion or more by 2030, mainly due to increasing demand for decentralized marketplaces and digital collectibles.

Some researchers suggest that current NFT buyers are primarily interested in reselling NFTs at a profit. As with collectibles such as the first edition of books and sports cards, rarity and popularity can drive the value of NFTs for collectibles.

NFTs can also offer opportunities to a wider group of artists and creators. For example, they can help artists sell their work without relying on a third party, such as a gallery. The decentralized market can allow artists to take full advantage of their art and interact directly with buyers worldwide. And it can allow buyers to support artists’ free expression and autonomy.

Other NFT applications are popping up. For example, some researchers suggest that storing electronic health records such as NFTs may give patients more control over who has access to their data and when or how to share it. One company uses NFTs to track and monitor consent for clinical trials. Individuals will be able to track and monitor their consent agreements in real time across different data sources. The company states that this will give individuals control over their personal information and allow for flexibility in managing their consent. The company also believes that it will increase efficiency by reducing redundancy and the need for human involvement.

What are some concerns? Areas of concern with current NFT use may affect public confidence and may prevent their expansion into new areas. Some users of the technology have bought collectibles with the aim of making money, but like other investments, NFTs come with financial risk and have shown unstable prices. Cryptocurrencies, which have fluctuated in value, are often used to buy and set a value for NFTs and can exacerbate this volatility. NFTs are exposed to artificial price influence, such as celebrity recommendations and illegal activities. For example, NFT owners can set up multiple digital wallets to sell NFTs to themselves, thus inflating an NFT’s perceived value.

The federal government and the private industry have also identified concerns related to NFTs. In March 2022, the President issued Executive Order 14,067 with a view to developing a holistic approach to government to address the risks and exploit the potential benefits of digital assets and their underlying technology. In addition, in March 2022, the Department of Justice charged two people with an alleged $ 1 million fraud scheme after promising an NFT fundraiser to investors, and then transferred all the money raised without making the fund available. At least one insurance company is considering alternatives to cover fraud and other NFT-specific risks. Furthermore, some government organizations are considering how to protect and inform consumers about NFT risks. In April 2022, the Joint Chiefs of Global Tax Enforcement issued a bulletin on how to recognize money laundering and other illegal use.

NFTs can also pose a risk to privacy. For example, without proper security measures, the assets of a person’s digital wallet may be publicly visible, which may reveal identifiable information. Users can also receive unwanted or illegal NFTs, such as NFTs related to obscene content, because some transactions do not require recipient approval.

Another concern is the federal government’s long-standing problems in hiring and retaining a highly qualified scientific and technological workforce. Some researchers suggest that sufficient expertise can help inform decision makers when considering what actions, if any, are needed to regulate NFTs.

Possibilities

- Decentralization. NFT creators and buyers can interact and set the terms of their transactions without the involvement of third parties, which can allow creators to retain a larger share of profits.

- Digital economy. NFT applications can improve the efficiency of the digital economy. For example, they can facilitate the processing of records, help companies attract start-up funding and help match fundraisers with donors.

Challenges

- Investment risk. Like other investments, NFTs come with financial risk and may have price volatility. In addition, when individuals buy NFTs online, they may not be warned about the risk as they would be for a traditional investment.

- Illegal activities. Criminals can take advantage of users through fraudulent activity to steal NFTs or the assets that were used to buy them. Smart contracts can pose similar cybersecurity risks.

- Privacy. NFT information on distributed digital ledgers and in digital wallets can be publicly visible and reveal personally identifiable information.

- Lack of federal expertise. NFTs are in rapid development. Many in the federal workforce may not understand current and new uses across different sectors, which may make it more difficult to identify and address statutory and legal challenges.

Policy context and questions

- What, if anything, can policy makers do to better protect individuals or entities using NFTs, including through the use of regulatory or criminal enforcement mechanisms?

- How can decision makers improve the expertise of the federal workforce to address the use of NFTs and clarify the applicability of current statutory and regulatory frameworks for current and future NFT use?

For more information, contact Karen Howard at 202-512-6888 or [email protected].