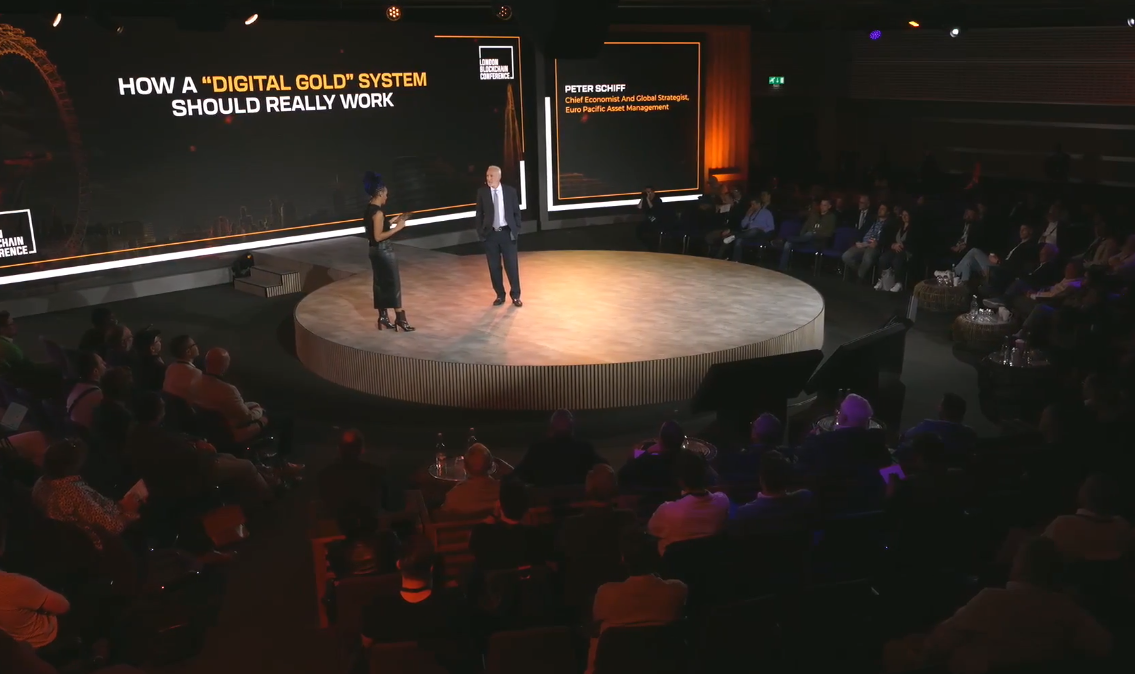

Peter Schiff at London Blockchain Conference 2023: Gold-backed Bitcoin is the answer to the world’s problems

[gpt3]rewrite

A blockchain technology conference that focuses not on hype or speculation, but on utility, will naturally bring out a more dynamic audience than you’re used to seeing at other industry events.

Nowhere was this more evident than in the keynote speaker for the final day of the London Blockchain Conference – Peter Schiff.

Schiff is a notorious proponent of gold in the financial system and a prominent critic of the speculative digital asset hype, which has made him a natural enemy of BTCers and especially on social media. In fact, if you’ve heard of Schiff, there’s a non-zero chance you first came across him in that very context.

But one thing like Peter Schiff is not it is a critic of blockchain or even digital currencies in general. On the contrary, Schiff has clear ideas about the role blockchain – and gold – can play in the global monetary system and the inevitable financial turmoil he says is just around the corner.

“I think the world is on the brink of a monetary upheaval,” he told a room packed with people eager to hear from the renowned crypto critic.

“The current monetary system is largely based on the US dollar. The problem is that since 1971 the US dollar has been based on nothing.”

He explained that before 1971, the US dollar was legally defined as a measure of gold, and gold was the backing behind every dollar. On that basis, he said, the United States was able to convince the rest of the world to back its own currency with the dollar. But the US left the gold standard in 1971 and stopped guaranteeing the exchange of dollars for gold. Since then, according to Schiff, the world has operated on a fiat system where another currency backs up one currency, but ultimately there is nothing of tangible value to back up the system.

“Right now, the United States has a budget deficit of over $2 trillion a year,” he said.

“At the same time, our trade deficit exceeds $1 trillion a year. That’s how dysfunctional the US economy has become under this system: the ability to create the reserve currency out of thin air means Americans don’t have to produce to consume. All they have to do is print paper and exchange it for goods that the rest of the world produces.”

“The only reason that can happen is because the rest of the world is collectively living below its means to subsidize the extravagant living standards of Americans.”

Enter the global upheaval Schiff warned about at the top of the talk: inflation. Record high inflation rates around the world since 2022, and the monetary policies adopted by central banks to counter it, have exposed fiat’s susceptibility to volatility and called into question its reliability. When inflation reaches a point where fiat is devalued too quickly to be trusted as a medium of exchange, the US dollar begins to lose its role as a reserve currency.

“What will drive an alternative are sellers of goods and services who want to be paid with real money. They will not sell anything and accept fiat in exchange if the value erodes too quickly.”

“There is this idea that the dollar will not be replaced because there is nothing to replace it with because every other fiat currency is in a similar position,” he added. “But the dollar didn’t really replace another currency; it replaced money. It replaced gold. So I think the future is not another fiat currency replacing the dollar – it’s gold replacing the dollar as the primary monetary reserve.”

“One way that could be introduced is through the private sector, probably even before the government, through blockchain.”

If your entire experience with blockchain has been in the BTC bubble, you might be surprised to hear Schiff say this. In that bubble, BTC and blockchain are interchangeable – so how can such a prominent critic of BTC say that blockchain is the answer to the world’s problems?

That’s because Schiff recognizes that BTC is not blockchain — and BTC, he says, is not an answer at all. Blockchain is backed by gold.

“With the internet, with blockchain, there is a huge improvement in the functionality of gold to act as a medium of exchange and as a unit of account,” he explained. “Gold’s role as a store of value does not change.”

But to serve as a currency, it is not enough for gold to be a store of value: it must be tradable.

“With the internet, with blockchain, it has never been easier. I don’t need to be physically in the same room or even the same country to shop.”

Note that he says blockchain – not BTC (which Schiff uses interchangeably with ‘Bitcoin’).

“They say ‘you can’t buy a cup of coffee with gold, but you can with bitcoin’ – but you really can’t buy a cup of coffee with bitcoin because it’s going to be very expensive. It’s too volatile, too expensive to be a medium of exchange. And it can never be a store of value because it has no value—it’s only worth what someone is willing to pay for it.”

What is needed is for a blockchain to be used to symbolize real gold, providing all the benefits promised by the blockchain (namely the simplicity, speed and cost-effectiveness of trading) without abandoning the real value offered by gold. A system that can achieve that will have the perfect blueprint for a new reserve currency, says Schiff.

And just as the choice of gold as a currency was originally driven by the public (thanks to its inherent value as a metal), so too will this new blockchain-powered replacement be driven.

“The reason governments started using gold as money was because it was the money chosen by the public,” he said. “If the government wanted goods or services, it had to pay with gold; if it wanted soldiers, it had to pay them in gold. So it was the private sector that invented gold as money. Other governments eventually just got involved.”

So for Schiff, it is gold that always underpinned the fiat currency that served as the standard method of transactions – at least until 1971. What blockchain can do is replace fiat as a superior method of exchanging increments of real money – gold . It can do better than fiat and better than some of the older payment providers, which charge fees at multiple points throughout the process.

“That’s the beauty of a monetary system on a blockchain – I can take a small piece of gold and use it to buy a cup of coffee, and that transaction can be completed at a fraction of the cost of transferring bitcoin and in a reliable way.”

So on that note, while Schiff wouldn’t be drawn into commenting on any specific blockchain in the post-speech Q&A, all we’re waiting for is a blockchain that can trade at scale with minimal fees, high speeds, and perfect verifiability—like all who listened to Schiff’s lecture just spent two days learning about BSV.

See: Gold as a commodity

New to Bitcoin? Check out CoinGeeks Bitcoin for beginners section, the ultimate resource guide for learning more about Bitcoin – as originally envisioned by Satoshi Nakamoto – and blockchain.

[gpt3]