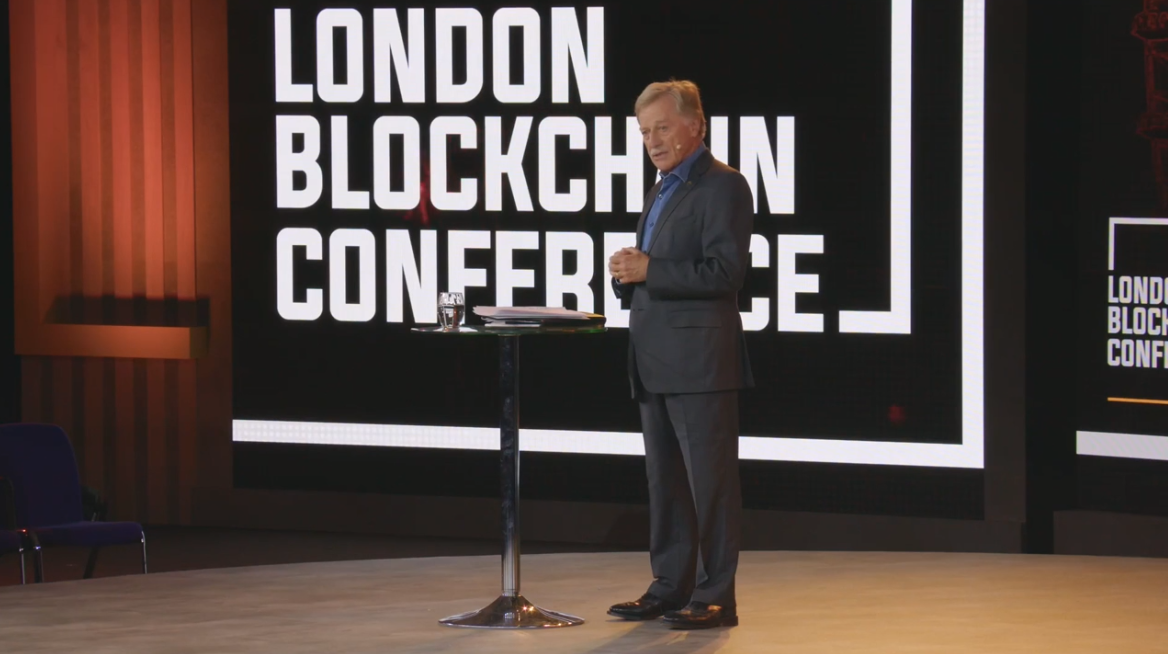

London Blockchain Conference 2023 keynote: Yves Mersch on regulatory framework for digital currency in Europe

[gpt3]rewrite

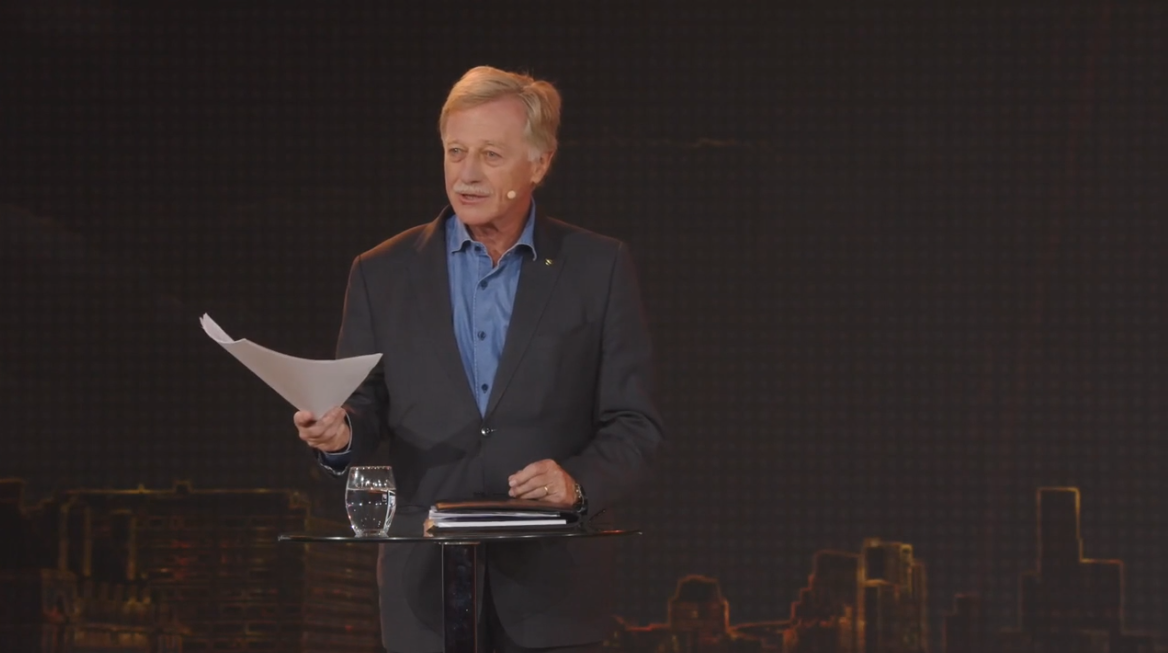

Energy was high in the QEII conference center on day two of the London Blockchain Conference 2O23 (LBC), despite evening drinks shared by attendees and guests the night before. After a short Day 2 opening to hype up the audience, economist Yves Mersch took to the stage for his keynote address on EU regulations.

“When we talk about regulatory change, I think we’re always talking about three, four different fundamental principles. One is regulation that comes too early, and then too late on the back of a series of frauds and scams, which will have consequences that undermine confidence to people. Another is that if the regulation is too intrusive in the beginning, it will be an element that does not support innovation, but if it is too lax, it will have the same effect as having an absence of regulation, he said.

Mersch has first-hand experience of these difficult regulatory dilemmas from his time as a member of the ECB’s Executive Board, which he left in 2020. He also previously served as the first governor of the Luxembourg central bank from 1998 to 2012.

“Before we move forward, we always need to better understand the risks and benefits of innovation, the welfare effects of crypto assets,” said Mersch, who suggested that the incoming Markets in Crypto Assets (MiCA) regulation in the EU will help to address some of these risks , while preserving innovation.

Regarding MiCA, Mersch stated that two key factors were considered. First was “harmonisation”, to unify different approaches to digital assets among the EU’s 27 member states; the second goal was to support innovation.

When it enters into force in 2024, MiCA will bring digital assets, issuers and service providers under a broad regulatory framework. Digital asset service providers, such as exchanges and wallet providers, must obtain a license from national regulators to provide services to EU citizens. Along with licensing mandates, MiCA will provide new classifications for different digital assets, rules specific to those assets, proof-of-funds requirements for issuers of stablecoins, and the requirement that any company wishing to issue digital assets/coins must publish a white paper containing information about the project, including possible risks.

“MiCA is not trying to reinvent the wheel, but build on existing regulatory frameworks that people know in the EU,” Mersch explained. “There is a requirement regarding the issuance of cryptoassets. There will be capital requirements and governance which is an authorization procedure as well as supervision of issuers and certain service providers … and there will be reserve requirements for stable currency issuers. For example, they will be asked to have a to-a reserve ratio for permanent redemption rights.”

This discussion of MiCA was coincidentally timed, coming just a day after the landmark bill was signed into law on Wednesday by European Parliament President Roberta Metsola and Swedish Rural Affairs Minister Peter Kullgren; MiCA passed its final vote in April and received approval from the European member states’ finance ministers in May.

The packed conference room also heard Mersch’s views on the issue of systemic risk related to digital assets; his perception of the problem may have calmed some. While acknowledging the risk to businesses whose security is based on “non-backed crypto-assets with no intrinsic value”, he stated that only a few internationally active banks have digital currency exposures.

“On the whole, the market is still not very large. Therefore, the risk to financial stability, at least in Europe, is measured,” he noted.

Mersch suggested that there is a higher proportion of alternative investment funds active in the digital currency world, what can be referred to as “shadow banks”, but these tend not to be the largest in the market. Thus, the risk is still negligible.

In terms of addressing the risks that exist, “there are still gaps, in my opinion, in MiCA,” Mersch admitted, but it will be an important first step toward a more reliable and secure digital asset, and perhaps wider adoption of the technology. As Mersch said in summarizing, “Money is about trust, and money is also about maintaining value.”

London Blockchain Conference Day 1 Highlights: Monetization with blockchain technology

New to Bitcoin? Check out CoinGeeks Bitcoin for beginners section, the ultimate resource guide for learning more about Bitcoin – as originally envisioned by Satoshi Nakamoto – and blockchain.

[gpt3]