Virtual land NFT rates crater as crypto winter bites

Virtual land metaverse projects such as Decentraland, Voxels, The Sandbox and others have experienced a significant drop in the floor prices of their NFTs between 2022 and 2023.

The move down the left digital collectible and non-fungible token (NFT) enthusiasts questioning the future of the digital real estate market.

Metaverse’s enthusiasm fades

A new study conducted between January 2022 and May 2023 reveals a stark reality for virtual land projects. The study examined the price fluctuations of the top five metaverse countries at their peak and current Ether (ETH) prices, shedding light on the changing dynamics of the metaverse landscape.

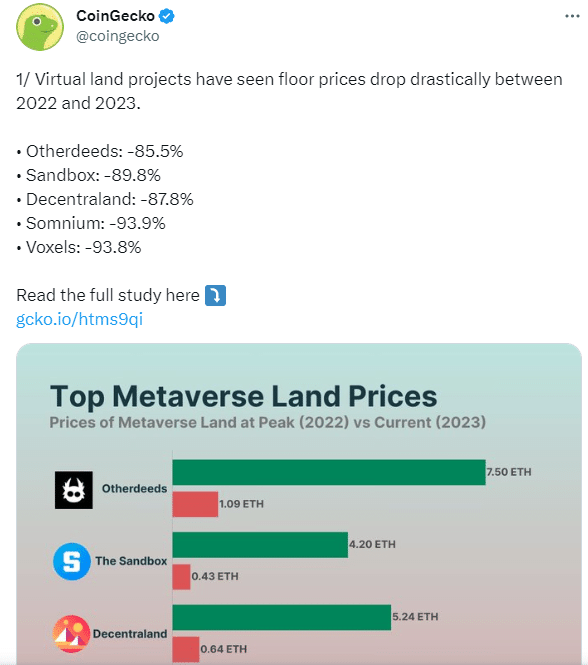

During the height of NFT mania, the floor prices of metaverse lands reached high levels. Otherdeeds, developed by OthersideMeta, was priced at 7.50 ETH on May 1, 2022, making it the most expensive virtual land collection.

It was closely followed by SomniumSpace, which traded at 6.05 ETH at the start of 2022. Decentraland secured the third position with a collection valued at 5.24 ETH.

Fast forward to May 24, 2023, and a significant transformation has occurred. The metaverse land market has experienced a drastic decline, with floor prices falling across various projects.

Today, metaverse land can be acquired for prices ranging from 0.37 to 1.09 ETH, depending on the project, the study reveals.

Surprisingly, Otherdeeds, developed by Yuga Labs, creators of the acclaimed Bored Ape Yacht Club (BAYC) NFTs, still claim the top spot for the most expensive metaverse land collection.

However, today’s price has fallen to 1.09 ETH, which represents a significant decline from its peak value. Decentraland follows, currently trading at 0.64 ETH.

The cheapest country in the metaverse can be found in Voxels, with packs priced at 0.16 ETH. This collection includes 7,930 parcels of land, each with distinct characteristics, including size and location. Somnium Space and The Sandbox follow, with respective prices of 0.37 ETH and 0.43 ETH.

Somnium Space suffered the biggest decline, plunging a whopping 93.9% from its peak. Voxels suffered a similar fate, with a 93.8% decline. Sandbox, Decentraland and Otherdeeds also faced significant losses, falling by 89.8% and 85.5% respectively.

Possible causes of virtual land price declines

Several factors can be cited for the drastic drop in virtual land prices.

First, the initial hype around NFTs and metaverse land created an inflated market where prices were driven up by speculation and fear of missing out (FOMO). As the market cooled and investor sentiment changed, prices fell.

Also, the increasing supply of virtual lands played a role in the price drop.

With more metaverse projects emerging and offering their own land collections, the market became saturated, diluting the value of individual projects. In addition, some early adopters and speculators may have decided to withdraw their investments, putting downward pressure on prices.

The maturation of the metaverse industry also played a role in the price drop.

As the technology and infrastructure behind virtual worlds improved, newer and more innovative projects emerged. This increased competition forced existing projects to reassess their value proposition and adjust prices accordingly.

Implications for the metaverse

The significant decline in prices of virtual lands raises questions about the long-term viability and sustainability of the metaverse as a digital economy. Some critics argue that the speculative frenzy surrounding NFTs and virtual lands created an unsustainable bubble and the price correction is a natural consequence of market dynamics.

Supporters of the metaverse, however, believe that the drop in price presents an opportunity for wider adoption and availability.

Lower barriers to entry can attract a wider audience and promote more diverse and inclusive virtual communities. As prices become more affordable, individuals who were previously priced out of the market may now have a chance to participate and contribute to the growth of the metaverse.

Furthermore, some claim that the price drop can lead to increased innovation and creativity within the metaverse ecosystem.

Developers and creators will be motivated to deliver unique and engaging experiences to differentiate their projects and attract users. This competition can drive the development of the metaverse, offering users more immersive and interactive environments.

Virtual country: advantages and disadvantages

Virtual land represents digital real estate within the metaverse, offering users the ability to own and customize their own parcels of the virtual world. These bundles are minted as non-fungible tokens and can be bought, sold and traded on NFT marketplaces.

Owning virtual land gives users the privilege to host events, build digital assets, socialize with others, and explore various tools in the metaverse.

Virtual Land provides creators with an innovative canvas to express their ideas, enabling the development of unique experiences and digital assets. These creations can make money in various ways, such as selling virtual goods, organizing events, or even offering services within the metaverse.

The metaverse, including virtual lands, has witnessed remarkable growth and investment interest from both individuals and businesses.

As the metaverse expands, the value of virtual lands has the potential to increase significantly, giving early adopters an attractive return on their investment. The evolving nature of the metaverse provides the opportunity for market growth and significant returns.

Despite the huge benefits mentioned above, virtual land ownership has its fair share of risks, including market volatility, platform hacks, network downtime, and others.

Looking forward

While the current state of the metaverse land market reflects a significant price drop, it is important to approach these developments with a balanced perspective. The metaverse is an emerging and rapidly developing industry, and price fluctuations are to be expected as the market matures.

Investors and enthusiasts should carefully consider the fundamentals, community involvement and development roadmaps of metaverse projects before making investment decisions. Thorough research and due diligence are essential to navigating this evolving landscape.

As the metaverse continues to capture the imagination of people worldwide, virtual land projects will remain a focal point of interest and investment. The future of the metaverse will depend on the collective efforts of developers, creators, and users to shape an immersive, vibrant, and sustainable digital realm.

The drastic drop in virtual land prices between 2022 and 2023 highlights the volatility and evolving nature of the metaverse market. While some may see the price drop as a setback, others see it as an opportunity for wider adoption and increased innovation.