China developer Greenland targets Hong Kong for crypto trading

Greenland, a Chinese state-owned real estate developer, will apply for a license to trade virtual assets in Hong Kong. The application comes as Hong Kong ramps up regulations.

Chinese state-owned Greenland, a property developer, will apply for a license to trade virtual assets in Hong Kong, according to reports. More specifically, the fintech unit in Greenland will apply for the licence. The Shanghai Municipal Government owns 46.4% of the company.

This will mark the first state-owned entity to apply for a digital asset license in Hong Kong. Chinese banks have already warmed up to offering services to crypto companies in the region. Speaking about the development, CEO James Geng Jing of Greenland Financial Technology Group said,

“We want to expand our digital finance business in Hong Kong as our gateway to the world. As Hong Kong launches a new regulatory regime for virtual asset trading platforms, it is the perfect timing for Greenland to enter this business in Hong Kong.”

Hong Kong has increased its activity, both in terms of actual offerings and regulation, in the crypto space in recent months. New rules have been implemented and more are likely to come soon.

Chinese authorities are cracking down on the NFT market

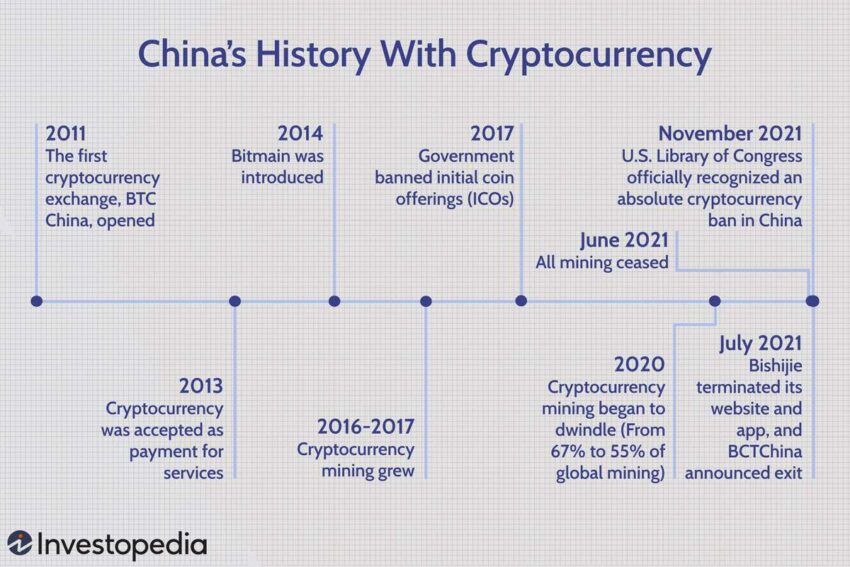

Meanwhile, mainland China has continued to crack down on the crypto market. Most recently, the prosecuting authorities have cracked down on “pseudo-innovation” in the NFT market.

These prosecutions target mechanics such as airdrops, rewards, blind boxes and limited sales. They believe that this could lead to pyramid schemes that inflate the prices of NFTs. It is another action taken by the Chinese authorities, who are not keen on letting the crypto market flourish as it is.

Hong Kong is making progress with crypto regulation

Hong Kong is taking a more lenient approach to regulation, with a licensing process set to come into effect on June 1. Among the many items on the agenda are stablecoins, which are a pain point for many regulators.

The authorities in the region have also gone so far as to emphasize to the banks that there is no ban on servicing crypto firms. Hong Kong aims to revitalize its financial hub status with crypto and places particular emphasis on web3. The financial manager has even said that now is the best time to invest in web3.

Disclaimer

In accordance with the guidelines of the Trust Project, BeInCrypto is committed to objective, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content.