Solana Price Prediction As SOL Blockchain Sees Huge Increase In New Users After Increase In ETH Gas Fees – Time To Buy?

[gpt3]rewrite

The Solana network, a layer-1 smart contract-enabled blockchain protocol known for its high transaction throughput and low gas fees, has seen an increase in daily users in recent weeks.

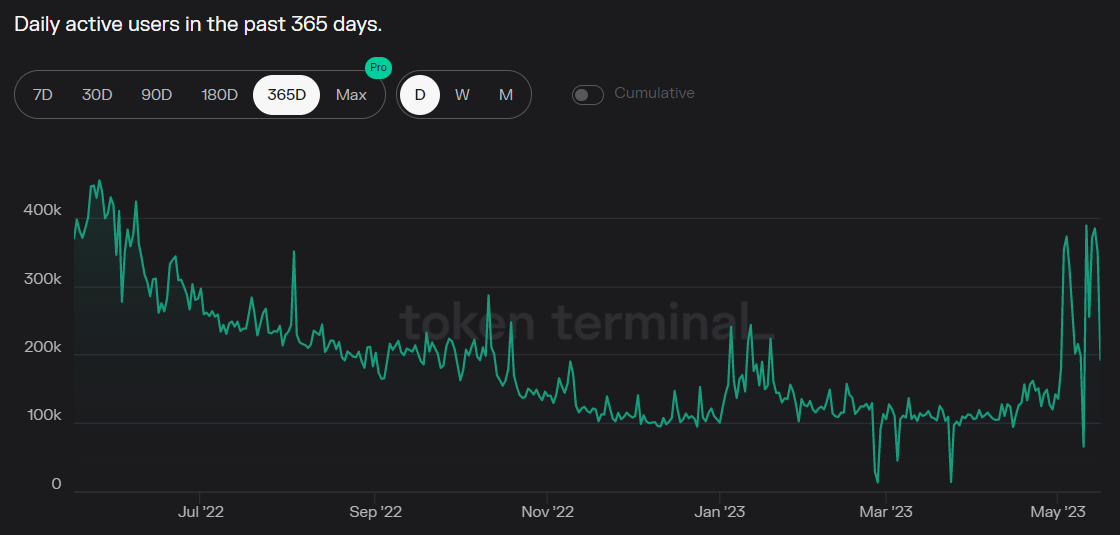

According to data presented by Token Terminal, the number of daily active users on the blockchain recently rose to the highest in nearly 12 months by nearly 400,000.

The peak in daily active users comes at a time when Solana’s major, more established blockchain competitors such as Bitcoin and Ethereum have struggled with increased congestion.

Recent Bitcoin transactions surged to record daily numbers amid the sudden surge in popularity of the new BRC-20 token standard (crypto tokens issued directly on the Bitcoin blockchain, somewhat like how ERC-20 tokens are issued on Ethereum), all powered by the Ordinals Protocol introducing inscriptions to the Bitcoin network late last year.

Meanwhile, the Ethereum blockchain is grappling with a sudden surge in meme coin-related transactions as new wave memecoins like Pepe (PEPE) gain significant buzz.

The increase in network congestion on the world’s two most used blockchains has gone hand in hand with an increase in transaction fees (referred to as gas fees on the Ethereum network), pushing crypto users to cheaper blockchain alternatives like Solana.

Price Prediction – Is It a Good Time to Buy?

Despite the positive trend in daily active users on the Solana blockchain, the SOL price continues to decline and was last around $20.50 per token, about 1.5% lower for the week.

SOL is the token that powers the Solana blockchain.

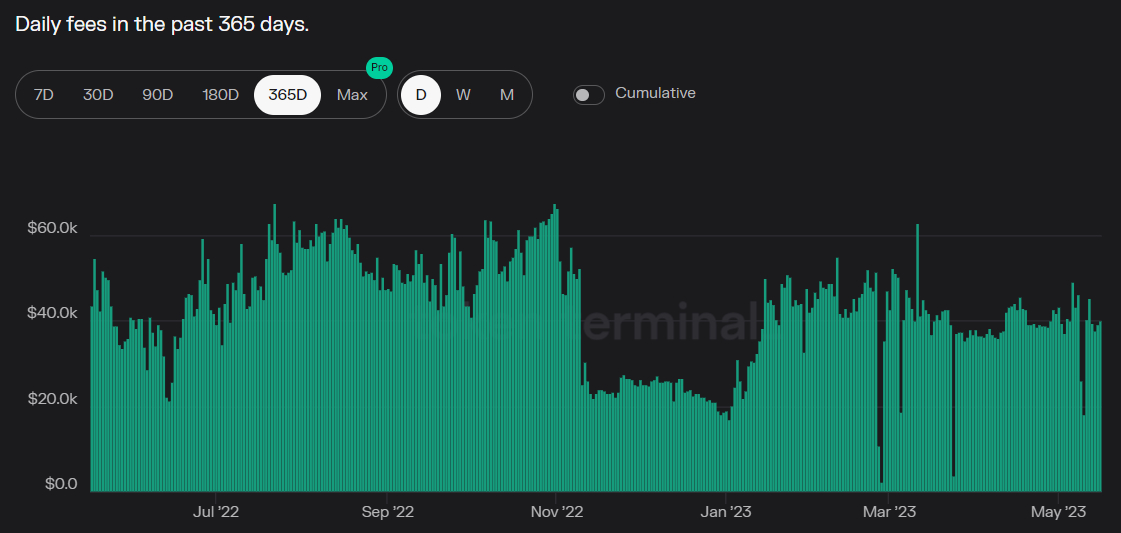

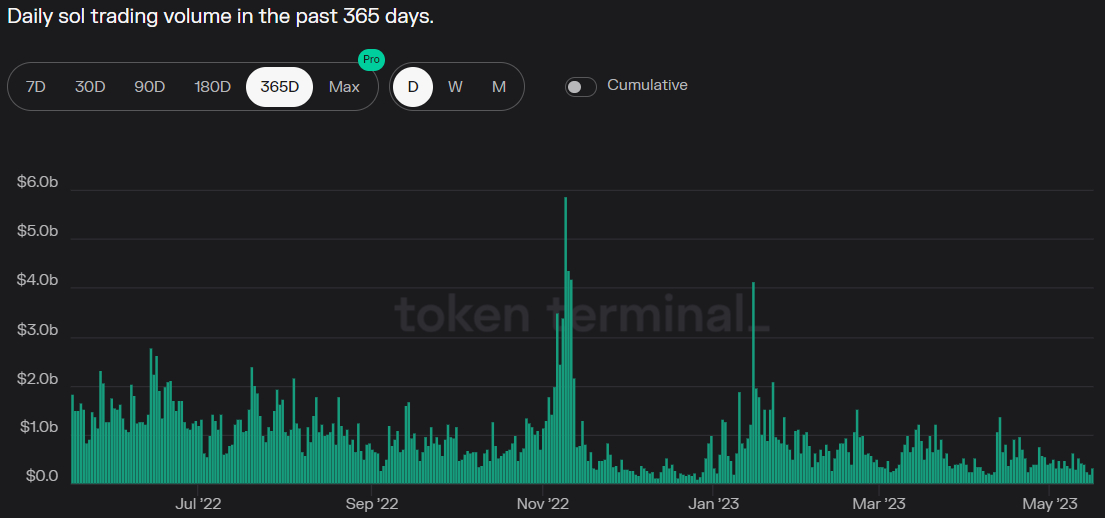

That can be partially explained by the fact that other on-chain metrics, such as the blockchain’s daily fees, and SOL trading volumes have not picked up.

SOL’s technical outlook, meanwhile, is mixed.

The cryptocurrency continues to trend to the downside within the framework of a bearish trend channel, but has continuously found support above the 200DMA in recent weeks.

It can be taken as a long-term bullish sign, but it is too early to declare a bull market for Solana just yet.

That’s because the cryptocurrency recently found strong resistance against a downtrend that has been in play since late 2021.

A break above this long-term downtrend could vault the SOL price above the significant $27-28 resistance area and open the door for gains towards the $39 and $48 resistance zones.

For investors who are confident that the broader crypto bull market will continue, now could be a good time to buy Solana, because once it breaks these key resistance levels, it could rise much higher very quickly.

Solana Alternatives to Consider

While Solana has the potential to perform very well in the medium term if it can break key resistance levels, investors should always be looking to diversify their crypto holdings.

A high-risk, high-reward investment strategy that some investors may want to consider is getting involved in crypto pre-sales.

This is where investors buy the tokens of fledgling crypto projects to help finance their development.

These tokens are almost always sold very cheaply, and there is a long history of pre-sales that provide huge exponential gains to early investors.

Many of these projects have amazing teams behind them and a great vision to deliver a revolutionary crypto application/platform.

If an investor can identify such projects, the risk/reward of their pre-sale investment is very good.

The team at Cryptonews spends a lot of time finding pre-sale projects to help investors.

Here is a list of 15 of what the project considers the best crypto presales of 2023.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

[gpt3]