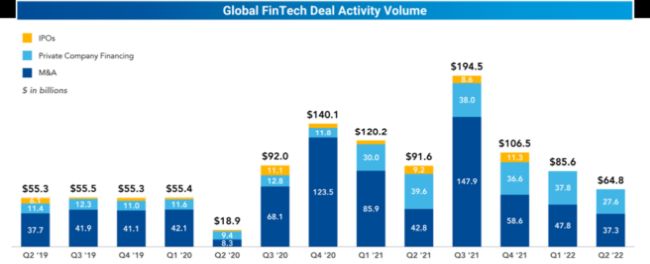

Globally, the total volume of fintech deal activity, which includes funding from private companies, IPOs and M&A activity, has fallen for three consecutive quarters. Activity in the second quarter of 2022 was down 67% from the peak recorded in the third quarter of 2021. Funding by private companies in the sector was at its lowest level since the fourth quarter of 2020, at $27.6 billion (for perspective), this is still higher than any quarter in 2019 or 2020). However, 2022 is the second largest year ever in terms of funding volume raised by fintech companies, despite the overall slowdown in the market. The number of financings per quarter has increased from the previous two quarters, although the revenue raised per round has decreased.

Source: FT Partners

In the second half of 2022, thirty-six fintech companies achieved unicorn status, including Binance.US and Backbase, among others. Three fintechs reached “decacorn” status (or a value of $10 billion or higher), including KuCoin, Rippling and Deel. Financing in the fintech sector remained most vibrant in North America, which accounted for 48% of the total number of completed deals in the quarter, and 50% of the total dollar volume. There have been no fintech IPOs in the US in 2022 year to date.

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (“Mayer Brown Practices”). The Mayer Brown practices are: Mayer Brown LLP and Mayer Brown Europe – Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorised and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its affiliates in Asia; and Tauil & Checker Advogados, a Brazilian law partnership with which Mayer Brown is affiliated. “Mayer Brown” and the Mayer Brown logo are trademarks of Mayer Brown Practices in their respective jurisdictions.

© Copyright 2020. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and commentary on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.