Fintech firm CASHE’s profits grow nearly 8X in FY22

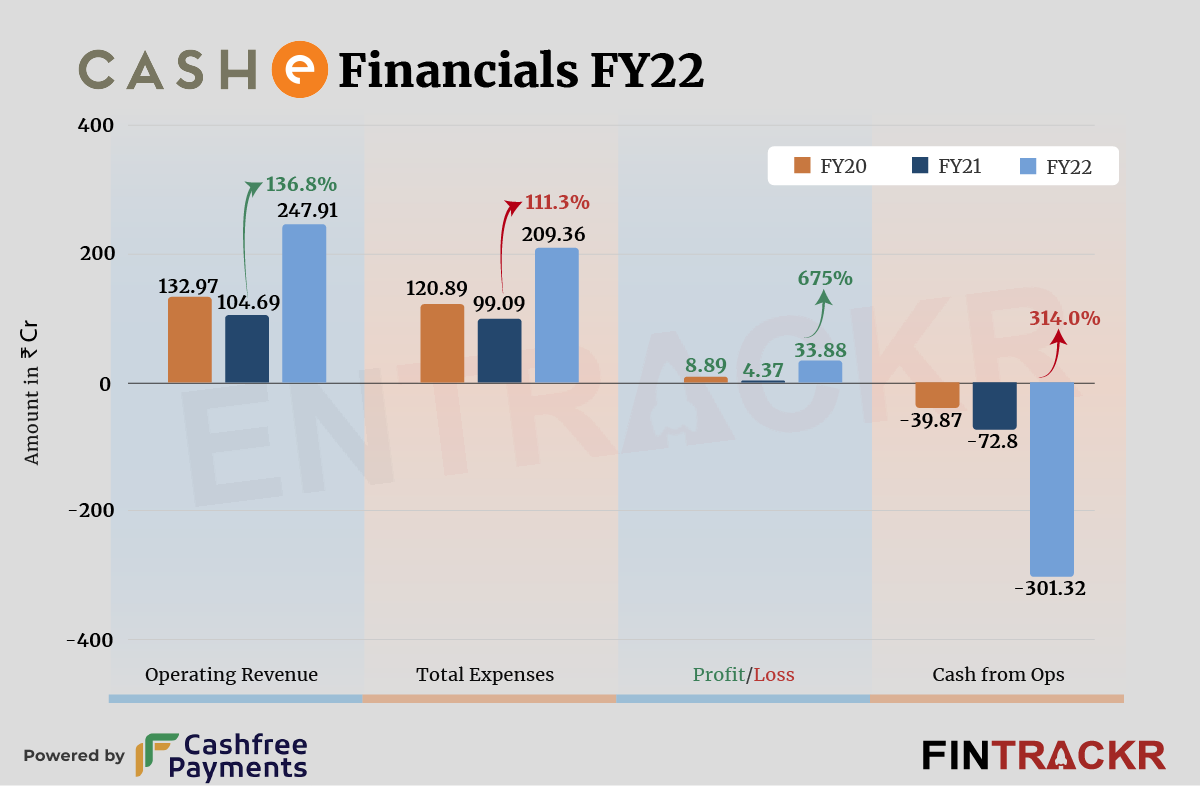

Lending startup CASHe has made a strong comeback in FY22 after witnessing a pandemic-driven decline at its scale during FY21. The eight-year-old firm managed to grow revenue by over 2X along with an impressive eightfold increase in profits in the fiscal year ending March 2022.

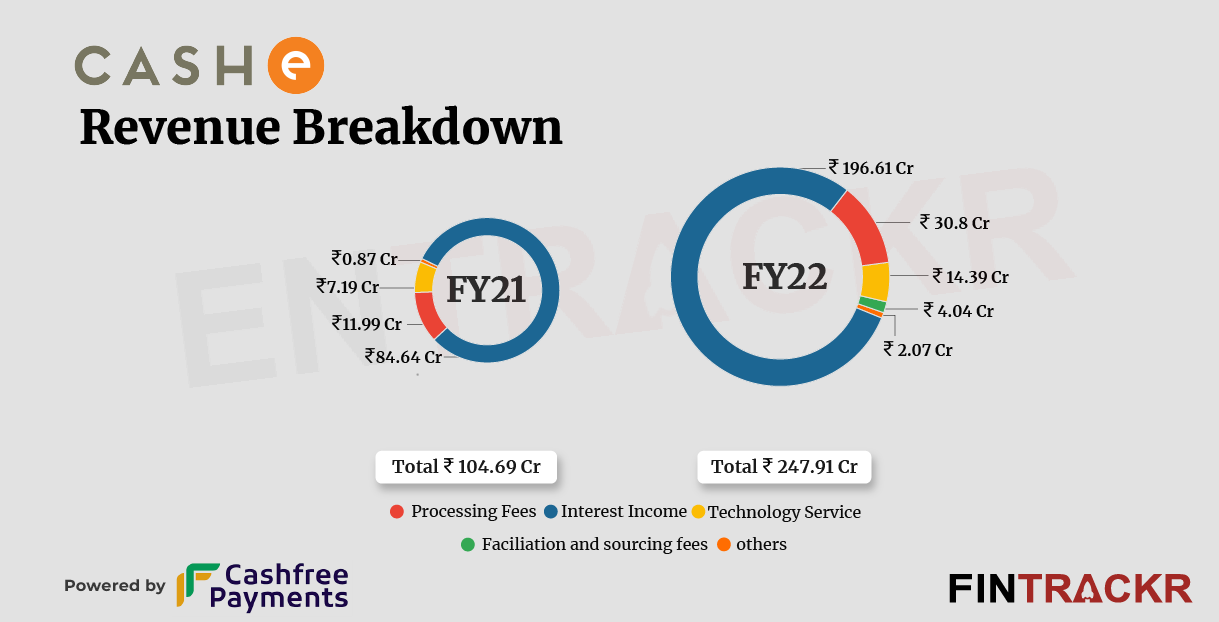

CASHE’s operating income rose 2.36X to Rs 247.91 crore in FY22 from Rs 104.69 crore in FY21, according to the company’s consolidated accounts with Registrar of companies.

CASHe offers millennial-focused credit products, including personal loans with tenors of 2 to 12 months and ticket sizes between Rs 7,000 to Rs 3 lakh. It also enables credit lines and BNPL products in partnership with Myntra, Uber, Amazon and others.

Interest on loans accounted for 79.3% of the total collection, which grew 2.3X to Rs 196.61 crore in FY22 from Rs 84.64 crore in FY21.

Income from loan processing fees and technology services rose by 2.5 and 2 times to Rs 30.8 crore and Rs 14.39 crore respectively during FY22. CASH also booked Rs 6.11 crore as income from facilitation, loan collection and bad debt recovery during FY22.

CASHe is demanding over Rs 7,200 crore in disbursal of 2.1 million loans. The app has been downloaded over 30 million times.

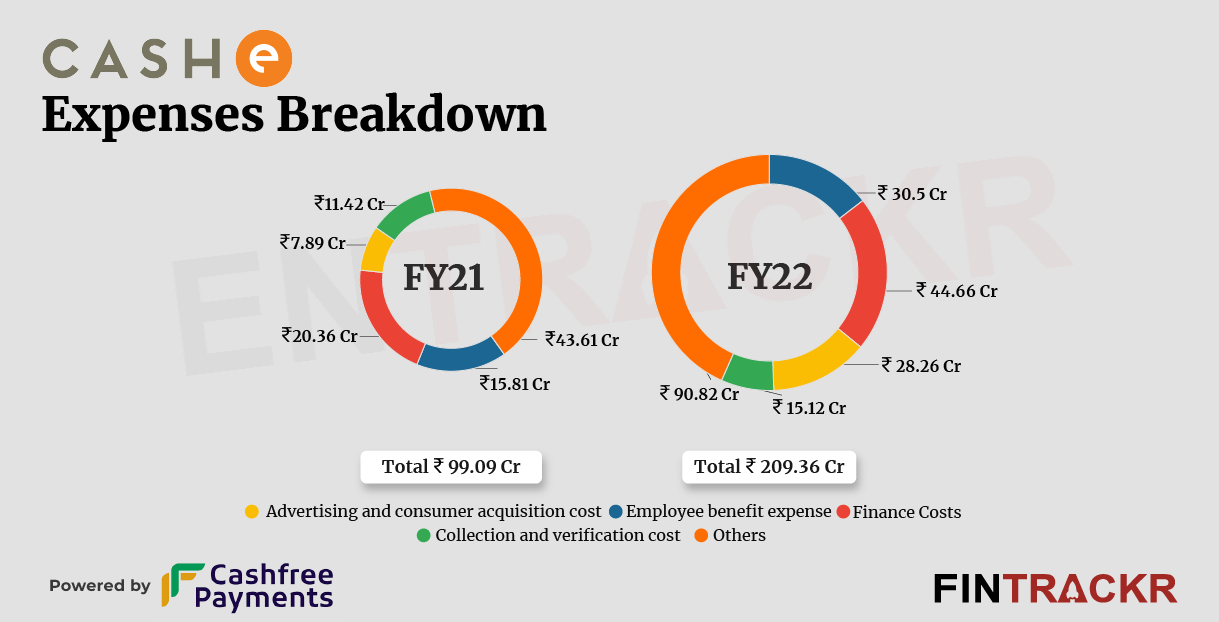

On the cost side, financing, i.e. interest paid on loans, made up 21.3% of total expenses. These expenses grew two-fold to Rs 44.66 crore in FY22 from Rs 20.36 crore in the previous financial year. Importantly, the company has a total loan of Rs 453 crore including short-term and long-term loans.

Employee benefits increased by 92.9% to Rs 30.5 crore in FY22 from Rs 15.81 crore in FY21. It also includes Rs 2.88 crore ESOP expenses, which are non-cash. Advertising and consumer acquisition cost for CASHe jumped 3.58X to Rs 28.26 crore in FY22 from Rs 7.89 crore in FY21.

The company added another Rs 15.12 crore as collection and verification costs and increased its total expenditure by 111.3% to Rs 209.36 crore in FY22 from Rs 99.09 crore during FY21.

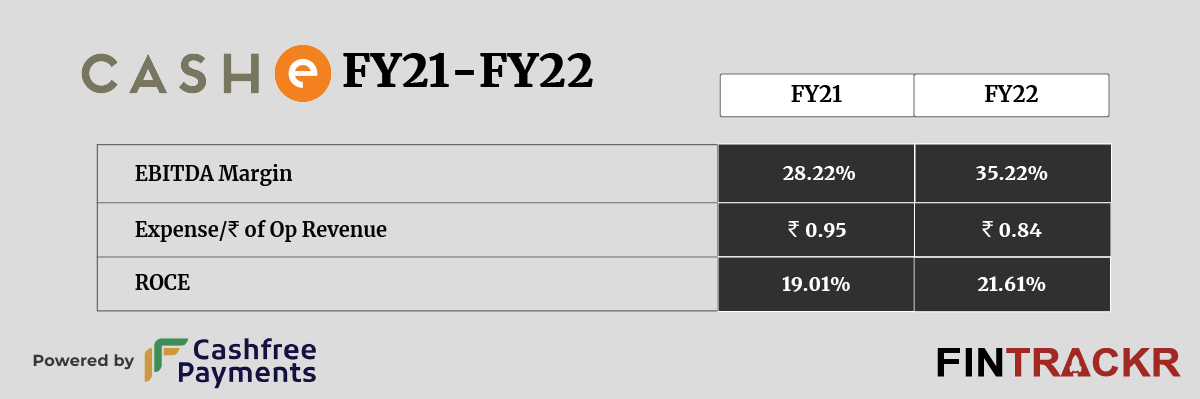

With over 2X growth in scale and cash burn under control, CASHe’s net profit increased 7.7X to Rs 33.88 crore in FY22 from Rs 4.37 crore in FY21. ROCE and EBITDA margin improved to 21.61% and 35.22% respectively. At the unit level, CASHe used Re 0.84 to earn a single unit of operating income in FY22.

CASHe continues to demonstrate the opportunity in the lending space, a reason why all fintech companies want to play in the space. But success depends on a number of factors, not the least of which is the ability to assess creditworthiness and, even more importantly, collection in the event of delays.

CASHE’s large volume of loans indicates its approach – focusing on core TG rather than any particular loan category. While the average ticket size is around Rs 35,000, we have no doubt that it has a very wide range of loan buckets in terms of customers right now. This puts the firm in a good position to sense any change in market dynamics, and go for course corrections, in addition to future expansions as a funnel for larger loans, it can be transferred to larger partners.