Lenders lend $95 million on the back of NFTs

Earlier this year, the new marketplace Blur made waves in the NFT sector. Recent figures suggest that the lending platform could create a similar buzz. However, there are real and serious risks when borrowing against an NFT.

Blur’s lending platform, Blend, has quickly gained popularity since its launch just ten days ago. According to data from the Dune dashboard, users have already borrowed a staggering 51,656 ETH – the equivalent of $95 million – against their digital collectibles. Impressively, over 3,000 individual loans have been opened on the platform so far.

Blend supports four collections

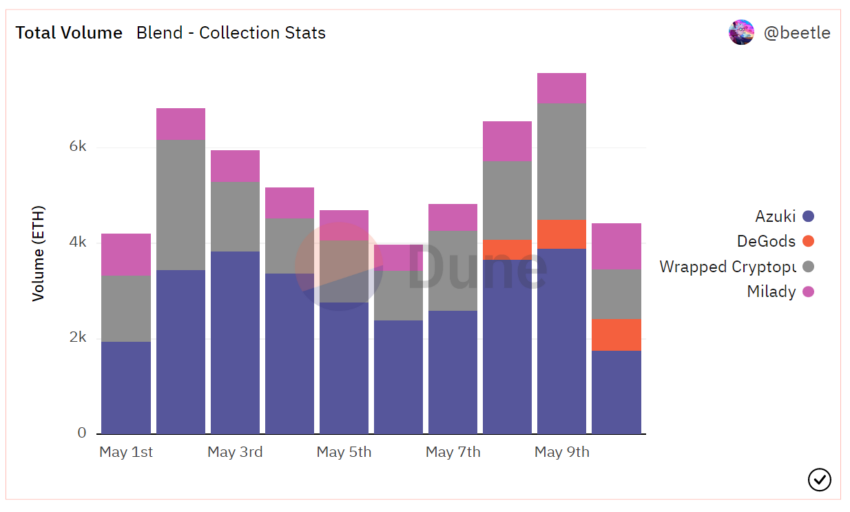

Blend currently supports loans backed by four NFT collections: Miladys, Azukis, DeGods and wrapped versions of CryptoPunks.

Blur generated a buzz earlier this year with its impact on the NFT market. Soon after its launch, it surpassed OpenSea, the king of NFT marketplaces, with 53% market share. Blur’s native token airdrop in Q1 2023 drove significant traction to the NFT market and aggregator, resulting in an increase in Ethereum’s NFT trading volume.

Blend, also known as Blur Lending, looks like it could make it even better. Since its launch, Blur’s lending platform has quickly surpassed competitors such as NFTfi, Arcade and BendDAO, driving NFT lending volume to an impressive $67 million in just one week.

Blend’s loans alone account for a remarkable 75% of total volume. Currently, the total number of accepted and refinanced loans is 3,045, with 922 unique lenders, according to Dune.

Blend is the latest player to join the market. However, using NFTs as collateral has been popular since 2021 thanks to the emergence of new platforms and the rising cost of digital assets. In recent months, prices have been more subdued. However, using NFTs as collateral poses a serious risk to lenders.

Liquidity risk

Using an NFT for collateral is not unlike using other assets to fund loans. Borrowers deposit NFT as collateral, set loan terms and receive ETH from lender, while NFT remains as collateral. The borrower then repays the loan to collect the NFT. A failure to repay results in liquidation and the lender claims ownership of the NFT.

However, NFT lending platforms such as Blur pose a danger by enabling collectors to purchase tokens without having the necessary funds. This creates liquidity risk in the future when the collection floors suddenly tank.

A liquidity risk occurs when a borrower will not have enough cash to meet their financial obligations – in this case the loan.

Borrowing on NFTs may require a margin call to avoid liquidation. A margin call occurs when the lender requests additional collateral from you to compensate for the reduced value of the asset.

In 2022, traders were hammered after BAYC NFT prices fell by 80% in six weeks. Many of them had over-leveraged themselves by using the Monkeys as collateral to take out loans on BendDAO. Dozens of those who did faced margin calls.

Disclaimer

In accordance with the guidelines of the Trust Project, BeInCrypto is committed to objective, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content.