Market sentiment and bitcoin price

Over the weekend, the price of Bitcoin fell back below $30,000, fueling traders’ fears of a bearish continuation in the coming months.

Market sentiment is now caught between fear of a prolonged bear market and confidence in a resumption of the bull phase.

Let’s analyze the situation together

The price of bitcoin fell sharply over the weekend after Binance temporarily suspended BTC withdrawals to its users due to heavy network congestionmainly caused by a disproportionate increase in transactions on the Ordinals protocol.

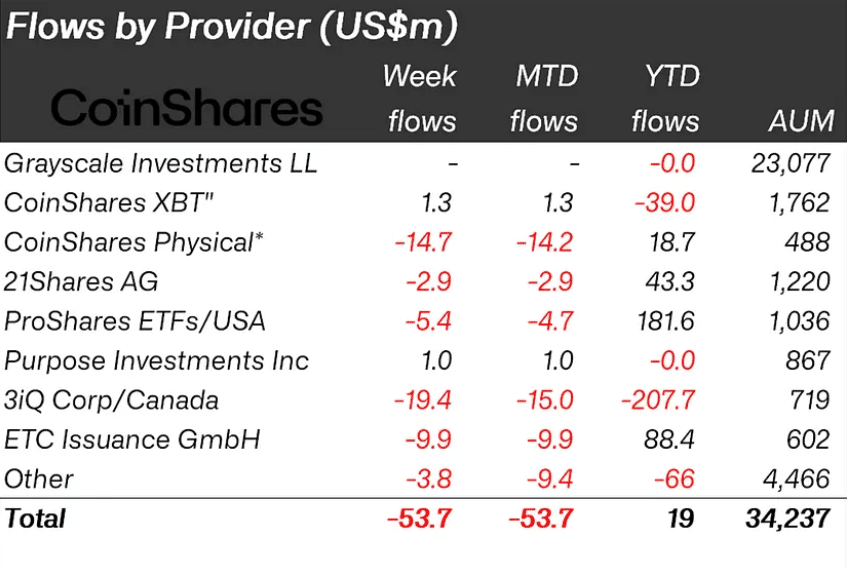

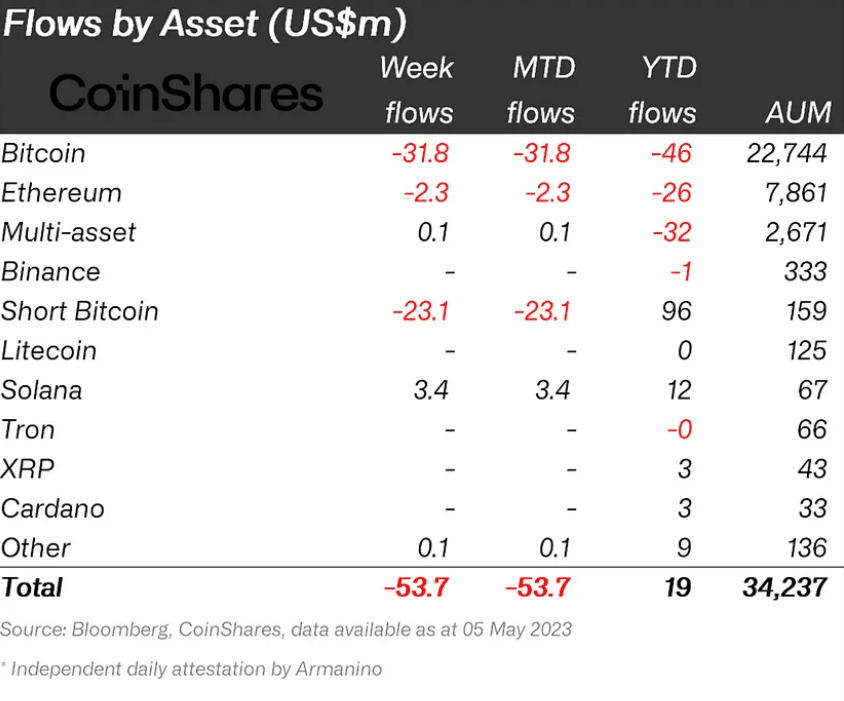

Meanwhile, digital asset investment products saw outflows of $53.7 millionwhich marks the third consecutive week of negative sentiment for this type of asset.

But if we look at the data since the beginning of the year, we see that the values are still positive with $19 million in an overall picture where “Proshares ETFs/USA” and “ETC Issuance GmbH” lead the way with market flows of $181.6 million and $88.4 million respectively

The worst performer appears to be 3iQ Corp/Canada, with weekly outflows of $19.4 million and YTD outflows of $207.7 million.

In total, the assets under management in these investment funds are USD 34.23 billion, while trading volumes are 16% higher than at the start of the year.

Looking in more detail, bitcoin was once again the most targeted asset of investors in this type of regulated product, with outflows of $31.8 million last week and a total of $46 million since the beginning of the year.

In this context, Bitcoin accounts for $22.74 billion or 66% of all money invested in the asset class.

Although the outlook does not look the best at first glance, sentiment in the US has turned positive with inflows of $18 million and the largest outflow in history for “card-Bitcoinproducts of 23.1 million dollars.

In other words, investors are liquidating their bets on future drops in the price of BTC.

Ethereum, the second largest cryptocurrency by market capitalization for the week, saw less payments of $2.3 million of a total of $7.86 billion managed by savings funds.

The only altcoin that saw positive flows was Solana with $3.4 million, but this was an insignificant amount.

How to Analyze Crypto Market Sentiment

The price of bitcoin moves according to several conflicting variables and logics, one of which is undoubtedly market sentiment.

There are several ways to analyze the sentiment of the crypto market apart from monitoring the cash flows of digital asset investment products managed by providers listed on traditional markets.

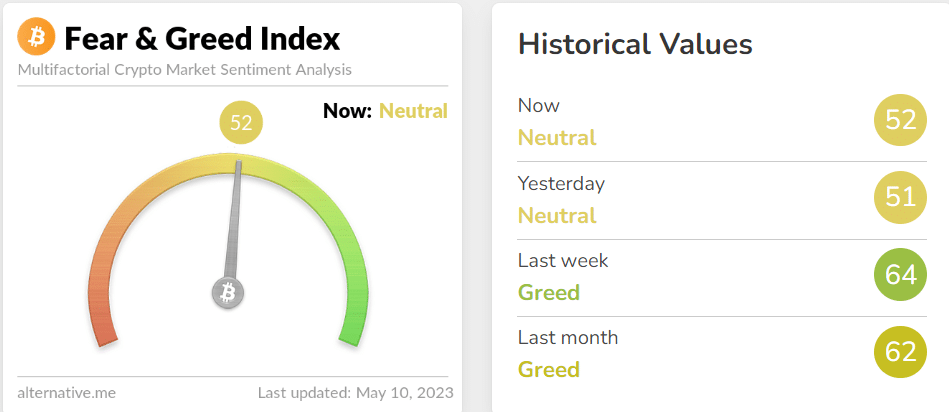

First, if you want to get in touch with investors’ short-term sentiment, you can take a look at the “Fear and Greed Index”, which shows investors’ confidence in the crypto market on a scale of 0 to 100.

Extremely high levels are usually a good time to sell and take profits, while fear in the sector, with the index in the red, can be an opportunity to buy at a discount.

The situation seems neutral at the momentin line with the analysis in the previous section,

It is important to remember that this type of indicator has a 24-hour delay.

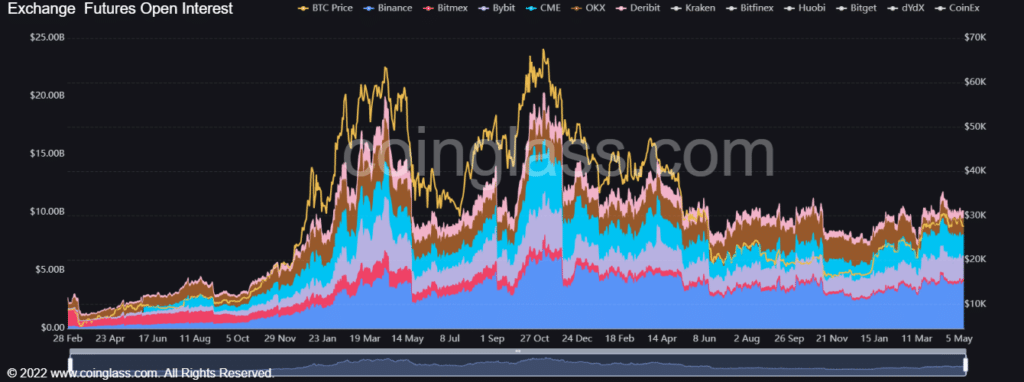

Another way to analyze market sentiment is to watch changes in open interest in the futures markets by relating this data to the price of bitcoin.

Open interest represents the number of derivative contracts that have not yet been closedgiven by the sum of the long and short open positions at a given time: this data is extremely important because it helps us understand the interest of financial traders in remaining in the market rather than choosing other investment locations.

The main futures brokers are Binance, Bybit, OKX, CME, Deribit and Bitmex.

Currently, the total open interest on all exchanges is at 10 billion dollarsabout. 30% higher than at the beginning of the year, but approx. 15% lower than in mid-April.

If total open interest were to exceed $15 billion, we would have another reason to be bullish about the immediate future of this market.

The last way, perhaps the most spartan, but also the most effective way to understand market sentiment for bitcoin and other cryptocurrencies is to observe the reaction of investors on Twitter in relation to market price movements.

By first doing the work of selecting the most crypto-friendly profiles and having a follower base of at least 20,000, it is possible to understand in real time what investors are thinking.

Usually the markets move in the opposite direction to the expectations of the masses, so by spending time analyzing tweets and comments, we can easily understand which scenarios are preferred by the Twitter audience and make them choose the exact opposite direction.

Technical analysis of the price of bitcoin

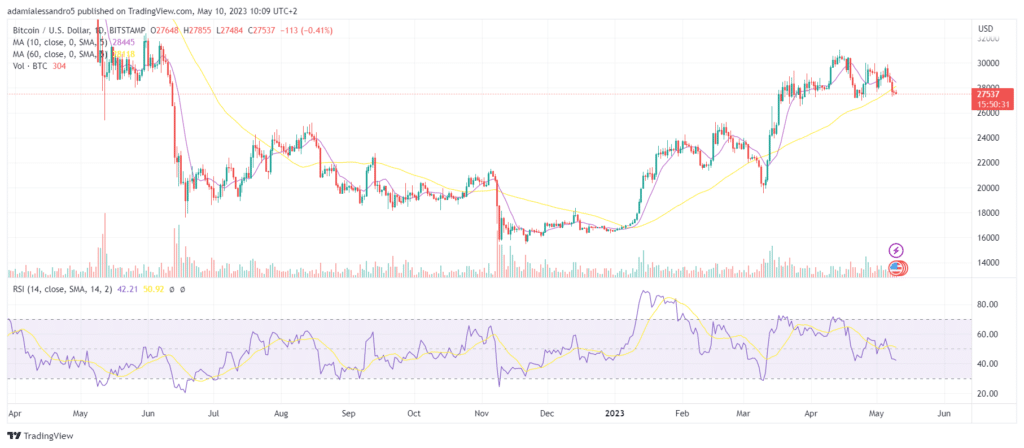

Bitcoin is currently trading at $27,537 with a market cap of $533 billion and a volume of $13.4 billion in the last 24 hours.

The situation on the technical analysis front is at a point maximum indecisionwhich is reflected in the trader sentiment analysis, which is caught between bullish and bearish views.

In the daily time frame, prices have fallen below the 60-period moving average, which marks fifth daily candle in a row in red (not completed yet).

If there is a drop below the $27,000 support level, we could see a sharp decline, at least to $24,000 in the short term.

This is the most likely hypothesis at the moment, granted bearish divergence which has formed on the Relative Strength Index (RSI).

Volumes are still low and there are no signs of a recovery that would contradict the bearish continuation theory in the near term.

Furthermore, after the rally in the crypto market in Q1 2023, it seems logical to see a situation where traders take profits on their still open positions.

On larger time frames (weekly and monthly), the situation does not look so serious and the bull/bear conflicts can resolve themselves in a period of stability and laterality in BTC prices.

While we wait for the next macroeconomic data on US inflation and see how the problem with the Bitcoin mempool is clogged of BRC-20 token transactions will be resolved, the best choice to make right now is probably to be patient and wait for next BTC price movements.

A small curiosity at the end of the article: the Ethereum Foundation has started to sell some ETH: every time this has happened in previous years, this event has marked a small spike in crypto market prices.

Be careful traders!