Tags in this story

Attacks, Backlog, Bitcoin, Bitcoin Miners, Blockchain, Cryptocurrency, DDoS, Financial Technology, Lightning Network, Mempool, Network Congestion, Transaction Fees, Unconfirmed Transactions

all about cryptop referances

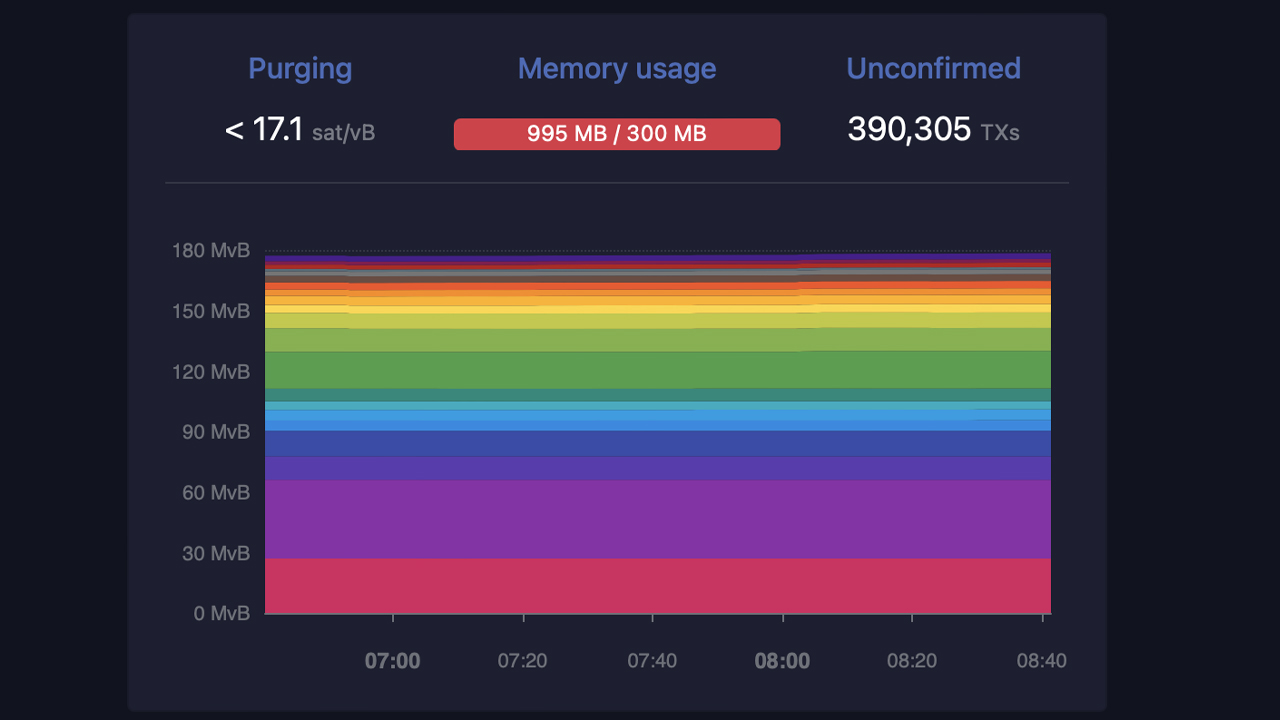

In just under two weeks, the number of unconfirmed transactions on the Bitcoin network has skyrocketed from 134,000 to over 390,000, causing a bottleneck in the mempool. This increase in unconfirmed transactions has resulted in a staggering 343% increase in transaction fees, which have risen from $1.99 per transaction on April 26th to a current rate of $8.82 per transaction as of May 7th. Bitcoin miners are struggling to keep up with demand, leaving many users frustrated and unable to complete their transactions on time.

As of Sunday, May 7, 2023, the Bitcoin network is experiencing a major traffic jam due to an overwhelming number of unconfirmed transactions. The latest statistics reveal that as many as 390,000 transfers are currently stuck in limbo awaiting confirmation.

This lag can be attributed to the increase in minting and transfer of Ordinal Inscriptions and BRC20 tokens, which have flooded the network. In fact, the Bitcoin blockchain now hosts over 13,000 BRC20 tokens and a staggering 4.17 million Ordinal inscriptions, further exacerbating the congestion.

To clear the current backlog, a total of 179 blocks must be mined. Given the average block time of 10 minutes, it will take approximately 1.24 days to mine the required number of blocks. This backlog has caused transaction fees to skyrocket by a whopping 343% in the past 11 days. According to bitinfocharts.com data, the average transaction fee is currently 0.00031 BTC or $8.82 per transfer.

Bitinfocharts.com further shows that the median Bitcoin transaction fee size is currently 0.00018 BTC or $5.16 per transfer. However, the situation is far from ideal, according to mempool.space. The website reveals that a low priority fee will set you back $7.74, while a medium priority fee costs $7.90.

For those who need their transactions processed quickly, a high priority fee of $7.99 per transfer. Adding to the frustration is that the current block time is longer than the average of ten minutes, with the last block taking a whopping ten minutes and 55 seconds to be discovered.

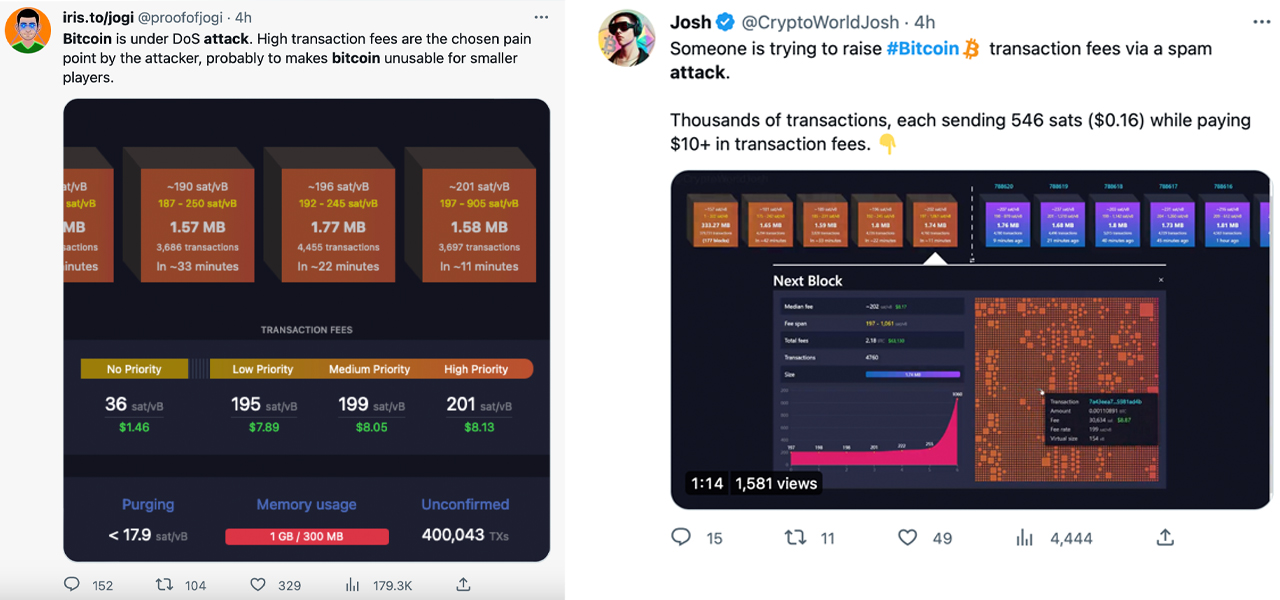

The tight mempool has been one hot topic on social media lately, with users voicing a range of opinions on the matter. While some are excited about the increase in activity, others have labeled the increase in non-financial transactions as a DDoS or an attack.

Bitcoin is not under attack.

The anemic block size increases simply weren’t sufficient to meet demand, and Lightning didn’t see mass adoption.

Stop whining. Either accept that a large mempool and high fees will be the norm, or increase the block size properly.

— Sam Patt (@SamuelPatt) 7 May 2023

Despite the optimism of some, the increase in unconfirmed transactions has not led to a significant increase in Lightning Network adoption. This is because it still is expensive to open and close a channel, and non-custodial solutions are few and far between.

At exactly 11:07 AM (ET), the largest crypto exchange in the world by trading volume temporarily halted bitcoin (BTC) withdrawals. The exchange has attributed this decision to a “congestion problem” that the Bitcoin network is currently struggling with.

“Our team is currently working on a solution until the network is stabilized and will reopen BTC withdrawals as soon as possible. Rest assured, the funds are SAFU,” Binance wrote on Sunday morning.

What are your thoughts on the current state of the Bitcoin network? Do you think the increase in unverified transactions and fees is a temporary setback or a sign of deeper problems? Share your opinions in the comments section below.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is directly or indirectly responsible for damages or losses caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.