Asia Pacific estimated to be the largest fintech market by 2030: Report

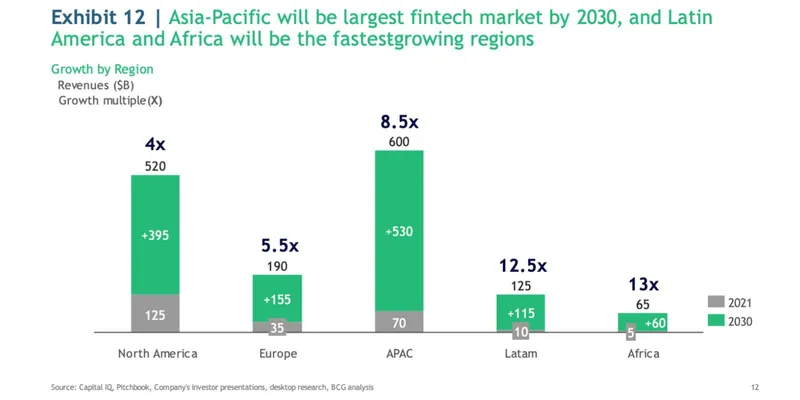

Asia-Pacific (APAC) is likely to surpass the US to become the world’s top fintech market by 2030, with a projected compound annual growth rate (CAGR) of 27%, according to a report by Boston Consulting Group (BCG) and QED Investors.

The report entitled, Global Fintech 2023: Reimagining the Future of Finance, said most of the growth is expected to come from emerging APAC regions, including China, India and Indonesia, compared to developed ones such as Japan and South Korea, as they have the largest fintechs, vast underbanked populations, a high number of SMEs, and a rising tech-savvy youth and middle class.

The report spotlighted India’s fintech sector and said the country has the opportunity to skip the intermediate stages of fintech development that more developed financial markets have undergone, especially if it can benefit from supportive regulation.

“The Indian regulator is taking an active role in shaping the market through vehicles such as UPI, Aadhar, Rupay and Digilocker,” the report added.

More than 1.3 billion Indians are enrolled in Aadhar – the largest biometric identity system in the world – while UPI processed $1.25 trillion in transactions in FY21-2022, and continues to grow rapidly.

It suggested that the sector’s growth will require regulators worldwide to act with urgency and consideration more holistically.

“At the moment, regulators often ‘react’ only to the latest difficulty. The recent series of banking crises (eg SVB and Crédit Suisse), together with massive financial frauds (eg Wirecard and FTX), have made regulators more sensitive for asset/liability management But while creating guardrails, they must also be careful not to over-regulate the industry and stifle innovation, it said.

Expanding GDP (a CAGR of 7% per annum), the rise of the educated middle class, younger demographics coming of age and increasing fintech penetration will drive fintech revenues in India, the report added.

“Distribution businesses such as neobanks and lending platforms will face challenges in the developed world while playing a critical role in emerging markets,” it said, adding that additional growth areas are lending, neobanking and wealth technology segments.

Global forecasts, B2B2X and B2b the next hotspots

The report said it expects global fintech revenue to grow 6X from $245 billion to $1.5 trillion by 2030.

The fintech sector, which accounts for 2% of the $12.5 trillion in global financial services revenue, is projected to grow up to 7%, of which bank fintechs will account for nearly 25% of all bank valuations worldwide by 2030.

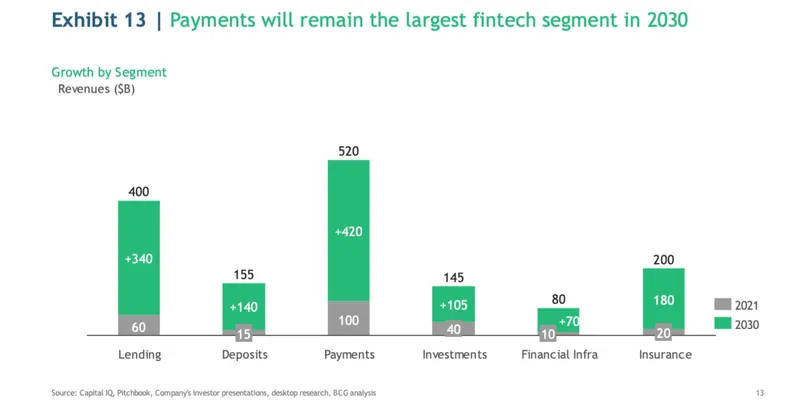

After payments, B2B2X and B2b (serving small businesses) will lead the next leg of the fintech journey, according to the report.

B2B2X consists of B2B2C (enabling other players to serve consumers), B2B2B (enabling other players to serve businesses), and financial infrastructure players. Growth will be supported by embedded finance and financial infrastructure, while the B2b fintech market will be led by providing solutions to credit-starved and underserved small businesses.

In addition, the impact of new emerging technologies such as generative AI, API-based open connectivity, DLT,

quantum and edge computing, and embedded hardware Internet of Things (IoT) and biometrics, it is not yet clear to enter the fintech arena.

Word of caution for fintechs

The report advised fintechs to strengthen their competitiveness and pursue aggressive strategies, including talent acquisition, gaining market share by entering new geographies/markets, and exploring M&A opportunities, while taking an active role in shaping and embracing forward-looking regulations such as increases customer confidence. and drive higher valuations.

“Venture capital firms must also help their portfolio companies tighten their belts and become more professional and pursue long-term competitive moats over short-term vitality. It is important for them to help and encourage their portfolio companies to be proactive and play offense, it said.