ARKF: Is the Cathie Woods FinTech ETF set to soar? (NYSEARCA:ARKF)

Marco Bello

Investment thesis

SHEET Fintech Innovation ETF (NYSEARCA:ARKF) is for investors seeking exposure to companies involved in transaction innovations, blockchain technology, risk transformation, frictionless financing platforms, customer-facing platforms and new intermediaries. These areas, described on ARKFs fund page, are exciting opportunities, and in its four-year history, ARKF has proven capable of both large returns and losses. The ETF is actively managed by Cathie Wood and her team at ARK Investment Management, has an expense ratio of 0.75% and manages $775 million in assets.

I previously concluded suggests that ARKF is unlikely to outperform broad-based growth ETFs if held for more than one year, as they primarily select low- or non-profitable companies. That perspective has remained the same. However, there is a short-term opportunity today due to positive Wall Street sentiment for these unique companies. Using Seeking Alpha Factor Grades as my guide, ARKF is now an anomaly too the right reasons, and it’s a hedge fund worth holding onto through the upcoming earnings season. I look forward to discussing why in more detail below.

ARKF Overview

Strategy discussion and top inventory

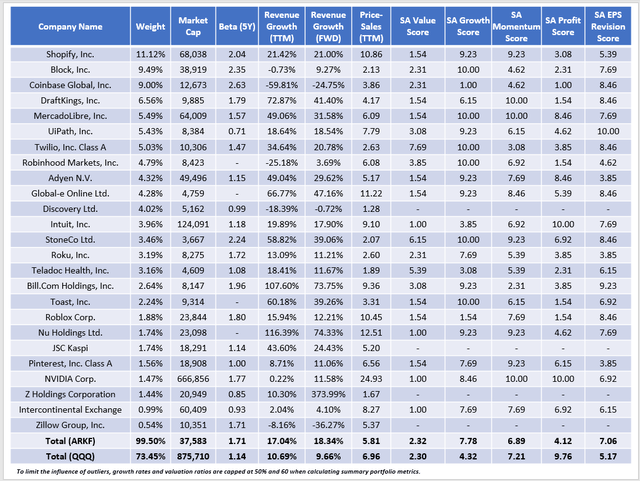

ARKF usually has 35-55 companies at a time, but it is more concentrated than usual today, with only 27. Shopify (SHOP), Blocks (SQ), and Coinbase Global (COIN) a total of 30% of the portfolio. With few exceptions, these companies have a low profitability score. To illustrate, only five companies (16% of the weight) have an “A-” or better Seeking Alpha Profitability Grade. Therefore, it is primarily speculative.

Ark Invest

ARK Performance History

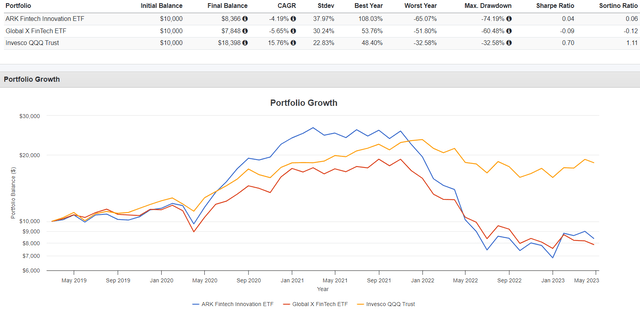

ARKF fell 4.19% year-on-year since February 2019, slightly outperforming the Global X FinTech Thematic ETF (FINX) but is significantly behind the Invesco QQQ ETF (QQQ). I used a logarithmic scale to highlight the significant fluctuations better. QQQ was more steady, while ARKF experienced a meteoric rise after the pandemic, only to crash a year later. As a result, risk-adjusted returns (Sharpe and Sortino Ratios) disappoint.

Portfolio visualization

ARKF analysis: Strong earnings momentum

In August 2022, I recommended readers avoid ARKF. Its track record was one reason, but ARKF also had poor Seeking Alpha Factor scores. These grades, which I have normalized and weighted on a ten-point scale, were as follows:

- Value score: 2.82/10

- Growth score: 5.61/10

- Momentum Score: 4.08/10

- Profitability score: 4.79/10

- EPS audit score: 4.37/10

- Quant Score: 4.97/10

Here are the latest results as of 25 April 2023:

- Value score: 2.32/10

- Growth Score: 7.78/10

- Momentum Score: 6.89/10

- Profitability score: 4.12/10

- EPS audit score: 7.06/10

- Quant Score: 6.68/10

All scores improved except for value and profitability, which are less of a concern when market sentiment is positive. A key contributor to ARKF’s higher Quant score is its estimated one-year sales growth of 18.34%, an impressive figure nearly double that of the Invesco QQQ ETF growth rate. Here’s how the two ETFs compare in other metrics.

The Sunday Investor

ARKF has smaller companies with high growth potential, as indicated by its weighted average market capitalization of $38 billion. ARKF’s 1.71 five-year beta illustrates its high volatility, and the ETF trades at a relatively cheap 5.81x trailing sales, down from 7.04x in August 2022. Unfortunately, I was unable to calculate other valuations because approximately 75% of the fund’s weighted holdings reported net income losses the last year.

ARKF’s 7.06/10 EPS audit score is what I want to highlight the most. QQQ’s 5.17/10 is close to what other diversified growth ETFs enjoy IWY and SCHG offer. Even leading small-cap growth ETFs like it VBK score around 5.50/10, so Wall Street clearly favors these more speculative stocks. Some of the key changes since August 2022 include:

- Coinbase Global (COIN): F to A-

- Global-e Online (GLBE): F to A-

- StoneCo (STNE): C- to A-

- Roblox (RBLX): C to A-

All have led ARKF year-to-date as well, with Coinbase standing out with a return of 66.83% versus ARKF’s 22.87%.

Seeking Alpha

Many other constituents also did well. However, the weakest performers still have relatively poor EPS audit grades. They include Robinhood Markets (HOOD), Adyen (OTCPK:ADYEY), Pinterest (PINS), and JD.com (JD). Roku ( ROKU ) is the exception and is up 42% YTD.

Seeking Alpha

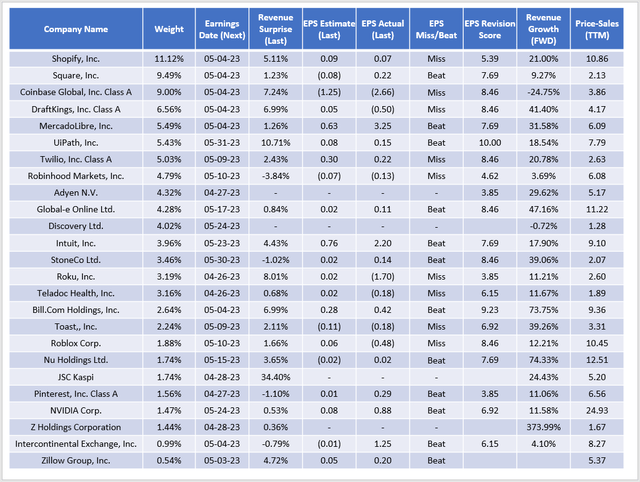

The following table is a result guide for ARKF. It includes each company’s earnings date, performance relative to consensus estimates last quarter and consensus estimate for Q1 2023. About three-quarters of the holdings will report by mid-May.

The Sunday Investor

Almost all components beat consensus sales estimates last quarter, but were mixed in earnings per share. For example, Shopify missed $0.02 on a $0.09 estimate. However, sales were up 25% quarter-on-quarter, and management expects growth in the high-teens with improved gross margins, according to Seeking Alpha’s results summary. Block topped EPS expectations by $0.22. Cathie Wood bought the dip last month when shares fell 15%. Like it or not, she and other active managers are being paid to do it. Rule-based ETFs cannot take advantage of these opportunities, and without a doubt, an active manager with highly volatile stocks is required.

Again, Wood’s track record isn’t great, but she’s hit it big a few times before. ARKF outperformed the QQQ by 28% from May 2020 to July 2020 and 14% from December 2020 to February 2021. Not coincidentally, overall S&P 500 earnings surprises hit record highs during this period. So far this quarter, the overall earnings surprise is 8%, with a third of companies reporting, the best start in about a year.

Yardeni Research

This chart is another reason why I am optimistic despite frequent discussions of recession. The Estrella and Mishkin model calculates one-year recession odds at 57% with short- and long-term US government interest rates as input. There is something to consider, but there could be one more bull market. A small and speculative position in ARKF is one way to take advantage.

Investment recommendation

I do not own ARKF and do not intend to buy it. However, ETFs like ARKF are useful to me because they can serve as a proxy for market sentiment. ARKF is up 23% YTD, and on review, that’s justified because Wall Street analysts have been raising earnings estimates faster than traditional growth ETFs like QQQ. Furthermore, preliminary surprise figures from Yardeni Research are positive. Declining market sentiment was why i recommended investors are avoiding QQQ last year and it’s exciting to finally see some good news again after a bad year.

Three-quarters of ARKF’s constituents report earnings over the next few weeks, and current shareholders should hang on until earnings season is over. Refrain from betting the farm on this unproven strategy, but the short-term benefits outweigh the risks. Nevertheless, I encourage readers to take a long-term view of growth investments. Use the time horizon to your advantage and accept the evidence that holding high-quality stocks is more rewarding. Thanks for reading and I look forward to the comments section below.