FTX sells crypto service LedgerX for $50 million

FTX’s new administration, tasked with handling the bankruptcy proceedings of the now defunct crypto exchange, is doing its job well, this time through the sale of the LedgerX service.

Announcement has been made of the sale of LedgerX, a crypto provider of futures and options, to an affiliate of Miami International Holdings for $50 million, thereby increasing the pool of liquid assets that sooner or later must be returned to debtors.

FTX and the sale of the LedgerX crypto service for $50 million.

FTX and its affiliated debtors announced today that an agreement has been completed with i M7 Holdings, LLC, a subsidiary of Miami International Holdings, Inc. (“MIH”), to sell LedgerX LLCFTX’s crypto futures and options exchange and clearing unit.

The sale of LedgerX, not to be confused with hardware wallet manufacturing company Ledger, came as part of the process of liquidating FTX’s assets under the District of Delaware’s “Chapter 11”.

With this move, FTX’s new bankruptcy management will have an addition $50 million in liquid assetswhich it can use to repay the exchange’s debtors or initiate future strategic actions.

Current CEO and Chief Restructuring Officer of FTX Debtors, John J. Ray III said:

“We are pleased to reach this agreement with MIH, which exemplifies our continued efforts to monetize assets to deliver recoveries to stakeholders.”

In January, a bankruptcy court had approved the sale of LedgerX and other FTX assets after passing a series of bureaucratic hurdles.

About 117 parties at that time had indicated a willingness to acquire the assets earmarked for auction, such as Embed, LedgerX, FTX Japan and FTX Europe.

However, the sale of LedgerX to M7 Holding, a family-owned private equity investment firm based in Akron, Ohio, will first have to go through a sales hearing to approve the transactionwhich is set for 4 May 2023.

For more details and access to documents related to the legal proceedings, including a copy of the agreement for the sale of LedgerX by FTX, please visit the website.

FTX and the possibility of reviving the crypto exchange after the sale of LedgerX

After the sale of LedgerX for $50 million to M7 Holding, the chances of a future reboot of the FTX crypto exchange are increasing.

On April 12, lawyers Sullivan & Cromwell, representing FTX, said that the bankrupt company had recovered approx. $7.3 billion in liquid assets.

As of November 2022 alone, the sum amounted to 4.8 billion dollars: this means that during approx. 6 months, $2.5 billion has been recovered, which must be added to the new $50 million from the sale of options and the futures trading service.

According to FTX’s legal team, it can be considered to restart the crypto Exchangeits business in the second quarter of 2024, if there are no losses and the new administration is able to find new liquid funds to distribute to associated debtors.

Although FTX has lost all the respect and credibility it enjoyed before the bankruptcy of Sam Bankman Fried’s company, the idea of relaunching the exchange may prove to be an apt move in an attempt to recover assets and pay off current debts.

It is actually worth reminding that FTX still owes approx 8 billion dollars in compensation to users who lost their capital during the collapse of the ecosystem, 3 of which belong to the top 50 creditors.

Who knows if, in case the exchange restarts, the former CEO of FTX, and a convicted criminal, will use that service to trade cryptocurrencies.

Nevertheless, after he was released 250 million dollars bail in December 2022, Sam Bankman Fried will not be able to execute trades over 1000 dollars on the financial markets.

All providers of options and futures trading in the crypto market

LedgerX, the company sold by FTX, represents one options and futures exchange mainly dedicated to professional parties in crypto trading.

In the cryptocurrency market, there are a number of services that provide the opportunity to carry out trades through derivative instruments and with an interface adapted to professional needs.

In recent years, this type of service has spread like wildfire, highlighting a high demand from experienced users in the world of crypto markets.

The landscape of trading service providers that includes tools such as options and leveraged trading includes both centralized platforms, such as LedgerX, and decentralized applications that act as trustless exchanges.

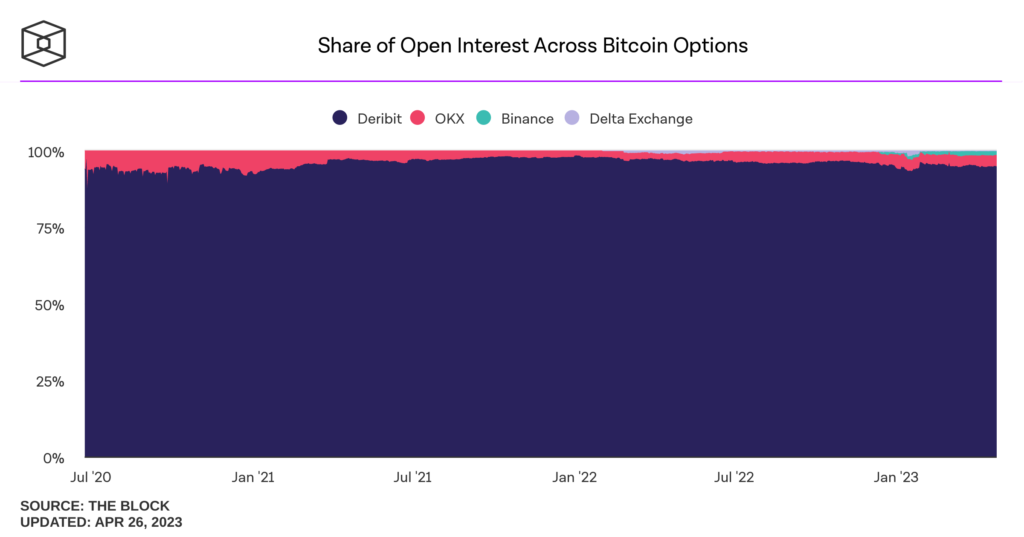

Centralized services such as force their clients to provide personal data through identity verifications such as KYC include names such as Deribit,, Bybit, Binance and Delta Finance.

In terms of the options market alone, the most prominent player is Deribit, which includes almost all open interest in Bitcoin and Ethereum.

Outside of crypto exchanges, there are platforms such as CME Group that provide the opportunity for professional exposure to the crypto market.

On the other hand, when it comes to options and futures trading DEX, there are several applications that work in one decentralized waywithout requiring names and information about the users who use them.

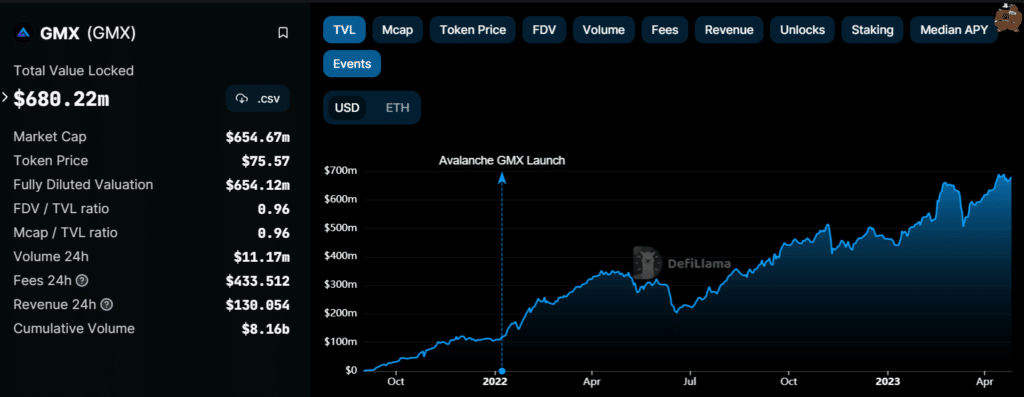

The number of decentralized platforms that include these services Expanding and new services will probably appear in the coming years, although there are already realities widely used by the crypto community such as Dydx, Dopex, Lyra, Hegic, GMX, Vela Exchange, Synthetix and Ribbon Finance.