Uncover the real financial villains

The world of finance is no stranger to controversy and scandal, but recent headlines have cast a harsh light on the underside of the crypto realm. As stories of hacks and carpet pulling grab the attention of the masses, it’s easy to overlook the misdeeds of more established financial players.

Here we take a closer look at the corruption of legacy banks and compare them to the trials of the crypto industry. Too often critics of crypto ignore equally serious flaws in conventional institutions.

Shifts the spotlight

In recent times, the financial world has witnessed various cyber breaches and thefts, with cryptocurrencies often in the spotlight. However, a deeper dive into the problem reveals that traditional banks, such as Wells Fargo, deserve some blame.

In particular, Wells Fargo has received a staggering $7 billion in fines since 2020, while the crypto sector has lost $6.45 billion to hacks and fraud. One could argue that the comparison between a single bank and the entire crypto sector is unfair. Consider, however, that Wells Fargo is a prime example of the failures of the old banking system, and its mismanagement reflects a broader trend in the industry.

Meanwhile, other legacy banks such as JPMorgan Chase, Citibank, Goldman Sachs and Deutsche Bank have also faced hefty fines. These banks, and others, were either convicted or settled on a variety of charges. These include money laundering, wire fraud and selling toxic securities to defraud investors.

Malfeasance at Legacy Banks

The fines imposed on Wells Fargo cover a wide range of issues, including whistleblower retaliation, discrimination, consumer protection violations, fraud and AML violations. This suggests that the problems in legacy financial institutions are deep-rooted and not limited to cryptocurrencies.

For example, in 2016, Wells Fargo faced a $185 million fine for opening over 1.5 million unauthorized bank accounts and issuing over 500,000 unauthorized credit cards. JPMorgan Chase, another leading bank, faced a penalty of $920 million in 2020 for manipulating the precious metals and financial markets.

A story of illegality

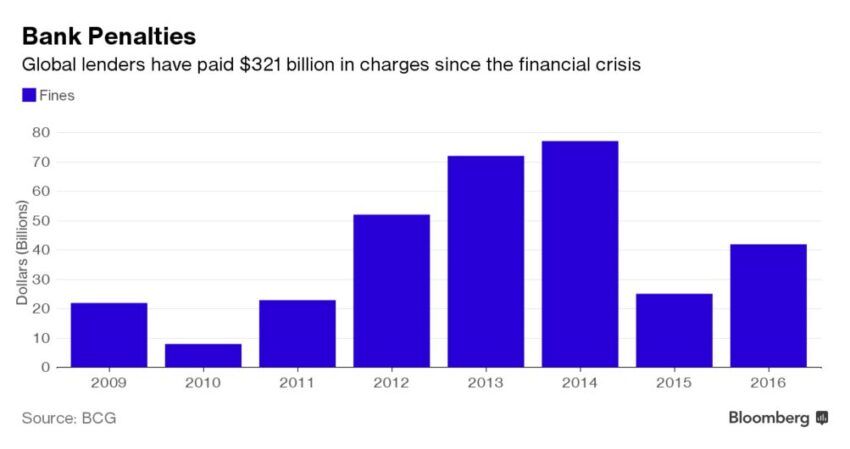

While cryptocurrencies have come in for intense scrutiny, the world’s largest banks have quietly collected staggering fines for their misconduct.

Bank of America, the largest of the bunch, has faced 214 fines, totaling $82.7 billion. Some notable cases include a $16.65 billion settlement in 2014 for misleading investors about the quality of mortgage-backed securities, and a $11.8 billion settlement in 2012 for abusive coercive practices. JPMorgan Chase, another US banking giant, has incurred 158 fines, amounting to $35.7 billion.

In 2020, the bank was fined $920 million for manipulating the precious metals and treasury markets. Another $13 billion fine came in 2013 for misleading investors during the housing crisis.

Wait, there’s more

- Citigroup has faced 122 fines, with a total value of $25.4 billion. These include a $7 billion settlement in 2014 for misrepresenting the quality of mortgage-backed securities, and a $1.25 billion fine in 2015 for its role in manipulating the foreign exchange market.

- As previously mentioned, Wells Fargo has accumulated 181 fines worth $21.3 billion. Notorious examples include the $185 million fine in 2016 for opening unauthorized bank accounts, and a penalty of more than $2 billion in 2018 for issuing mortgages containing incorrect income information.

- Deutsche Bank, Germany’s largest bank, has incurred 59 fines totaling $18.1 billion. The bank was fined $7.2 billion in 2017 for its role in the US mortgage crisis and a fine of $2.5 billion in 2015 for its involvement in the manipulation of the LIBOR benchmark rate. Deutsche Bank has also paid fines in relation to fraud and money laundering.

- The Swiss bank UBS has faced 83 fines, amounting to 16.7 billion dollars. Some notable cases include a $1.5 billion fine in 2012 for manipulating LIBOR and a $5.1 billion fine in 2015 for misleading investors on mortgage-backed securities.

- In the end, Goldman Sachs has drawn 44 fines, a total of 16.3 billion dollars. Notable examples include a $5.1 billion settlement in 2016 for the sale of toxic mortgage-backed securities and a $2.9 billion fine in 2020 for involvement in the 1MDB scandal. The US Department of Justice charged Goldman Sachs with conspiracy, wire fraud, bribery and witness tampering.

Staggering figures reveal massive illegality in major banks, showing fraudulent behavior in the financial sector. Despite crypto criticism, regulated giants are not infallible and cause greater economic damage.

Separate fact from fiction

While cryptocurrencies have been associated with hacks and other illegal activities, it is important to separate reality from hype. Many hacks in the crypto space are the result of poor security measures by individual users or exchanges. Rather than inherent vulnerabilities in the technology itself.

- In addition, the decentralized nature of cryptocurrencies offers greater transparency and accountability. Makes it easier to trace and recover stolen funds in some cases.

- Banks provide false security with low returns and fractions. People are now seeing the risks and benefits of managing finances with digital currencies.

- The global financial crisis of 2008 exposed banking vulnerabilities and mistrust. Bitcoin emerged and emerged in 2009, a decentralized currency outside of central banks and governments.

Despite the negative sentiment surrounding cryptocurrencies, the corrupt global legacy financial system – supported by governments and central banks – is the real culprit. These entities have caused more economic upheaval, death, destruction and limited personal freedom than the entire crypto sector combined. Why? Because they have more power than most governments.

Given the mounting evidence against traditional banks, it is imperative for society to reassess its trust in these establishments. This involves recognizing the potential benefits of digital currencies. As well as understanding the risks and benefits of this new financial technology.

Embracing digital currencies

Embracing this new technology can help people regain financial control and escape the confines of legacy banks.

Cryptocurrencies offer the advantage of disintermediate transactions, enabling faster, cost-effective transfers. This benefits money transfers, as people can send money globally with minimal fees and without traditional banking delays.

Another benefit is the potential for financial inclusion, as cryptocurrencies can provide access to financial services for the unbanked. With a smartphone and an internet connection, anyone can participate in the global economy. Regardless of location or credit history.

While cryptocurrencies offer many advantages, it is important to strike a balance between innovation and regulation. Regulations must be designed to protect consumers and prevent illegal activities. Such as money laundering and terrorist financing. But without stifling the growth and use of digital currencies.

Some countries, such as Switzerland and Singapore, have already taken steps to build a supportive environment for cryptocurrency businesses. Promote innovation while ensuring consumer protection and financial stability.

A new era of openness and inclusion

Cryptocurrencies face negative sentiment. But legacy financial institutions deserve more scrutiny than they have received. Backed by governments and central banks, these organizations have done far more damage to the global economy than cryptocurrencies.

Adopting digital currencies enables a fairer, more transparent financial system, free of previous restrictions. The technology’s potential benefits, such as greater financial inclusion and lower transaction costs, can outweigh the risks, with responsible management.

As we move forward, a balance between innovation and regulation will be critical to shaping the future of finance. By fostering an environment that encourages the responsible use of digital currencies, we can pave the way for a more inclusive and transparent global financial system.

Disclaimer

In accordance with Trust Project guidelines, this feature article presents the opinions and perspectives of industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect the views of BeInCrypto or its employees. Readers should verify information independently and consult with a professional before making decisions based on this content.