Bitcoin value transfers over physical gold is a crucial use case

This week, an air cargo container containing an estimated $15 million in gold and valuables disappeared from Toronto’s Pearson International Airport. Could they have transferred this value with “digital gold” or Bitcoin instead?

According to reports, the theft of $15 million cannot be blamed on anyone yet. In particular, high value crime occurred after unloading the aircraft and transferring the cargo to a storage facility.

Stephen Duivesteyn of Peel Regional Police informed CNN that the high-value container was illegally removed.

Meanwhile, it is unclear whether this was the work of professional thieves or an inside job. Regardless, it begs the question: Is there an easier and more secure way to send value around the world? Many proponents of Bitcoin will tell you that there is a simple answer to that question.

High value Bitcoin transactions

In 2020, a user paid a fee of just $0.26 to move nearly 107,000 Bitcoins worth $670 million at the time. The transaction costs and logistics of trying to make a transfer of this size through a bank would surely frustrate some.

A mysterious crypto wallet also transferred nearly $1 billion in Bitcoin to an anonymous wallet in 2021.

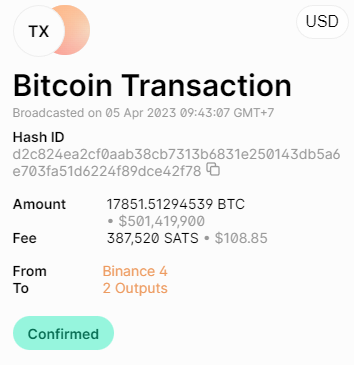

This month, a $500 million transaction took place on the Bitcoin blockchain, with the sender paying just over $100 in fees.

In 2023, the debate is still ongoing as to whether Bitcoin can one day overtake the market value of physical gold.

Will Bitcoin Ever Overtake Gold?

The amount of Bitcoin is limited to 21 million. Meanwhile, gold is a natural resource with no such limitations.

However, Bitcoin’s regulatory ambiguity could affect its future value. BTC’s market cap today has topped $540 billion. By comparison, the estimated market value of gold is $13 trillion.

However, the advantages outweigh the disadvantages. Bitcoin transfers are faster because they don’t need any physical transfers like gold. With that, there is no need for third parties in these transactions, such as air freight.

In addition, only a professional can determine whether a gold bar is authentic. Or to know if someone replaced it in transit with a lower quality one. On the other hand, verifying Bitcoin only needs a few clicks on a public, verifiable network.

Bitcoin’s use of an energy-intensive proof-of-work consensus mechanism has put the royal coin in a difficult position over the past decade. Critics raise concerns about the carbon footprint despite seamless transfers. A single Bitcoin transaction, according to Digiconomist, emits 475.50 kgCO2, equivalent to the carbon footprint of 1,053,881 Visa transactions.

It should be noted that the calculation methods used by Digiconomist have been highly contested and are misleading, but it does show that Bitcoin has an environmental impact. It is interesting how much more expensive it is to move a cargo plane. According to one estimate, air travel emits 500 grams of carbon dioxide per metric ton of cargo per kilometer. Without a doubt, almost 20-30 times higher than the environmental costs of sea freight.

Disclaimer

In accordance with the guidelines of the Trust Project, BeInCrypto is committed to objective, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content.