The Fed will raise interest rates? How will Crypto react?

The US central bank (Fed) believes that inflation is still at a problematic level. How will the crypto market react if the Fed raises interest rates in May?

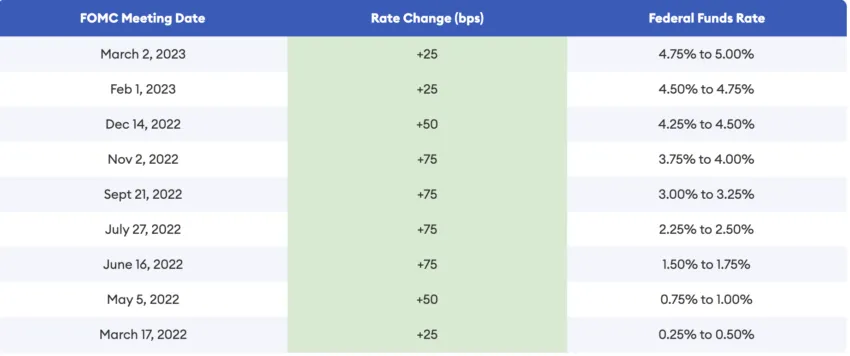

As the upcoming Federal Open Market Committee (FOMC) meeting on May 3 approaches, discussions about the impact on the crypto markets have started again. The Fed raised interest rates by 0.25 basis points (bps) in March. After nine successive aggressive interest rate increases, today’s interest rate is 4.75-5%.

Inflation still too high: Fed Official

While there were some expectations of no increase, a recent statement by John Williams, Federal Reserve Bank of New York president, dashed them. According to the WSJ, he said, “Inflation remains too high and we will use our monetary policy tools to restore price stability.”

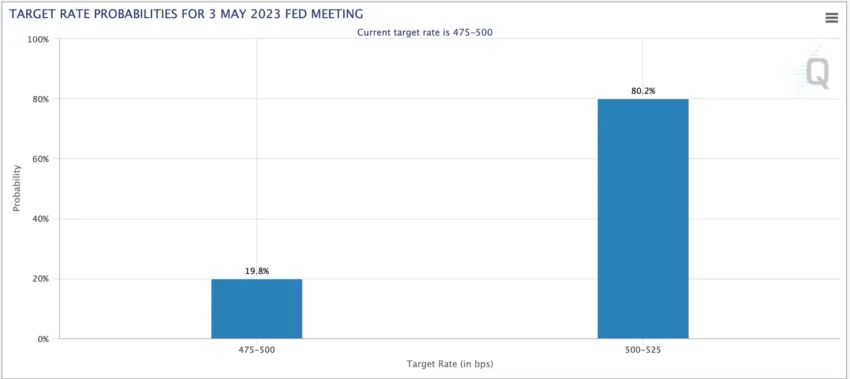

March’s US consumer price index (CPI) came in at 5% year-over-year growth, which is still far short of the Fed’s target of 2%. According to the CME Group, there is an 80.2% probability of an interest rate increase of 25 bps in May.

How would Bitcoin react to interest rate hikes?

Neel Kukreti, a crypto analyst behind the YouTube channel Crypto Jargon, believes that the outcome of a 25 bps increase is unlikely to cause a significant drop in the price of Bitcoin. He told BeInCrypto:

If the result is as expected by the market, there should not be any significant decline in the price of Bitcoin as now, the $28k zone is strong support with $26k as the next support.

So unless there is some significant announcement of a 50bps+ interest rate hike, the price of Bitcoin should more or less stay within these ranges. The worst case scenario for Bitcoin depends on the price at the time of the announcement, as near critical support chances of a ripple effect dump will increase. But even at 50bps I don’t expect BTC to break 20k.

Give the world a chance to catch up

The Fed’s aggressive rate hike to over 4.75% in one year has had serious consequences. While many also blame the recent failure of a number of banks on the Fed’s rapid rate hike.

Claudia Sahm, the former Fed chief, believes the agency should stop raising interest rates and give the world a chance to catch up.

She told Barron’s: “The Fed raised interest rates by 4.75 percentage points in a year — the fastest increase since [former Fed Chair Paul] Volcker raised interest rates in the early 1980s. Powell has been clear that the economy has entered a disinflationary cycle.”

She adds: “Going too fast risks the strong upswing in the labor market. That is not a risk the Fed should take.”

Do you have anything to say about Fed rate hikes or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In accordance with the guidelines of the Trust Project, BeInCrypto is committed to objective, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content.