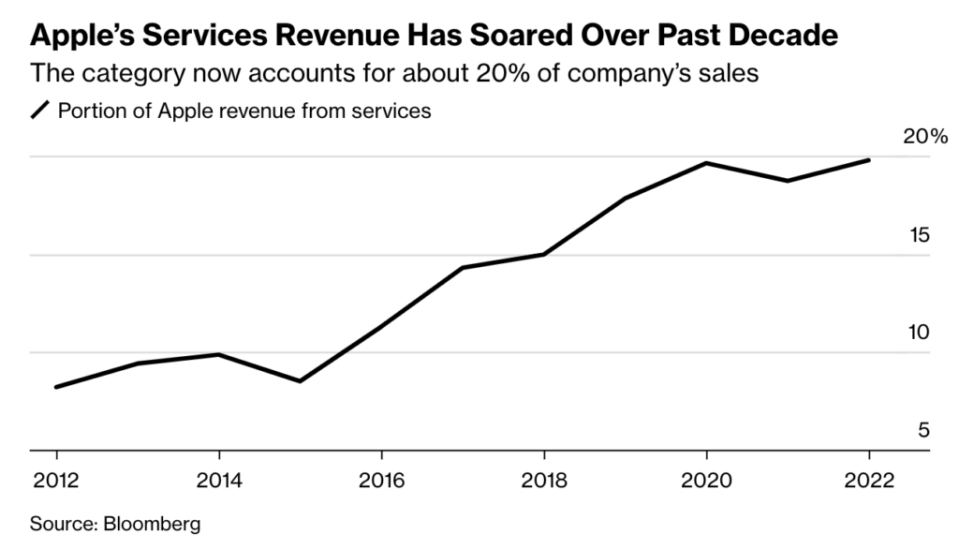

Apple’s services are now 20% of all sales, and that’s before these three big fintech plays in 2023

This post originally appeared on The Basis Point: Apple service revenue reaches 20% of all sales, and that’s before these 3 big fintech plays by 2023

As Apple expands further into fintech with its new savings account, Bloomberg reports that 8.2% of Apple sales came from services in 2012, growing to 19.8% in 2022. The savings account is Apple’s second big fintech move in 2023. Apple Pay Later was the first, and that product will soon expand to a third credit card-like initiative. Here’s a recap and a theory on why Apple is the only Big Tech winning mainstream trust in consumer banking.

– This month, Apple is delving deeper into fintech with their new high-yield savings account that claims to pay interest rates 10 times the average paid by banks right now.

– Apple Savings, powered by Goldman Sachs for US users and limited to deposit limits of $250k per customer, has no fees and no minimum balances.

– All you need to do is set it up in Apple Wallet.

– When Apple shows users their smooth user experience where they can see budgeting, saving and spending, you can imagine how this will grow.

– They already have a practice of showing users this type of UX on spending with Apple Card, and the savings account is a service extension for Apple Card users.

– It will make the Apple Card more sticky even though there is currently apparently no income linked to savings – because there are no fees for consumers.

– Last month, Apple launched Apple Pay Later, which allows people to make purchases as low as $50 and up to $1,000 and then pay in installments.

– This is also apparently an attempt at low income because there is no interest if you pay within the 6 week repayment period.

– It was more of a beautiful Apple user experience that fits millions of phones for people who are already used to paying with Apple Pay.

– I have to say that I have become addicted to the simplicity of Apple Pay and rarely have a wallet or credit card anymore.

– When Apple Pay Later launched, we noticed 3 ways Apple Pay Later would eat into Buy Now, Pay Later competitors.

– In that piece, we asked 2 key questions:

– 1. How is BNPL not a credit card?

– 2. Why wouldn’t Apple Pay Later users with small dollars just use debit or credit if they have to pay back within 6 weeks anyway?

– Bloomberg helps answer those questions, saying that Apple is planning “an expanded version of the Pay Later program called Apple Pay Monthly Installments that can handle larger transactions over longer periods of time — while still charging interest.”

– So a credit card. But Apple style.

– And apparently not run by Goldman Sachs, so Apple’s service revenue will grow even more.

– And perhaps even more importantly: it’s just so simple and cool for consumers.

– Buy now, pay later was always moving towards credit card-like behavior and economics – from consumer users and regulatory expectations. Apple, as they often do, just cleaned up their business model and user experience.

– Last note: I attribute Apple’s success in fintech and consumer banking not just to superior UX. It is also a result of their steadfast commitment to privacy. They are arguably the only Big Tech company that truly respects privacy and this is ALL about gaining trust with people’s money.

___

Referral:

– Apple, Goldman Sachs first savings account with 4.15% annual return

@byline

DO YOU LIKE MONEY? GET MORE ON THE BASICS®

Google’s CEO says the “Don’t Be Evil” mantra is “more nuanced” now with AI

Key stats and quotes from 1Q23 Wells Fargo, JP Morgan, Citigroup earnings

Musk’s AI company certainly won’t threaten humanity and fuel political misinformation, right?