What is the difference between a Litecoin halving and a Bitcoin halving?

Litecoin, often called “the silver to Bitcoin’s gold”, shares many properties with the world’s oldest and best-known cryptocurrency. Both assets have a fixed scarcity, a proof-of-work (PoW) mining system, and, crucially, both have pre-programmed halving events.

However, there are many crucial differences between Litecoin and Bitcoin halving. But before we explore them, let’s take a deeper look at what a halving event is and its impact on the broader crypto market.

How do halving events work?

In the world of cryptocurrency, halving events protect a coin from inflation. While fiat currencies can suffer from inflation due to an abundance of cash in circulation, cryptocurrencies such as Bitcoin and Litecoin have regular halving events to prevent devaluation.

Traditional currencies rely on a central body to impose higher interest rates and other measures to curb inflation. However, the decentralized nature of a crypto means that no governing body will help prevent problems like this. That’s why halving events are an excellent means of protecting a crypto’s scarcity.

For example, the total limited supply of Litecoin is set at 84,000,000 LTC, and once this limit is reached, there will be no new supply of LTC to be mined. You should check out our Litecoin halving primer if you want to know more about this event in the context of this coin.

Halving events work by literally halving the blocks produced on a cryptocurrency’s network, slowing the rate of new assets being created to reach that number. Currently, Litecoin’s circulating supply is just over 72.5 million, meaning that fewer than 12 million coins can still be minted.

Although Bitcoin operates a similar halving setup, both halving events have many critical differences. So let’s take a deeper look at the differences to keep in mind:

1. Litecoin’s halving does not have the same market effect

Bitcoin’s quadrennial halving events may operate on a similar timeframe to Litecoin, but the dominance of BTC means it has a different impact on the market.

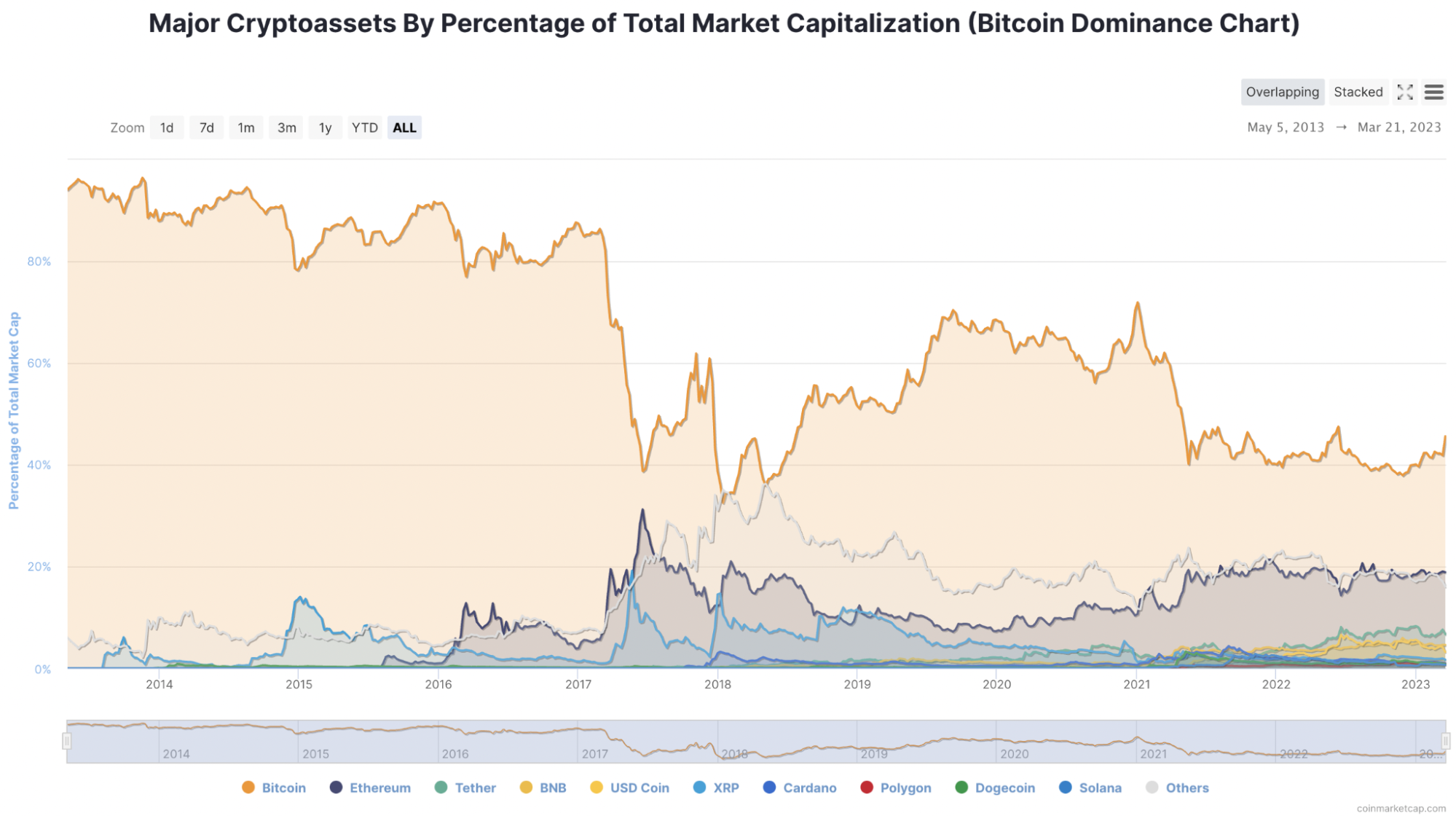

As CoinMarketCap data shows, Bitcoin’s market dominance has rarely been challenged within the cryptocurrency landscape, so the impact of Bitcoin halvings has always carried more weight than Litecoin.

While Bitcoin’s halving in 2016 sent many coins to new highs in 2017 and early 2018, and Bitcoin’s subsequent halving event in 2020 led to a massive market rally in 2021, Litecoin’s halving events, which have so far occurred in 2015 and 2019, have failed . produce the same significant movements.

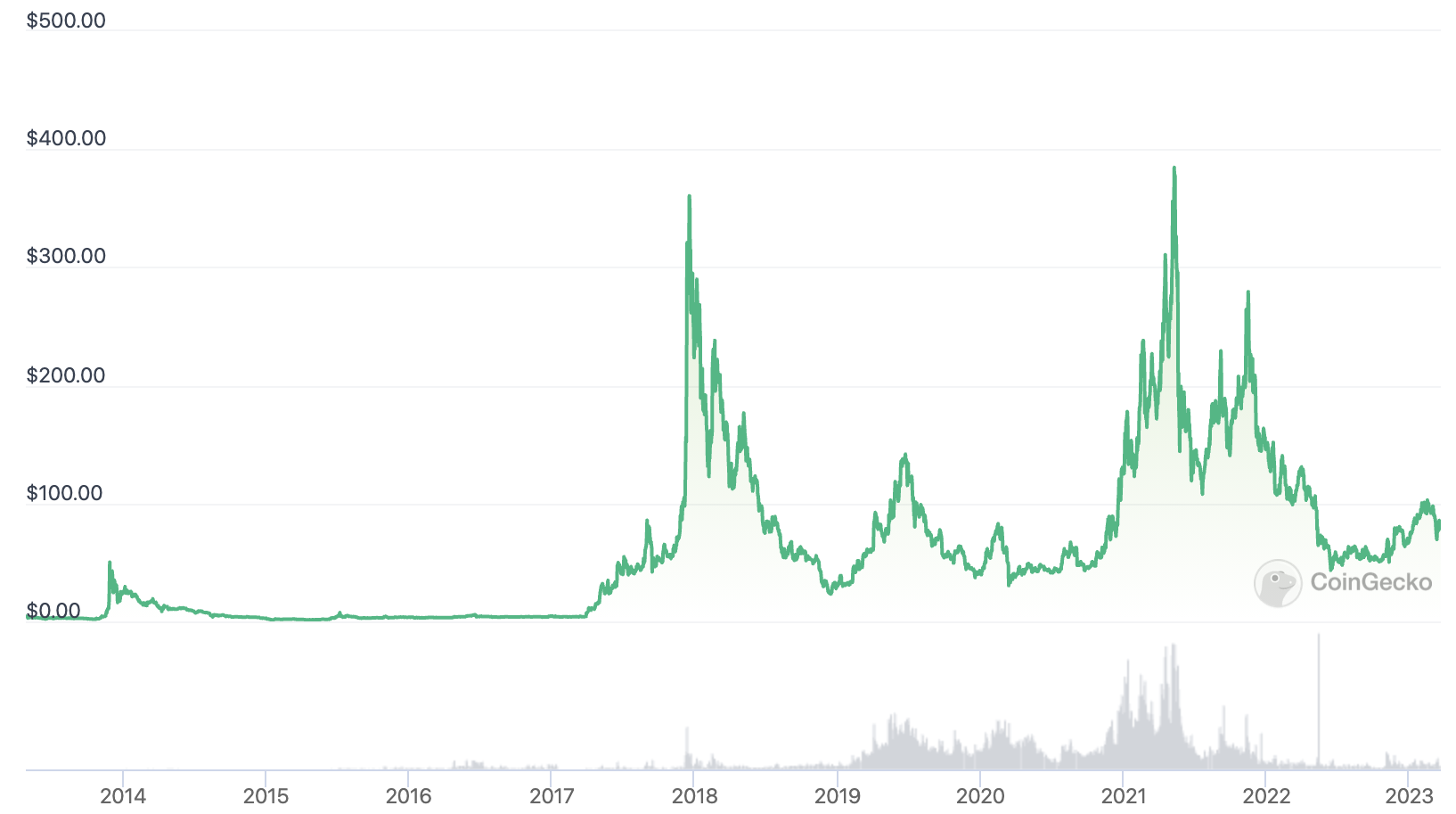

In fact, looking at CoinGeck’s Litecoin price chart, we can see that Litecoin’s biggest rally has come in the wake of Bitcoin halving events rather than on its own.

Without significant correlations between Litecoin’s halving events and the asset’s performance, it may be more difficult for investors to spot buying opportunities for LTC.

2. Litecoin trails Bitcoin by three years

Although Litecoin is set to undergo its halving event in 2023, with Bitcoin’s next halving in 2024, Litecoin actually trails its older counterpart by three years. This means that LTC will simply replicate Bitcoin’s halving event in 2020 in real terms.

This is because LTC awarded to miners this year will drop to 6.25, the same rate as Bitcoin today. When Bitcoin’s next halving event takes place in 2024, the reward for miners will drop to 3.125. To know more about Litecoin’s halving rate and more, check out our quick guide to mining Litecoin.

3. Litecoin and Bitcoin operate with different levels of scarcity

While Litecoin’s fixed supply is 84,000,000 coins produced, Bitcoin’s is limited to only 21,000,000. Because of this, miners have to deal with a severely limited supply of Bitcoin unlike LTC.

This has led cryptocurrency commentators to recognize Litecoin as the silver to Bitcoin’s gold. As such, more miners are likely to turn their attention to the significantly more scarce BTC rather than opting to tap into the far more widespread supply of LTC.

4. Miners may be drawn to the higher volumes of LTC for access

On the flip side, this also means that the volume of LTC available to miners is significantly higher than BTC. With CoinGecko data suggesting that there are now fewer than 1.7 million BTC left to be mined, and with future halving events further limiting the volume of BTC to be mined, it will likely take more than 100 years for the final Bitcoin to be mined .

If you ask, “How many Litecoins are there? How many are left to be mined?” The answer is 11.5 million LTC at the time of writing, more than six times larger than Bitcoin’s remaining supply.

Litecoin’s halving still marks a big moment for crypto

While it may be fanciful for investors to expect Litecoin’s upcoming halving event to lead to significant price movements, it will undoubtedly play an important role in stimulating a cryptocurrency market still seeking a change in fortunes after 2022’s crypto winter.

Litecoin’s halving event will represent one of the cryptocurrency market’s most important moments of the year and drive more market sentiment towards the asset. The event itself will be central to highlighting the shortage of LTC, of which 87% of the coins have already been mined, so this could be significant if market demand follows.

It could be that Litecoin’s halving event will be a catalyst to drive demand back into one of the cryptocurrency market’s oldest assets. Should sentiment return to Litecoin, we could see an impressive price rise from one of the ecosystem’s old favorites.