Bitcoin’s rise isn’t over yet, Bank of America strategists say

Strategists at Bank of America predict that Bitcoin’s remarkable rise, which took it from around $17,000 at the start of 2023 to over $30,000 today, may not be over.

The strategists recently assessed the bullish trend based on transfers between cryptocurrency exchanges and individual wallets, according to Bloomberg

Bank of America analysis based on Bitcoin outflows from exchanges

In the week ending April 4, a net worth of $368 million was transferred into individual wallets, according to a note from BofA’s Alkesh Shah and Andrew Moss. They emphasize that when investors plan to hold their coins, they move them from exchange wallets to personal wallets, potentially reducing selling pressure.

According to the banking strategists, the outflow from exchanges may have been triggered by concerns about the US regulatory efforts on digital asset platforms.

The weekly figures tell a different story. For the week ending April 7, inflows of $57 million were reported in CoinShares’ Digital Asset Fund Flows Report. The analysis indicated a low volume week; But the feelings were favorable. Interestingly, BTC dominated 98% of all inflows with $56 million.

However, one needs to look at the macro factors that may affect the value of crypto assets in 2023. Some economists argue that riskier investments may benefit from forecasts of future interest rate cuts by the Federal Reserve. And Bitcoin could be a likely beneficiary when the banking crisis has only recently shaken the traditional market.

Until April 10, Bitcoin traded above $29,000 before breaking the important $30,000 threshold. It stayed close to the crucial level until Thursday. BTC’s price increased by 24% in a month, despite losing over a quarter of its value compared to the previous year. Nevertheless, the price of Bitcoin is still 56% below the all-time high of $69,000, reached in November 2021.

How Macro Factors Can Affect BTC

The latest and biggest market event is Ethereum’s Shapella upgrade. It was recently carried out and was the biggest upgrade since the merger. BofA strategists predict increased volatility due to the significant market event that enabled the withdrawal of the bet ETH.

However, while they do not expect the event to trigger selling pressure directly, they do expect greater volatility due to reduced liquidity, derivative activity and IPOs.

Meanwhile, indicators on the chain are bullish at the time of writing. 2% of Bitcoin owners break even with the current price, according to IntoTheBlock, while 74% are “in the money”. The concentration parameter is also positive, meaning that whales and investors increase their positions.

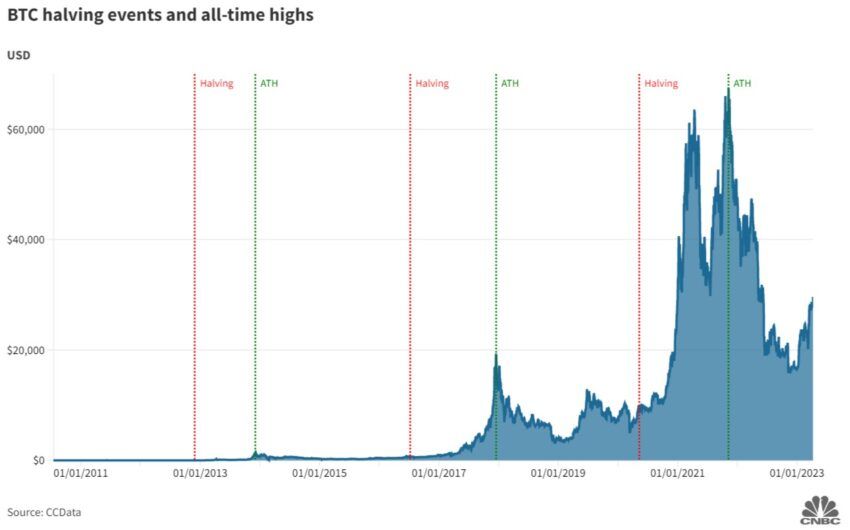

The most important thing is that Bitcoin is almost a year away from the next “halving”. The estimated date for the halving of Bitcoin, which occurs approximately every four years, is April 2024. In addition, the period leading up to the event generally has a positive trend for BTC.

Vijay Ayyar, vice president of corporate development at Luno, told CNBC that a cyclical “bottom” is developing for Bitcoin before the halving.

Jamie Sly, a CryptoCompare analyst, argued that while the exact timing and size of post-halving returns may vary, it appears that investors are often accumulating Bitcoin ahead of it.

Sly considered the 500-day accumulation period before any Bitcoin halving. According to the analyst, this would indicate that we are only 142 days into the current cycle. This considering that the market bottomed out in November 2022 when BTC reached $15,760.

Disclaimer

In accordance with the guidelines of the Trust Project, BeInCrypto is committed to objective, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content.