Two events today will trigger volatility in the crypto market

Crypto market traders and analysts fear that Ethereum’s Shapella hard fork could cause volatility in altcoin markets as validators begin to exit, albeit in a controlled manner. Adding to the mix is the unpredictable effects of the release of US consumer price index (CPI) data for March.

Bitcoin and cryptocurrencies are likely to rise if the price of a basket of goods and services shows signs of cooling.

ETH traders support potential volatility in the crypto market

The Ethereum (ETH) Shapella hard fork, a combination of an execution layer upgrade Shanghai and a consensus layer upgrade called Capella, will go live in block 6209536 on April 12.

The upgrade will allow validators who staked ETH on the network’s consensus layer to help secure the network to withdraw their funds.

Anyone could unlock 32 ETH in a smart contract to confirm and broadcast transaction blocks after Ethereum changed from a proof-of-work blockchain to a proof-of-stake chain in September 2022. They could earn up to 5% interest as a reward for doing this work.

The intraday ETH price has been largely flat around the $1,870 mark, indicating that traders may be bracing for potential selling pressure that could affect the ETH and altcoin markets.

A report from K33 Research suggests that stakers can withdraw 1.1 million ETH in stake rewards. The rewards can be withdrawn immediately after the upgrade and liquidated using a centralized exchange. The user will remain a validator after this partial withdrawal.

A full withdrawal, which in some cases can take up to 60 days, will remove the validator’s original 32 ETH plus any accrued rewards. The node operator will then cease to be a validator.

Bankrupt crypto lender Celsius is also set to withdraw around 158,000 staked ETH to return funds to creditors.

Both of these withdrawals will amount to $2.4 billion in selling pressure, roughly a quarter of ETH’s 24-hour trading volume.

Of the top 10 altcoins by market cap, 90% have been underwater in the last 24 hours. Dogecoin (DOGE), Cardano (ADA), Binance Coin (BNB) and Polygon (MATIC) are all down over 3%.

Lower US CPI likely to push Altcoins up

The release of US CPI numbers later today is likely to cause volatility in the Bitcoin (BTC) market. Investors tend to mine the economic data for clues about easing monetary policy from the Federal Reserve (Fed).

Analysts forecast an annual US CPI of 5.2% for March, down 0.8% from February’s 6%. Month-on-month inflation is expected to be half of the previous month, at 0.2%.

Should this result prove true, Bitcoin’s gains could continue to outpace the Nasdaq and gold. On April 10, Bitcoin rose 4.5%, while the Nasdaq and gold recorded 0.1% and 0.9% declines. According to K33 Research, the Bitcoin pump was likely due to traders on the Chicago Mercantile Exchange commingling their exposure to BTC.

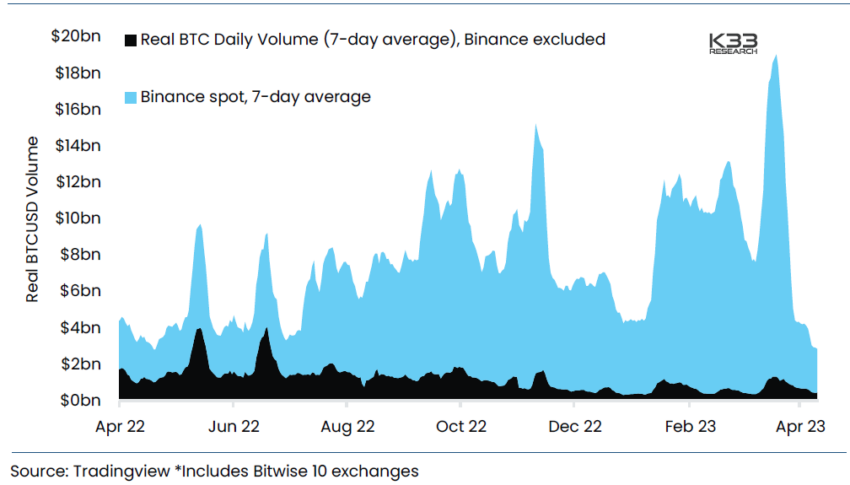

Bitcoin’s daily seven-day spot trading volume reached $2.8 billion on April 10, 2023, the lowest trading volume in nearly a year. BTCUSDT men saw trading volume burst during a short squeeze as Bitcoin surged above $30,000.

Signs that the Federal Reserve will pause or reduce interest rate hikes will likely mean that derivatives volume will drive Bitcoin above $30,000.

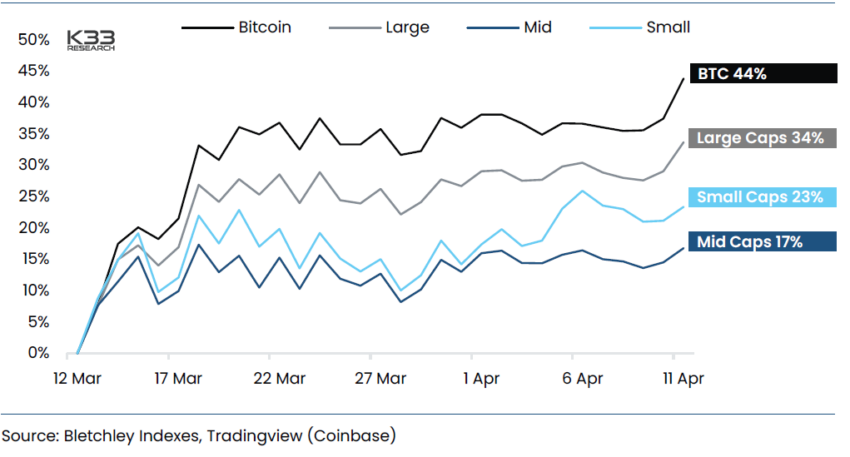

While Bitcoin’s correlation with traditional finance declines, positive CPI news could also see it outperform other crypto market indices.

The correlation between Bitcoin and altcoins also suggests that a positive BTC response will boost altcoin prices.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In accordance with the Trust Project guidelines, BeInCrypto is committed to objective, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content.